Question: CPA FAR task-based simulation question TBS-731907 Can someone share the answer key to this problem please? Scroll down to complete all parts of this task.

CPA FAR task-based simulation question TBS-731907

Can someone share the answer key to this problem please?

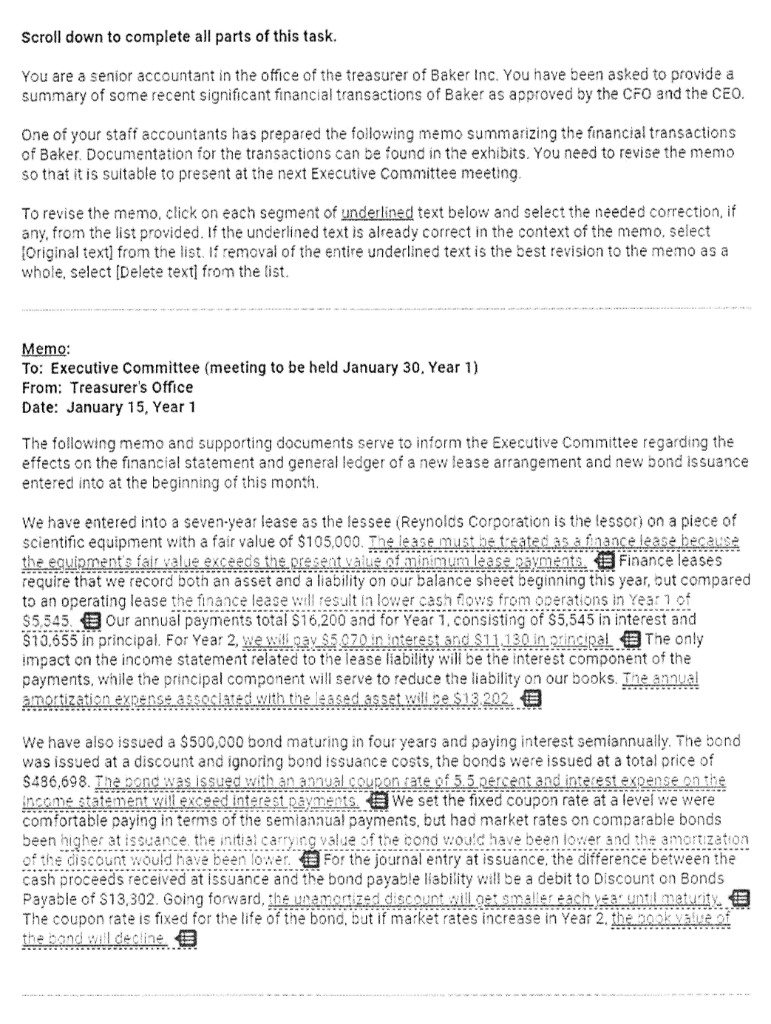

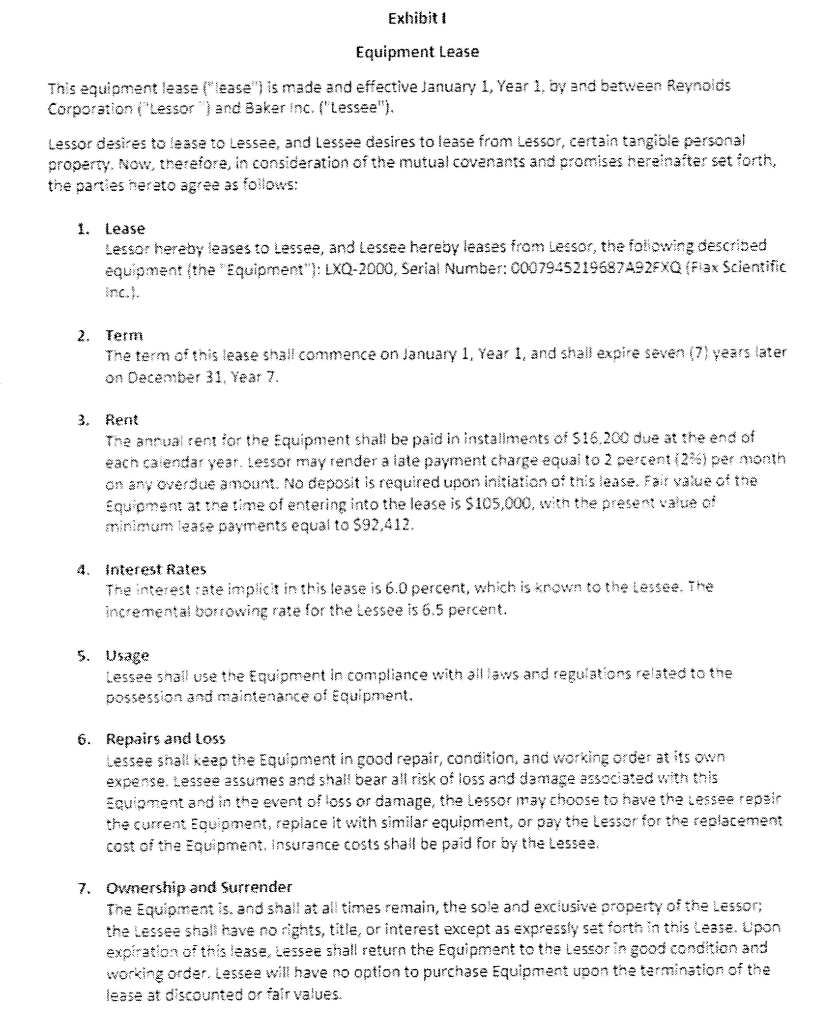

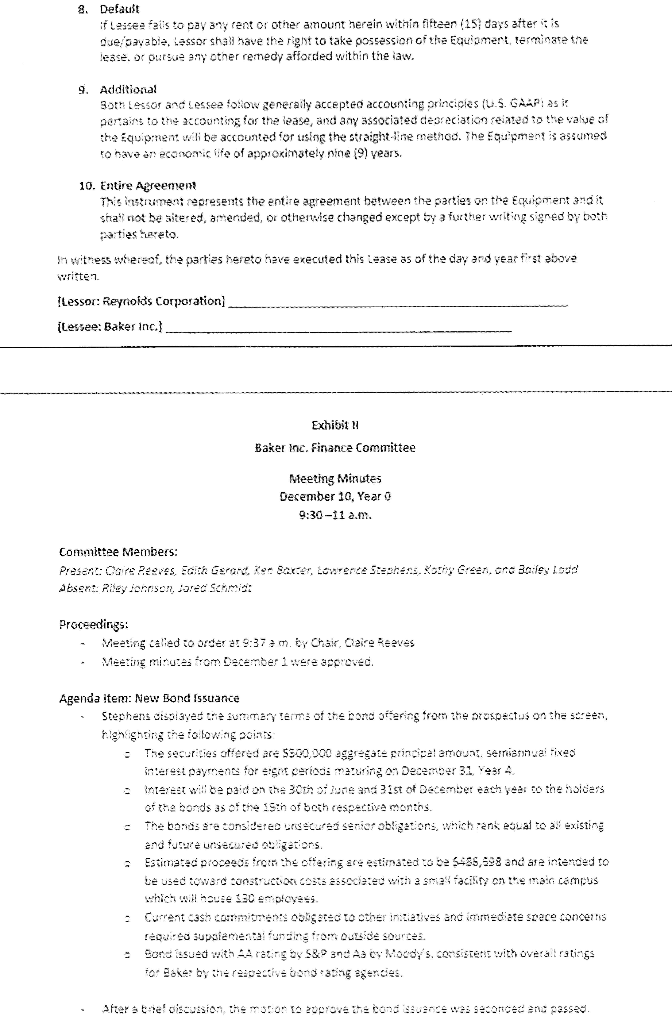

Scroll down to complete all parts of this task. You are a senior accountant in the office of the treasurer of Baker Inc. You have been asked to provide a summary of some recent significant financial transactions of Baker as approved by the CFO and the CEO. One of your staff accountants has prepared the following memo summarizing the financial transactions of Baker. Documentation for the transactions can be found in the exhibits. You need to revise the memo so that it is sultable to present at the next Executive committee meeting. To revise the memo, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the memo, select [original text] from the list. If removal of the entire underlined text is the best revision to the memo as a whole, select [Delete text] from the list. Equipment Lease This equipment lease ("lease") is made and effective January 1 , Year 1 , by and between Reynoids Corporation ("essor") and Baker inc. ('tessee"). Lessor desires to lease to Lessee, and Lessee desires to lease from Lessor, certain tangiole personal property. Now, theyefore, in consideration of the mutual covenants and promises herenatter set torthe the parties herato agree as follows: 1. Lease Lessor hereby fases to Lessee, and Lessee hereby leases from Lessor, the folpwing described equipment (the "Equipment"): LXQ-2000, Serial Number: C007945219587A92FXQ (Fiax Scientific inc.i. 2. Tem The term of this lease shall commence on January 1 , year 1 , and shall expire steven (7) years later on December 31 , Year 7. 3. Rent The anmual rent for the Equipment shall be paid in installments of 516.200 due at the end of each calendar year tessor may render a iate payment charge equai to 2 pertent (2%) per month on any overfue anount No deposit is required upon initiation of this lease. Far yane of the Equoment at the time of entering into the lease is $105,000, with the present valu of minimum iease payments equal to $92,412. 4. Interest Rates The interest:ate implicit in this lease is 6.0 percent, which is known to the lessed. The incremental borrowing rate for the Lessee is 6.5 percent. 5. Usage Lessee shall use the Equipment in compliance with all iaws and regulations related to the possession and maintenance of Equipment. 6. Repairs and loss Lessee shall kerp the Equipment in good repair, condition, and working order at its own expense. Lessee assumes and shall bear all risk of loss and famase associated with this Equipment and hin the event of loss or damage, the lassor may choos to have the cessee repair the current Eouipment, replace it with similar equipment, or pay the Lessor for the replacement cost of the Equipment. Insurance costs shall be pjid for by the Lessee. 7. Ownership and Surrender The Equipment is, and shall at all times remain, the sole and exciusive property of the Lessor; the Lessee shall have no ights, title, or interest except as expressly set forth in this Lease. Upon expiration of this lease, Eessee shall return the Equipment to the Lescoringood condition and working order Lessea will have no option to purchase Equipment upon the termination of the lease at discounted or tair values. 2. Default if lassea falis to pay any rent or other amount herein within fitteen i15; days atter i is Less. or oursoan any other remedy afforded within the iaw. 9. Additional perant to the scoonthos ior the iease, and an assotiated deveriation felated :o the walue of tha fquipment witi be accountad ior using the straght hine method. ine toupment is assumes ro navo an econonic if of apploximately nine i9? years. 10. Entire Abreemem This intrament repesents the entire agreement batween the parties on the Equgnent and it strai not be siteref, amented, or otherwise changed excopt by 3 fucther witing signed by both paties haceto. M witnens whereat, the partizs hereto have executed this izase as of the day and year first aboye written. Ttessor: Reynofo's Corporation! iLessee: Baker incl Exhibit } Baker hn. Finance Committee Meeting Ninctes December 10, Year 0 a:30-11 a.m. Comniltee Nembers: Praceedings: - Menti minuta trom December 1 were sproved. Agendia item: New Bond issuance righenting tolone poins of the donds 3s of the 15 h of beth copective months. end turare urtietuiced atizars. rAQurea supsiemental uncing rom ourive sourtes. Scroll down to complete all parts of this task. You are a senior accountant in the office of the treasurer of Baker Inc. You have been asked to provide a summary of some recent significant financial transactions of Baker as approved by the CFO and the CEO. One of your staff accountants has prepared the following memo summarizing the financial transactions of Baker. Documentation for the transactions can be found in the exhibits. You need to revise the memo so that it is sultable to present at the next Executive committee meeting. To revise the memo, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the memo, select [original text] from the list. If removal of the entire underlined text is the best revision to the memo as a whole, select [Delete text] from the list. Equipment Lease This equipment lease ("lease") is made and effective January 1 , Year 1 , by and between Reynoids Corporation ("essor") and Baker inc. ('tessee"). Lessor desires to lease to Lessee, and Lessee desires to lease from Lessor, certain tangiole personal property. Now, theyefore, in consideration of the mutual covenants and promises herenatter set torthe the parties herato agree as follows: 1. Lease Lessor hereby fases to Lessee, and Lessee hereby leases from Lessor, the folpwing described equipment (the "Equipment"): LXQ-2000, Serial Number: C007945219587A92FXQ (Fiax Scientific inc.i. 2. Tem The term of this lease shall commence on January 1 , year 1 , and shall expire steven (7) years later on December 31 , Year 7. 3. Rent The anmual rent for the Equipment shall be paid in installments of 516.200 due at the end of each calendar year tessor may render a iate payment charge equai to 2 pertent (2%) per month on any overfue anount No deposit is required upon initiation of this lease. Far yane of the Equoment at the time of entering into the lease is $105,000, with the present valu of minimum iease payments equal to $92,412. 4. Interest Rates The interest:ate implicit in this lease is 6.0 percent, which is known to the lessed. The incremental borrowing rate for the Lessee is 6.5 percent. 5. Usage Lessee shall use the Equipment in compliance with all iaws and regulations related to the possession and maintenance of Equipment. 6. Repairs and loss Lessee shall kerp the Equipment in good repair, condition, and working order at its own expense. Lessee assumes and shall bear all risk of loss and famase associated with this Equipment and hin the event of loss or damage, the lassor may choos to have the cessee repair the current Eouipment, replace it with similar equipment, or pay the Lessor for the replacement cost of the Equipment. Insurance costs shall be pjid for by the Lessee. 7. Ownership and Surrender The Equipment is, and shall at all times remain, the sole and exciusive property of the Lessor; the Lessee shall have no ights, title, or interest except as expressly set forth in this Lease. Upon expiration of this lease, Eessee shall return the Equipment to the Lescoringood condition and working order Lessea will have no option to purchase Equipment upon the termination of the lease at discounted or tair values. 2. Default if lassea falis to pay any rent or other amount herein within fitteen i15; days atter i is Less. or oursoan any other remedy afforded within the iaw. 9. Additional perant to the scoonthos ior the iease, and an assotiated deveriation felated :o the walue of tha fquipment witi be accountad ior using the straght hine method. ine toupment is assumes ro navo an econonic if of apploximately nine i9? years. 10. Entire Abreemem This intrament repesents the entire agreement batween the parties on the Equgnent and it strai not be siteref, amented, or otherwise changed excopt by 3 fucther witing signed by both paties haceto. M witnens whereat, the partizs hereto have executed this izase as of the day and year first aboye written. Ttessor: Reynofo's Corporation! iLessee: Baker incl Exhibit } Baker hn. Finance Committee Meeting Ninctes December 10, Year 0 a:30-11 a.m. Comniltee Nembers: Praceedings: - Menti minuta trom December 1 were sproved. Agendia item: New Bond issuance righenting tolone poins of the donds 3s of the 15 h of beth copective months. end turare urtietuiced atizars. rAQurea supsiemental uncing rom ourive sourtes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts