Question: Coventry Limited is considering a five year project whose initial cost would be 3 million. The contribution consists of annual Sales of 2.8 million and

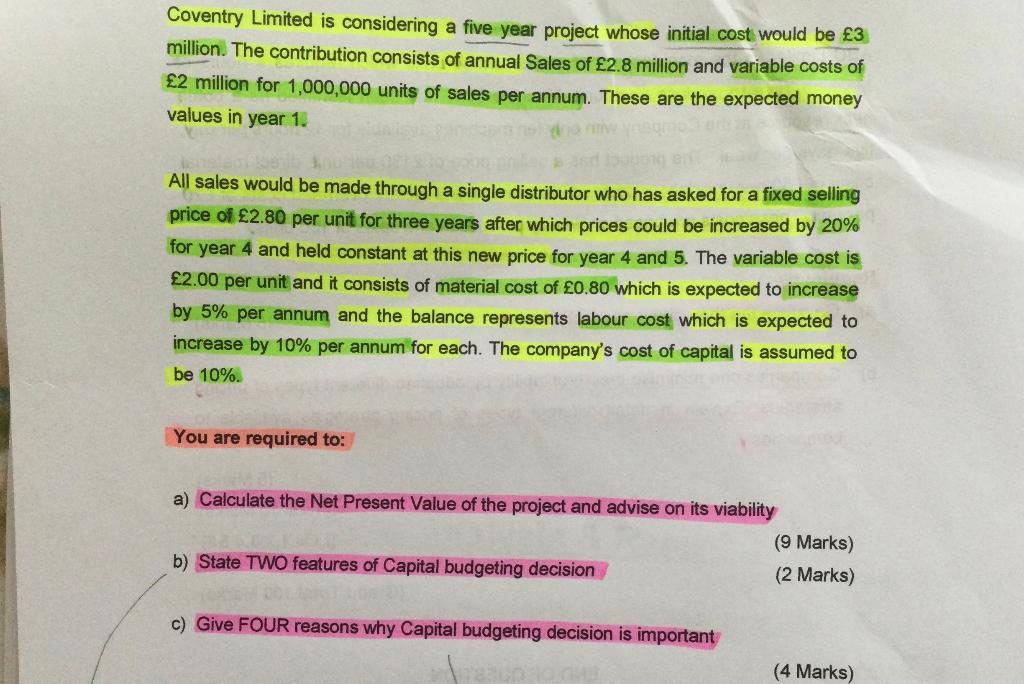

Coventry Limited is considering a five year project whose initial cost would be 3 million. The contribution consists of annual Sales of 2.8 million and variable costs of 2 million for 1,000,000 units of sales per annum. These are the expected money values in year 1. All sales would be made through a single distributor who has asked for a fixed selling price of 2.80 per unit for three years after which prices could be increased by 20% for year 4 and held constant at this new price for year 4 and 5. The variable cost is 2.00 per unit and it consists of material cost of 0.80 which is expected to increase by 5% per annum and the balance represents labour cost which is expected to increase by 10% per annum for each. The company's cost of capital is assumed to be 10%. You are required to: a) Calculate the Net Present Value of the project and advise on its viability (9 Marks) b) State TWO features of Capital budgeting decision (2 Marks) c) Give FOUR reasons why Capital budgeting decision is important (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts