Question: CP11-5 (Algo) Computing and Interpreting Return on Equity (ROE) and Price/Earnings (P/E) Ratios [LO 11-5] Eagle Flights, and Albatross Airlines are two publicly traded airline

CP11-5 (Algo) Computing and Interpreting Return on Equity (ROE) and Price/Earnings (P/E) Ratios [LO 11-5]

Eagle Flights, and Albatross Airlines are two publicly traded airline companies. They reported the following in their financial statements (in millions of dollars, except per-share amounts and stock prices):

| Eagle | Albatross | |||

|---|---|---|---|---|

| 2021 | 2020 | 2021 | 2020 | |

| Net income | $ 4,015 | $ 3,592 | $ 2,555 | $ 3,503 |

| Total stockholders' equity | 13,837 | 14,060 | 9,943 | 10,520 |

| Earnings per share | 5.71 | 4.55 | 4.33 | 5.82 |

| Stock price when annual results reported | 52.13 | 54.74 | 58.54 | 55.61 |

Required:

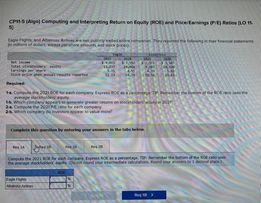

1-a. Compute the 2021 ROE for each company. Express ROE as a percentage. TIP: Remember the bottom of the ROE ratio uses the average stockholders equity.

1-b. Which company appears to generate greater returns on stockholders equity in 2021?

2-a. Compute the 2021 P/E ratio for each company.

2-b. Which company do investors appear to value more?

![Ratios [LO 11-5] Eagle Flights, and Albatross Airlines are two publicly traded](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ee2ae2db76d_57866ee2ae288685.jpg)

please help thank you.

F 3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts