Question: Crane Company uses the FIFO method for internal reporting purposes and LIFO for external reporting purposes. The balance in the LIFO Reserve account at the

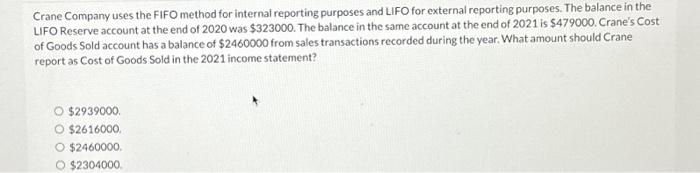

Crane Company uses the FIFO method for internal reporting purposes and LIFO for external reporting purposes. The balance in the LIFO Reserve account at the end of 2020 was $323000. The balance in the same account at the end of 2021 is $479000. Crane's Cost of Goods Sold account has a balance of $2460000 from sales transactions recorded during the year. What amount should Crane report as Cost of Goods Sold in the 2021 income statement? O $2939000. O $2616000. O $2460000. O $2304000.

Crane Company uses the FIFO method for internal reporting purposes and LIFO for external reporting purposes. The balance in the LIFO Reserve account at the end of 2020 was $323000. The balance in the same account at the end of 2021 is $479000. Crane's Cost of Goods Sold account has a balance of $2460000 from sales transactions recorded during the year. What amount should Crane report as Cost of Goods Sold in the 2021 income statement? $2939000. $2616000. $2460000. $2304000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock