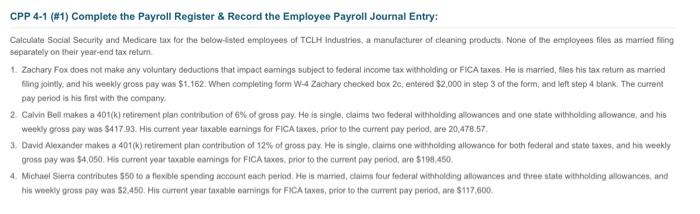

Question: CPP 4-1 (#1) Complete the Payroll Register & Record the Employee Payroll Journal Entry: Calculate Social Security and Medicare tax for the betow-tsted employees of

CPP 4-1 (#1) Complete the Payroll Register \& Record the Employee Payroll Journal Entry: Calculate Social Security and Medicare tax for the betow-tsted employees of TCLH Industries, a manufacturar of eleaning prothets, None of the employees files as martied fling separately on their year-end tax feturn. 1. Zachary Fox does not make any voluntary deductions that impoct eamings subject to federal income tax withhoiding or FiCA taxes. He is married, thes his tax retum as married fling joinlly. and his weekly gross pay was $1,162. When completing form W4 Zachary checked box 2c, entered $2,000 in step 3 of the form, and laft step 4 blank. The curfent pay period is his first with the company. 2. Calvin Bell makes a 401(k eetirement plan contribution of 6% of gross pay. He is single, claims two federal withhoiding allowences and one state withholding allowance, and his. weekly gross pay was $417.93. His current year taxable earnings for FiCA taxes, priot to the current pay pericd, are 20,478.57. 3. David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay. He is single, claims one with oilding allowance for both federal and state taxes, and his weekly gross pay was $4,050. His current year taxable eamings for FiCA taves, prior to the current pay period, are \$198, 450. 4. Michae Sierra contributes 550 to a flexible spending account each period. He is married, dairns four federal withholding allowances and three state withholding allowances, and his weelly gross pay was $2,450. Hit current year taxable earnings for FicA taxes, grior to the current pay period, are $117,600. 1: Zachary Fox Social Security Tax =$, Medicare Tax=$ 2: Calvin Bell Social Security Tax =$ Medicare Tax=$ 3: David Alexander 4: Michael Sierra

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts