Question: CP 26-6 Net Present Value Method for a Service Company Metro-Goldwyn-Mayer Studios Inc. (MGM) is a major producer and distributor of theatrical and television filmed

CP 26-6

Net Present Value Method for a Service Company

Metro-Goldwyn-Mayer Studios Inc. (MGM) is a major producer and distributor of theatrical and television filmed entertainment. Regarding theatrical films, MGM states, Our feature films are exploited through a series of sequential domestic and international distribution channels, typically beginning with theatrical exhibition. Thereafter, feature films are first made available for home video (online downloads) generally 6 months after theatrical release; for pay television, one year after theatrical release; and for syndication, approximately 3 to 5 years after theatrical release.

Assume that MGM produces a film during early 2018 at a cost of $340 million and releases it halfway through the year. During the last half of 2018, the film earns revenues of $420 million at the box office. The film requires $90 million of advertising during the release. One year later, by the end of 2019, the film is expected to earn MGM net cash flows from online downloads of $60 million. By the end of 2020, the film is expected to earn MGM $20 million from pay TV, and by the end of 2021, the film is expected to earn $10 million from syndication.

-

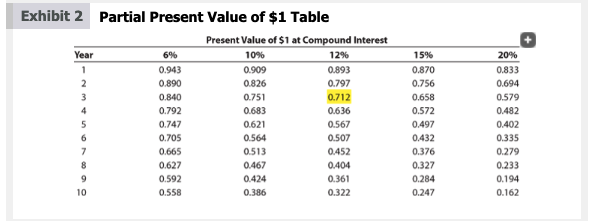

Determine the net present value of the film as of the beginning of 2018 if the desired rate of return is 20%. To simplify present value computations, assume that all annual net cash flows occur at the end of each year. Use the table of the present value of $1 appearing in Exhibit 2 of this chapter. Round to the nearest whole million dollars.

-

Under the assumptions provided here, is the film expected to be financially successful? Explain.

Exhibit 2 Partial Present Value of $1 Table Present Value of $1 at Compound Interest Year 1 2 3 4 5 6 7 8 9 10 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts