Question: Cr 4 - 5 L ( cap ) - 1 1 - 2 Document reading pane Target Corporation Walmart Inc. Comparing Companies

Cr

L cap

Document reading pane

Target Corporation

Walmart Inc.

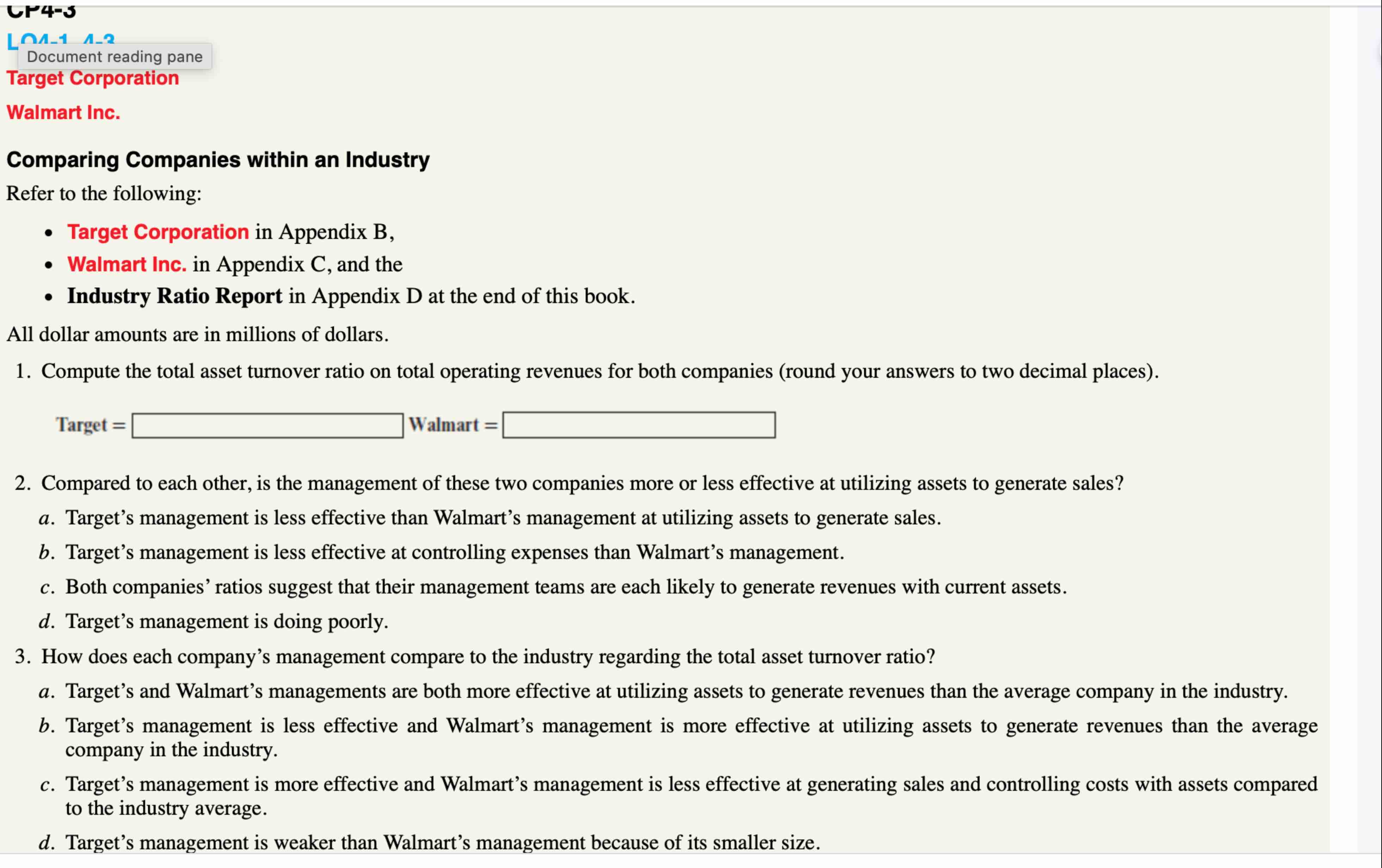

Comparing Companies within an Industry

Refer to the following:

Target Corporation in Appendix B

Walmart Inc. in Appendix C and the

Industry Ratio Report in Appendix D at the end of this book.

All dollar amounts are in millions of dollars.

Compute the total asset turnover ratio on total operating revenues for both companies round your answers to two decimal places

text Target quad mid text Walmart

Compared to each other, is the management of these two companies more or less effective at utilizing assets to generate sales?

a Target's management is less effective than Walmart's management at utilizing assets to generate sales.

b Target's management is less effective at controlling expenses than Walmart's management.

c Both companies' ratios suggest that their management teams are each likely to generate revenues with current assets.

d Target's management is doing poorly.

How does each company's management compare to the industry regarding the total asset turnover ratio?

a Target's and Walmart's managements are both more effective at utilizing assets to generate revenues than the average company in the industry.

b Target's management is less effective and Walmart's management is more effective at utilizing assets to generate revenues than the average company in the industry.

c Target's management is more effective and Walmart's management is less effective at generating sales and controlling costs with assets compared to the industry average.

d Target's management is weaker than Walmart's management because of its smaller size. Compared to each other, is the management of these two companies more or less effective at utilizing assets to generate sales?

a Target's management is less effective than Walmart's management at utilizing assets to generate sales.

Document reading pane

b Iarget s management is less effective at controlling expenses than Walmart's management.

c Both companies' ratios suggest that their management teams are each likely to generate revenues with current assets.

d Target's management is doing poorly.

How does each company's management compare to the industry regarding the total asset turnover ratio?

a Target's and Walmart's managements are both more effective at utilizing assets to generate revenues than the average company in the industry.

b Target's management is less effective and Walmart's management is more effective at utilizing assets to generate revenues than the average company in the industry.

c Target's management is more effective and Walmart's management is less effective at generating sales and controlling costs with assets compared to the industry average.

d Target's management is weaker than Walmart's management because of its smaller size.

If both companies failed to record the adjusting entry for depreciation expense for the most recent year, what impact will that have on the total asset turnover ratio?

a There will be no effect on either company's total asset turnover ratio.

b Failure to record the adjusting entry for depreciation expense understates expenses, resulting in higher net income and a higher asset turnover ratio for the year.

c Failure to record depreciation expense overstates assets, resulting in a higher denominator and lower total asset turnover ratio for the year.

d Target's ratio will be closer to Walmart's ratio.

For each company, calculate the percentage change from fiscal year ended in to the fiscal year ended in for each of the following accounts round your percentage to two decimal places:

Which company's management was more effective at controlling costs between fiscal years ended and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock