Question: CP CF The net present value (NPV) method estimates how much a potential project will contribute to shareholders' wealth and it is the best selection

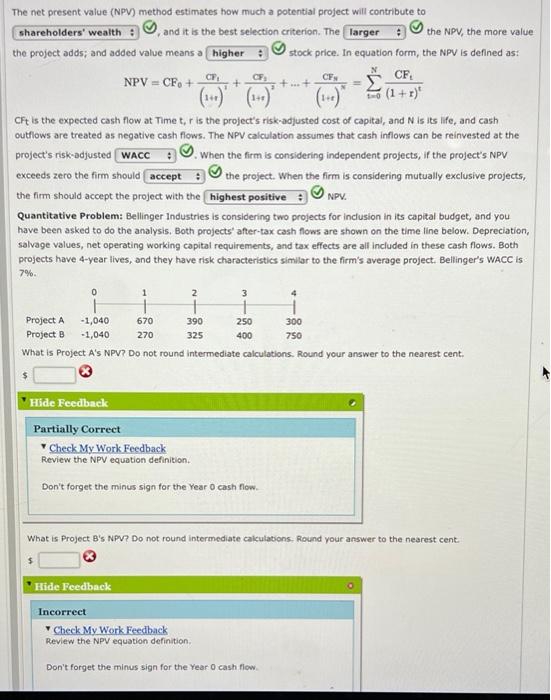

CP CF The net present value (NPV) method estimates how much a potential project will contribute to shareholders' wealth and it is the best selection criterion. The larger the NPV, the more value the project adds; and added value means a higher stock price. In equation form, the NPV is defined as: CF. NPV = CF. + + CPA +...+ (-) = (1 + r)" Cft is the expected cash flow at Time t, r is the project's risk-adjusted cost of capital, and N is its life, and cash outflows are treated as negative cash flows. The NPV calculation assumes that cash inflows can be reinvested at the project's risk-adjusted WACC When the firm is considering independent projects, if the project's NPV exceeds zero the firm should accept the project. When the firm is considering mutually exclusive projects, the firm should accept the project with the highest positive NPV. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 7%. 0 1 3 2 1 390 325 -1,040 -1,040 670 270 250 400 Project A Project B What is Project A's NPV? Do not round Intermediate calculations. Round your answer to the nearest cent. 300 750 Hide Feedback Partially Correct Check My Work Feedback Review the NPV equation definition Don't forget the minus sign for the Year o cash flow. What is Project B's NPV? Do not round Intermediate calculations. Round your answer to the nearest cent. Hide Feedback Incorrect Check My Work Feedback Review the NPV equation definition, Don't forget the minus sign for the Year 0 cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts