Question: Crane Corp. is a fast-growing company whose management expects it to grow at a rate of 25 percent over the next two years and then

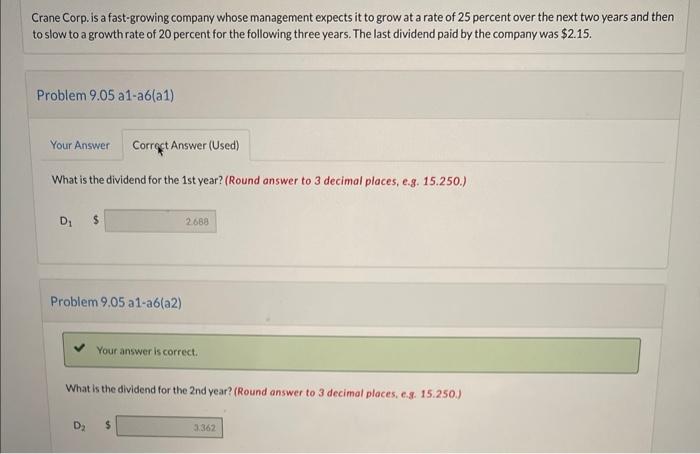

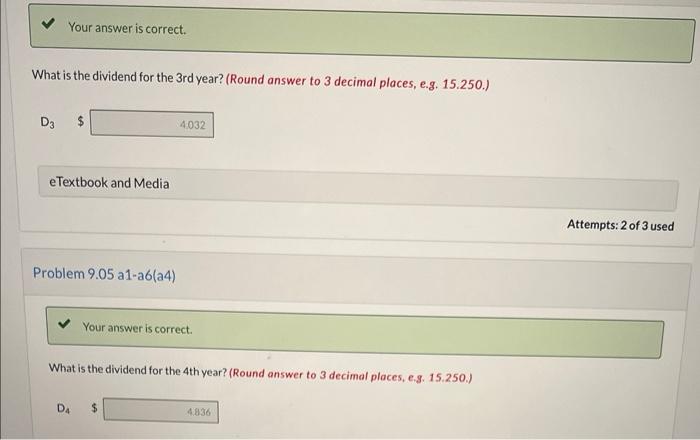

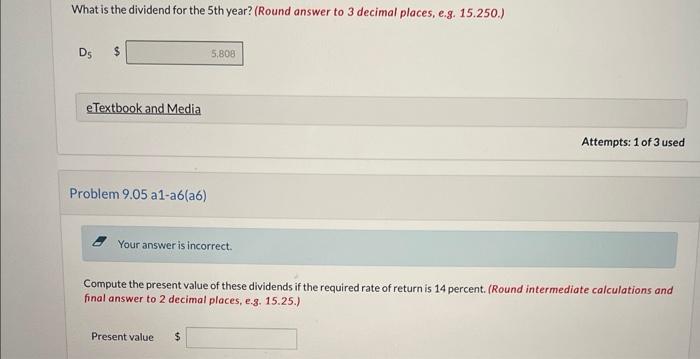

Crane Corp. is a fast-growing company whose management expects it to grow at a rate of 25 percent over the next two years and then to slow to a growth rate of 20 percent for the following three years. The last dividend paid by the company was $2.15. Problem 9.05 a1-a6(a1) What is the dividend for the 1st year? (Round answer to 3 decimal places, e.g. 15.250.) D1$ Problem 9,05 a1-a6(a2) Your answer is correct. What is the dividend for the 2 nd year? (Round answer to 3 decimal places, e.g. 15.250.) What is the dividend for the 3rd year? (Round answer to 3 decimal places, e.g. 15.250.) D3$ eTextbook and Media Problem 9.05 a1-a6(a4) What is the dividend for the 4 th year? (Round answer to 3 decimal places, e.g. 15.250.) What is the dividend for the 5 th year? (Round answer to 3 decimal places, e.g. 15.250.) eTextbook and Media Attempts: 1 of 3 use Problem 9.05 a1-a6(a6) - Your answer is incorrect. Compute the present value of these dividends if the required rate of return is 14 percent. (Round intermediate calculations and final answer to 2 decimal places, e.3.15.25.) Present value $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts