Question: CQ A cost accounting system should be revised when; A) The exsisting cost accounting system could be updated, just to keep ahead B) The existing

CQ

A cost accounting system should be revised when;

A) The exsisting cost accounting system could be updated, just to keep ahead

B) The existing cost accounting system does not produce information that reflects the way various products use scarce resources

C) A new system would be easier to understand but would not be reliable.

D) The existing cost accounting system provides information that is representiative of operations.

E) Management wants to change the system even though the information is relevant and correct.

: Cost accounting provides management with accurate information about the cost of manufacturing a product. The type of cost accounting system a business uses depends on the nature of its manufacturing operations.

I Need a research showing the effect of cost accounting in enhancing managerial decisions and the types of cost accounting systems used in the manufacturing companies. with NUMERICAL EXAMPLES

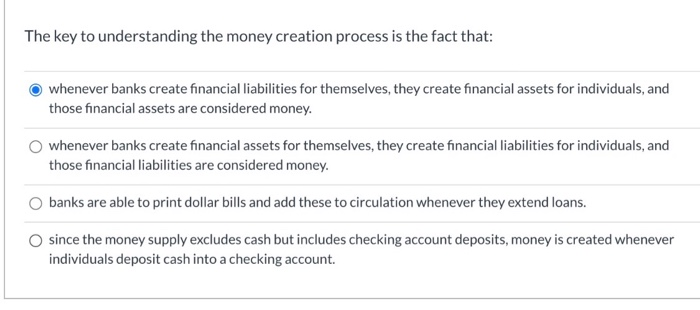

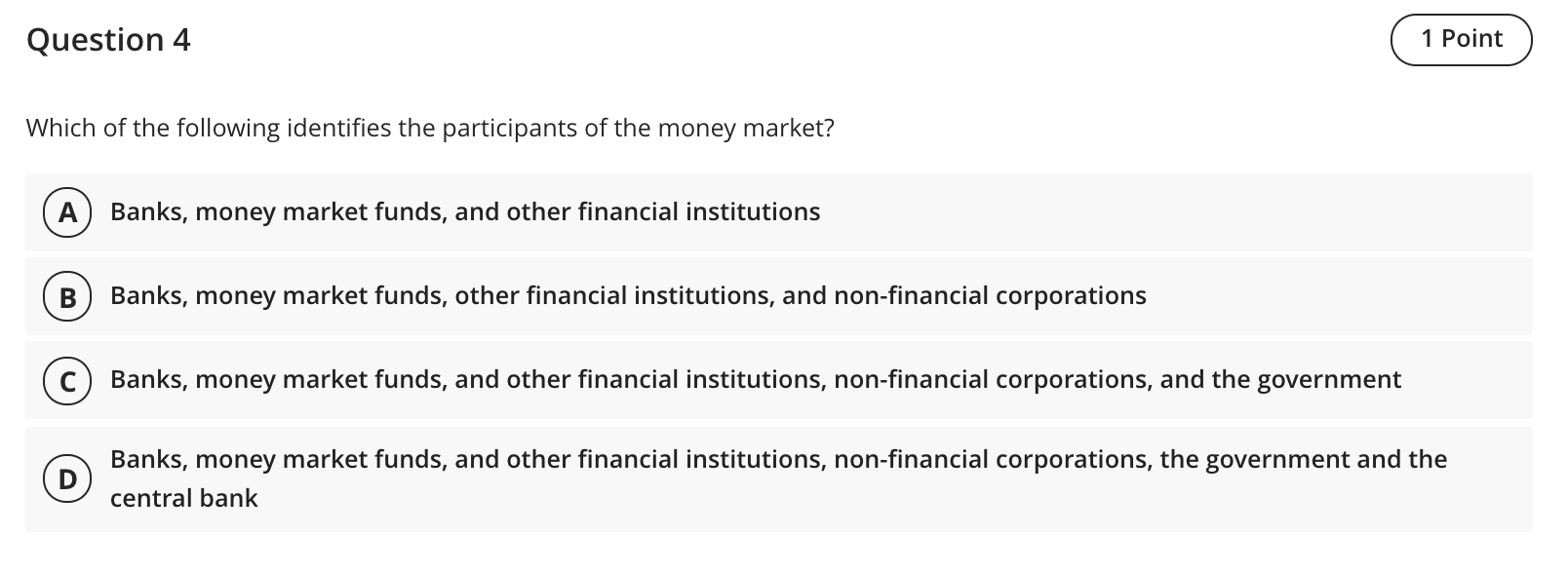

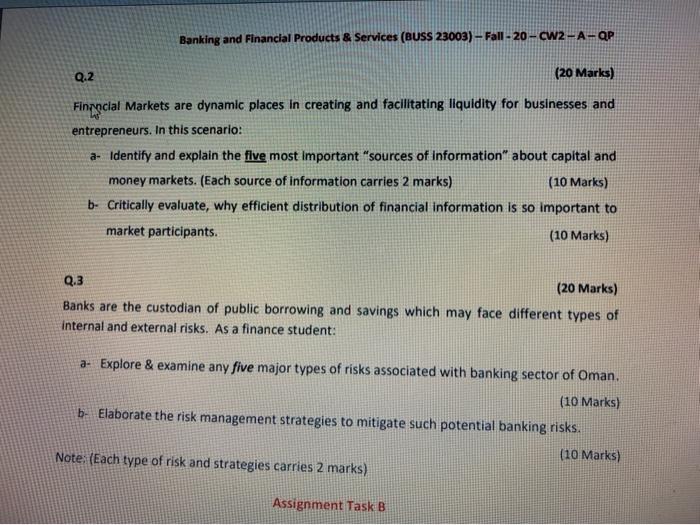

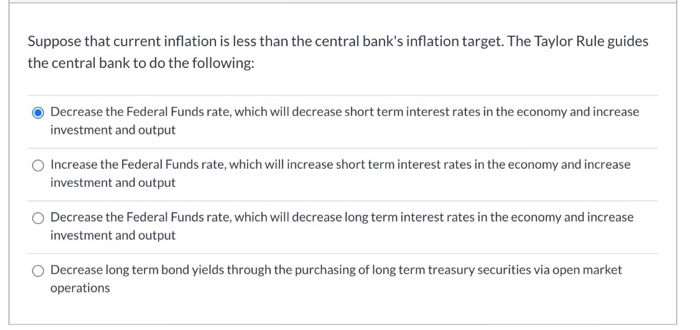

The key to understanding the money creation process is the fact that: whenever banks create financial liabilities for themselves, they create financial assets for individuals, and those financial assets are considered money. O whenever banks create financial assets for themselves, they create financial liabilities for individuals, and those financial liabilities are considered money. O banks are able to print dollar bills and add these to circulation whenever they extend loans. O since the money supply excludes cash but includes checking account deposits, money is created whenever individuals deposit cash into a checking account.Question 4 1 Point Which of the following identifies the participants of the money market? A Banks, money market funds, and other financial institutions B Banks, money market funds, other financial institutions, and non-financial corporations C Banks, money market funds, and other financial institutions, non-financial corporations, and the government Banks, money market funds, and other financial institutions, non-financial corporations, the government and the D central bankBanking and Financial Products & Services (BUSS 23003) - Fall - 20 - CW2 -A - QP Q.2 (20 Marks) Financial Markets are dynamic places in creating and facilitating liquidity for businesses and entrepreneurs. In this scenario: a- Identify and explain the five most Important "sources of Information" about capital and money markets. (Each source of information carries 2 marks) (10 Marks) b- Critically evaluate, why efficient distribution of financial information is so important to market participants. (10 Marks) Q.3 (20 Marks) Banks are the custodian of public borrowing and savings which may face different types of internal and external risks. As a finance student: a- Explore & examine any five major types of risks associated with banking sector of Oman. (10 Marks) b- Elaborate the risk management strategies to mitigate such potential banking risks. (10 Marks) Note: (Each type of risk and strategies carries 2 marks) Assignment Task BSuppose that current inflation is less than the central bank's inflation target. The Taylor Rule guides the central bank to do the following: Decrease the Federal Funds rate, which will decrease short term interest rates in the economy and increase investment and output O Increase the Federal Funds rate, which will increase short term interest rates in the economy and increase investment and output O Decrease the Federal Funds rate, which will decrease long term interest rates in the economy and increase investment and output O Decrease long term bond yields through the purchasing of long term treasury securities via open market operations