Question: (CPA, adapted) Strutter Company was constructing fixed assets that qualified for interest capitalization. Strutter had debt outstanding during the entire year of construction. None of

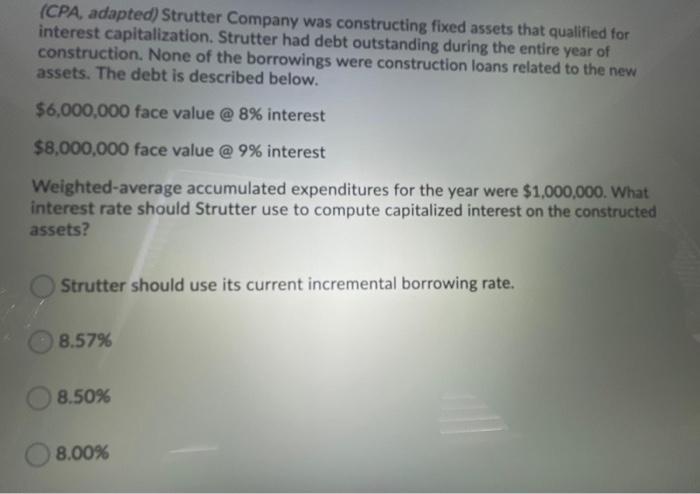

(CPA, adapted) Strutter Company was constructing fixed assets that qualified for interest capitalization. Strutter had debt outstanding during the entire year of construction. None of the borrowings were construction loans related to the new assets. The debt is described below. $6,000,000 face value @ 8% interest $8,000,000 face value @ 9% interest Weighted average accumulated expenditures for the year were $1,000,000. What interest rate should Strutter use to compute capitalized interest on the constructed assets? Strutter should use its current incremental borrowing rate. 8.57% 8.50% 8.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts