Question: Crane Corp. management is considering purchasing a machine that will cost $117.250 and will be depreciated on a straight-line basis over a five-year period. The

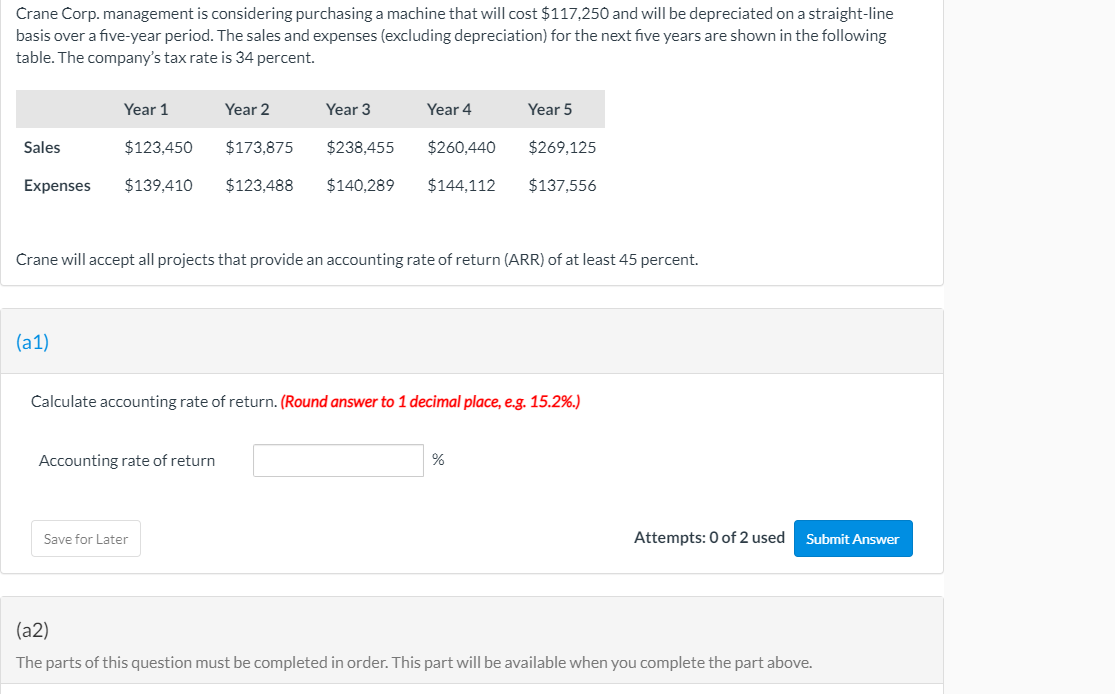

Crane Corp. management is considering purchasing a machine that will cost $117.250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the following table. The company's tax rate is 34 percent. Year 1 Year 2 Year 3 Year 4 Year 5 Sales $123,450 $173,875 $238,455 $260,440 $269,125 Expenses $139,410 $123,488 $140,289 $144,112 $137,556 Crane will accept all projects that provide an accounting rate of return (ARR) of at least 45 percent. (a1) Calculate accounting rate of return. (Round answer to 1 decimal place, e.g. 15.2%.) Accounting rate of return % Save for Later Attempts: 0 of 2 used Submit Answer (a2) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts