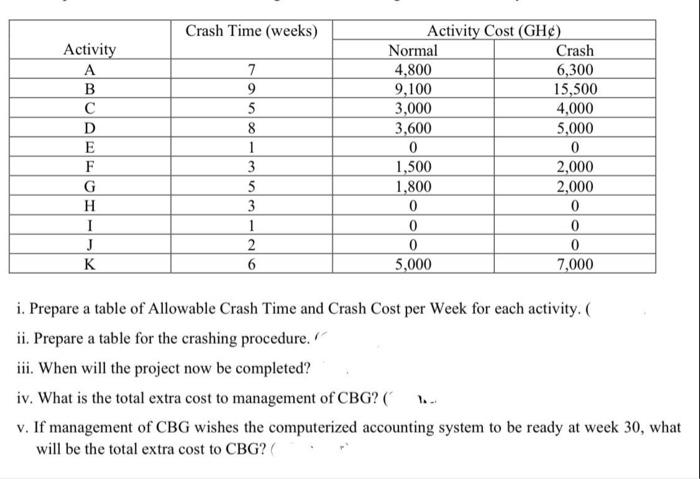

Question: Crash Time (weeks) Activity A B D E F G H I J K 7 9 5 8 1 3 5 3 1 2 6

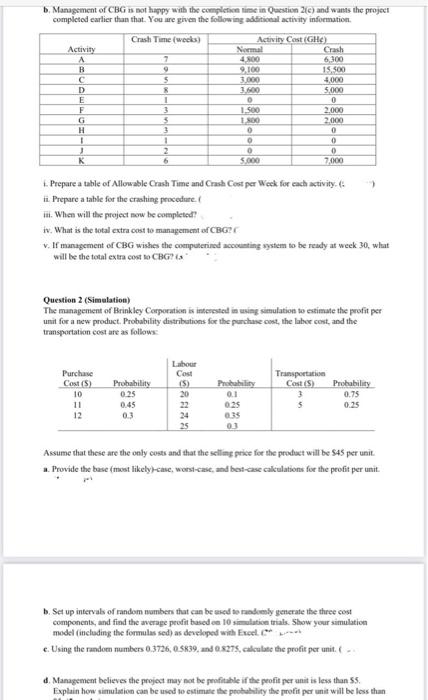

Crash Time (weeks) Activity A B D E F G H I J K 7 9 5 8 1 3 5 3 1 2 6 Activity Cost (GHC) Normal Crash 4,800 6,300 9,100 15,500 3,000 4,000 3,600 5,000 0 0 1,500 2,000 1,800 2,000 0 0 0 0 0 0 5,000 7,000 i. Prepare a table of Allowable Crash Time and Crash Cost per Week for each activity. ( ii. Prepare a table for the crashing procedure. / iii. When will the project now be completed? iv. What is the total extra cost to management of CBG? ( v. If management of CBG wishes the computerized accounting system to be ready at week 30, what will be the total extra cost to CBG? b. Management of CBGs not happy with the completion time in Question 21c) and wants the project completed earlier than that. You are given the following additional activity information Crash Time (weeks) Activity A B 7 9 5 D E F G H 1 1 K 1 3 3 3 1 2 6 Activity Cost (GH) Normal Crash 4 DO 6,300 9.100 15.500 3.000 4,000 3.600 5.000 0 0 1.500 2.000 180 2.000 o O 0 O 0 5.000 7.000 2 1. Prepare a table of Allowable Crash Time and Crash Cost per Week for each activity. (: ti. Prepare a table for the crashing procedure m. When will the project now be completed? iv. What is the total extra cost to management of CBGPC V. If management of CBG wishes the computerized accounting system to be ready at week 30, what will be the total extra cost to CBG Question 2 (Simulation) The management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. Probability distributions for the purchase cost, the labor cest, and the transportation cost are as follows Purchase Cost (5) 10 11 12 Labour Cost (5) 20 Probability 0.25 0.45 0.3 Probability 0.1 0.25 033 03 Transportation Cost (5) Probability 3 0.75 0.25 25 Assume that these are the only costs and that the selling price for the product will be 845 per unit. Provide the base (most likely)-cme.westcastand best-case calculations for the profit per unit. b. Set up intervals of random numbers that can be used to randomly generate the three cost components, and find the average profit based on 10 satio trials. Show your simulation model (including the formulas sed) as developed with Excel . Using the random numbers 0.3726, 0.5639 and 0.3275, calculate the profit per unit. d. Management believes the project may not be profitable if the profit per unit is less than 55. Explain how simulation can be used to estimate the probability the profit per unit will be less than Crash Time (weeks) Activity A B D E F G H I J K 7 9 5 8 1 3 5 3 1 2 6 Activity Cost (GHC) Normal Crash 4,800 6,300 9,100 15,500 3,000 4,000 3,600 5,000 0 0 1,500 2,000 1,800 2,000 0 0 0 0 0 0 5,000 7,000 i. Prepare a table of Allowable Crash Time and Crash Cost per Week for each activity. ( ii. Prepare a table for the crashing procedure. / iii. When will the project now be completed? iv. What is the total extra cost to management of CBG? ( v. If management of CBG wishes the computerized accounting system to be ready at week 30, what will be the total extra cost to CBG? b. Management of CBGs not happy with the completion time in Question 21c) and wants the project completed earlier than that. You are given the following additional activity information Crash Time (weeks) Activity A B 7 9 5 D E F G H 1 1 K 1 3 3 3 1 2 6 Activity Cost (GH) Normal Crash 4 DO 6,300 9.100 15.500 3.000 4,000 3.600 5.000 0 0 1.500 2.000 180 2.000 o O 0 O 0 5.000 7.000 2 1. Prepare a table of Allowable Crash Time and Crash Cost per Week for each activity. (: ti. Prepare a table for the crashing procedure m. When will the project now be completed? iv. What is the total extra cost to management of CBGPC V. If management of CBG wishes the computerized accounting system to be ready at week 30, what will be the total extra cost to CBG Question 2 (Simulation) The management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. Probability distributions for the purchase cost, the labor cest, and the transportation cost are as follows Purchase Cost (5) 10 11 12 Labour Cost (5) 20 Probability 0.25 0.45 0.3 Probability 0.1 0.25 033 03 Transportation Cost (5) Probability 3 0.75 0.25 25 Assume that these are the only costs and that the selling price for the product will be 845 per unit. Provide the base (most likely)-cme.westcastand best-case calculations for the profit per unit. b. Set up intervals of random numbers that can be used to randomly generate the three cost components, and find the average profit based on 10 satio trials. Show your simulation model (including the formulas sed) as developed with Excel . Using the random numbers 0.3726, 0.5639 and 0.3275, calculate the profit per unit. d. Management believes the project may not be profitable if the profit per unit is less than 55. Explain how simulation can be used to estimate the probability the profit per unit will be less than