Question: Courtney Company uses a periodic inventory system. Data for 2020 are as follows: beginning merchandise inventory (December 31, 2019), 3,450 units at $35.90; purchases,

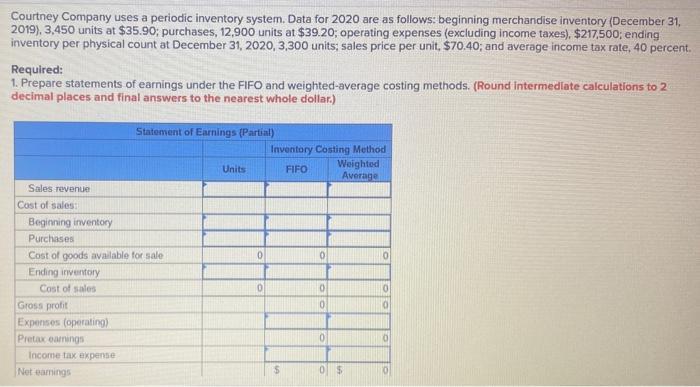

Courtney Company uses a periodic inventory system. Data for 2020 are as follows: beginning merchandise inventory (December 31, 2019), 3,450 units at $35.90; purchases, 12,900 units at $39.20; operating expenses (excluding income taxes), $217,500; ending inventory per physical count at December 31, 2020, 3,300 units; sales price per unit, $70.40; and average income tax rate, 40 percent. Required: 1. Prepare statements of earnings under the FIFO and weighted-average costing methods. (Round intermedlate calculations to 2 decimal places and final answers to the nearest whole dollar.) Statement of Earnings (Partial) Inventory Costing Method Weighted Average Units FIFO Sales revenue Cost of sales: Beginning inventory Purchases Cost of goods available for sale Ending inventory Cost of sales Gross profit Expenses (operating) Pretax eamings Income tax expense Net eamings %24

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Statement of Earnings Inventory Costing Method Particulars Units FIFO Weighted Averag... View full answer

Get step-by-step solutions from verified subject matter experts