Question: CoursHeroTranscribedText: Use the information below to answer the two questions that follow. A company has two divisions: Division A and B. Division A Division B

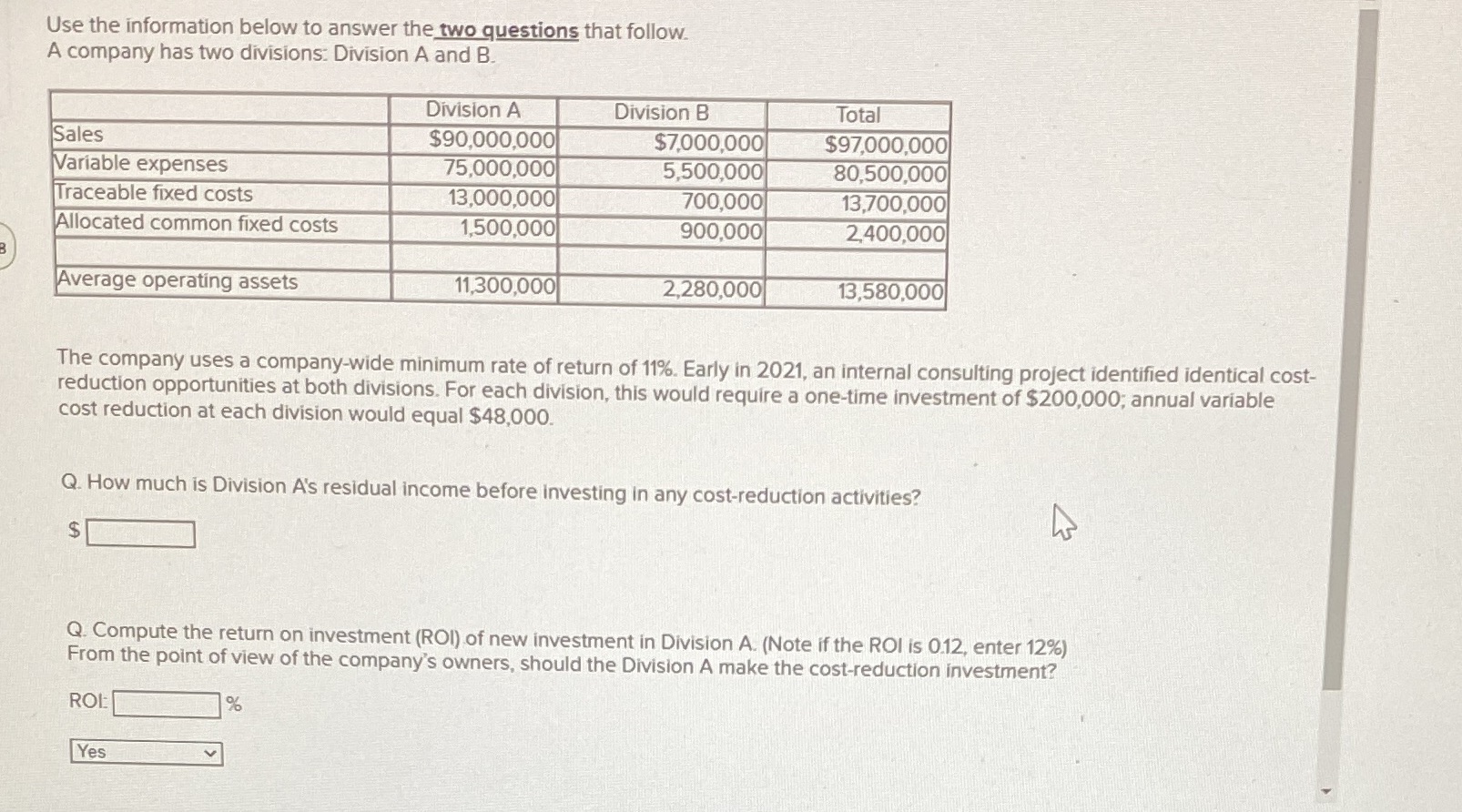

CoursHeroTranscribedText: Use the information below to answer the two questions that follow. A company has two divisions: Division A and B. Division A Division B Total Sales $90,000,000 $7,000,000 $97,000,000 Variable expenses 75,000,000 5,500,000 80,500,000 Traceable fixed costs 13,000,000 700,000 13,700,000 Allocated common fixed costs 1,500,000 900,000 2,400,000 Average operating assets 11,300,000 2,280,000 13,580,000 The company uses a company-wide minimum rate of return of 11%. Early in 2021, an internal consulting project identified identical cost- reduction opportunities at both divisions. For each division, this would require a one-time investment of $200,000; annual variable cost reduction at each division would equal $48,000. Q. How much is Division A's residual income before investing in any cost-reduction activities? Q. Compute the return on investment (ROI) of new investment in Division A. (Note if the ROI is 0.12, enter 12%) From the point of view of the company's owners, should the Division A make the cost-reduction investment? ROL % Yes V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts