Question: create a 1-2 page write-up explaining your results and how you will expect to reach your goals. PLEASE ALSO DOUBLE CHECK CALCULATIONS ARE RIGHT IN

create a 1-2 page write-up explaining your results and how you will expect to reach your goals.

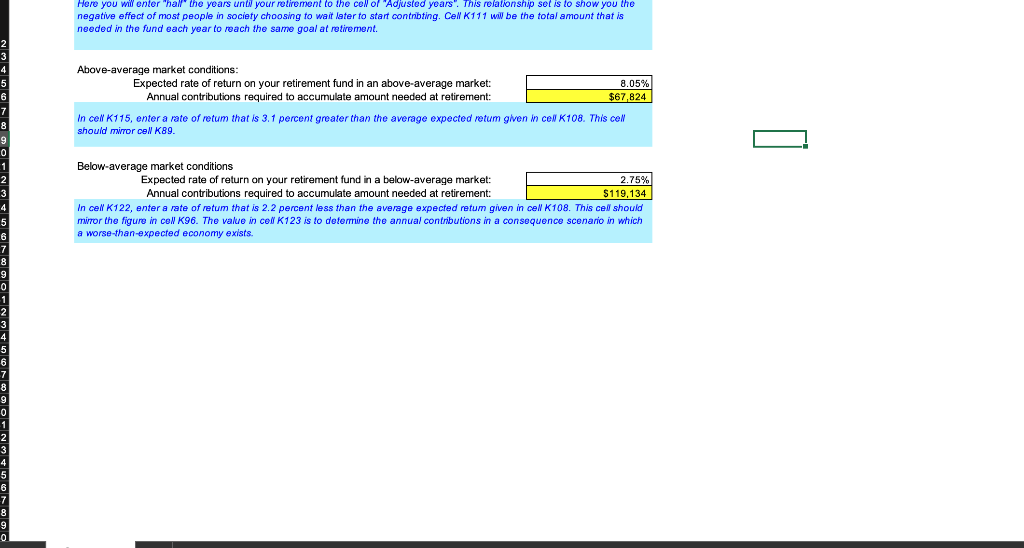

PLEASE ALSO DOUBLE CHECK CALCULATIONS ARE RIGHT IN THE FORM. *** ONLY THE WHITE CELLS ARE TO BE EDITED.

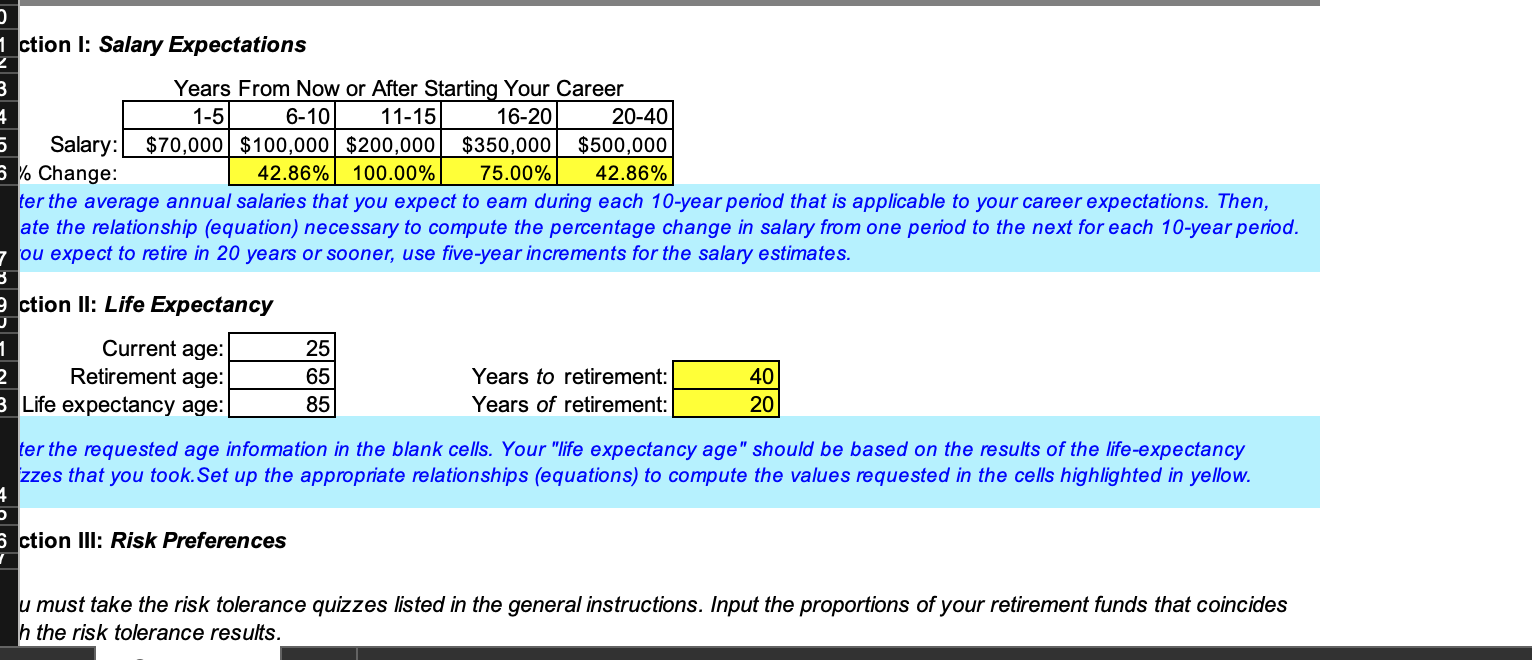

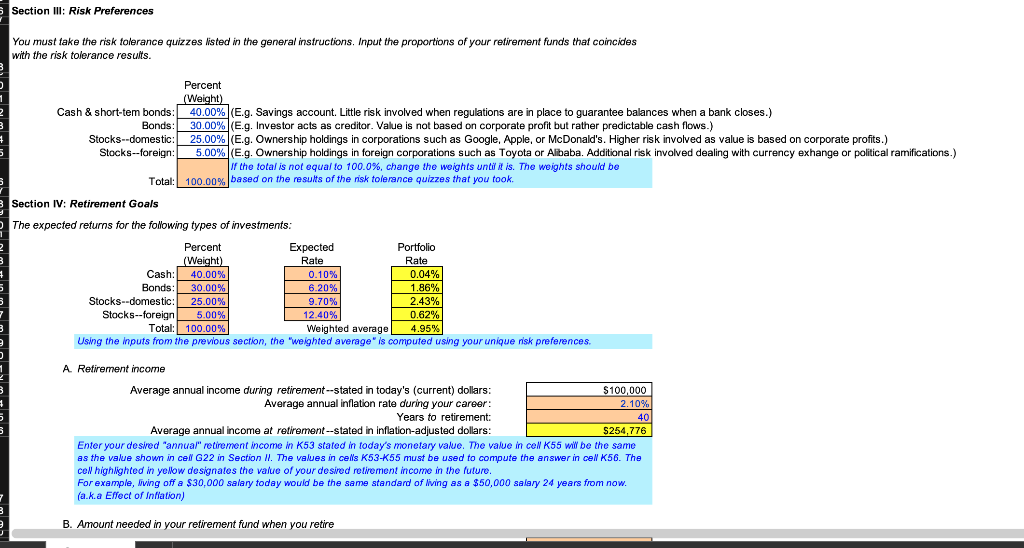

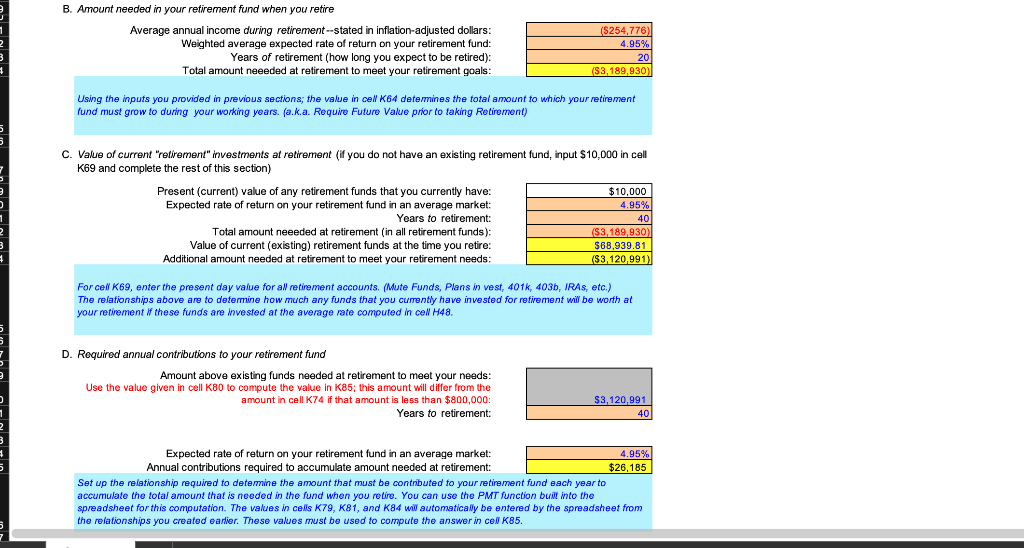

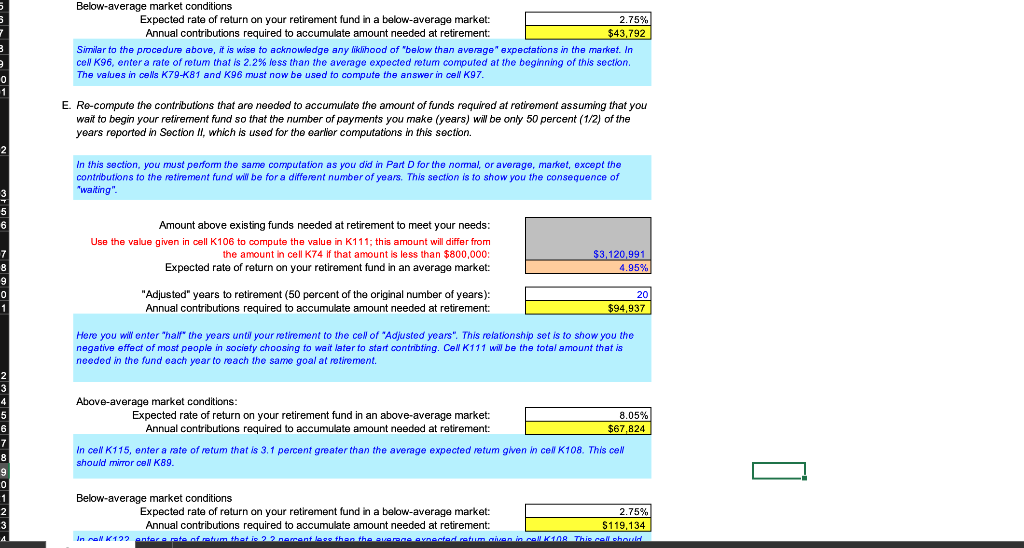

1 ction I: Salary Expectations 3 Years From Now or After Starting Your Career 2 1-5 6-10 11-15 16-20 20-40 5 Salary: $70,000 $100,000 $200,000 $350,000 $500,000 5% Change: 42.86% 100.00% 75.00% 42.86% ter the average annual salaries that you expect to eam during each 10-year period that is applicable to your career expectations. Then, ate the relationship (equation) necessary to compute the percentage change in salary from one period to the next for each 10-year period. 7 ou expect to retire in 20 years or sooner, use five-year increments for the salary estimates. 3 ction II: Life Expectancy J 1 Current age: 2 Retirement age: 3 Life expectancy age: 25 65 85 Years to retirement: Years of retirement: 40 20 ter the requested age information in the blank cells. Your "life expectancy age" should be based on the results of the life-expectancy zzes that you took. Set up the appropriate relationships (equations) to compute the values requested in the cells highlighted in yellow. ction Ill: Risk Preferences u must take the risk tolerance quizzes listed in the general instructions. Input the proportions of your retirement funds that coincides h the risk tolerance results. Section III: Risk Preferences You must take the risk tolerance quizzes listed in the general instructions. Input the proportions of your retirement funds that coincides with the risk tolerance results. Percent (Weight) Cash & short-tem bonds: 40.00% (E.g. Savings account. Little risk involved when regulations are in place to guarantee balances when a bank closes.) Bonds: 30.00% (E.g. Investor acts as creditor. Value is not based on corporate profit but rather predictable cash flows.) Stocks domestic 25.00% (E.g. Ownership holdings in corporations such as Google, Apple, or McDonald's. Higher risk involved as value is based on corporate profits.) Stocks--foreign:! 5.00% E.g. Ownership holdings in foreign corporations such as Toyota or Alibaba. Additional risk involved dealing with currency exhange or political ramifications.) If the total is not equal to 100.0%, change the weights until it is. The weights should be Total: 100.00% based on the results of the nisk tolerance quizzes that you took Section IV: Retirement Goals The expected returns for the following types of investments: Percent Expected Portfolio (Weight) Rate Rate Cash 40.00% 0.10% 0.04% Bonds: 30.00% 6.20% 1.86% Stocks--domestic: 25.00% 9.70% 2.43% Stocks--foreign 5.00% 12.40% 0.62% Total: 100.00% Weighted average 4.95% Using the inputs from the previous section, the "weighted average" is computed using your unique nisk preferences A Retirement income A Average annual income during retirement--stated in today's (current) dollars: $100,000 Average annual inflation rate during your career: 2.10% Years to retirement: 40 Average annual income at retirement --stated in inflation-adjusted dollars: $254,776 Enter your desired "annual retirement income in K53 stated in today's monetary value. The value in cel K55 will be the same as the value shown in cell G22 in Section II. The values in cells K53-K55 must be used to compute the answer in cel K56. The cell highlighted in yellow designates the value of your desired retirement income in the future. For example, living off a $30,000 salary today would be the same standard of living as a $50,000 salary 24 years from now. (a.k.a Effect of Inflation) B. Amount needed in your retirement fund when you retire B. Amount needed in your retirement fund when you retire Average annual income during retirement-stated in inflation-adjusted dollars: Weighted average expected rate of return on your retirement fund: Years of retirement (how long you expect to be retired): Total amount neeeded at retirement to meet your retirement goals: ($254,776) 4.95% 20 ($3,189,930) Using the inputs you provided in previous sections; the value in cel K64 determines the total amount to which your retirement fund must grow to during your working years. (a.k.a. Require Future Value prior to taking Retirement) C. Value of current "retirement investments at retirement (if you do not have an existing retirement fund, input $10,000 in cell K69 and complete the rest of this section) Present (current) value of any retirement funds that you currently have: $10,000 Expected rate of return on your retirement fund in an average market: 4.95% Years to retirement: 40 Total amount neeeded at retirement (in all retirement funds): ($3,189,930) Value of current (existing) retirement funds at the time you retire: $68,939.81 Additional amount needed at retirement to meet your retirement needs ($3,120,991) For cell K69, enter the present day value for all retirement accounts. (Mute Funds, Plans in vest, 401k, 403b, IRAs, etc.) , , The relationships above are to determine how much any funds that you currently have invested for retirement will be worth at your retirement if these funds are invested at the average rate computed in cel H48. D. Required annual contributions to your retirement fund Amount above existing funds needed at retirement to meet your needs: Use the value given in cell K80 to compute the value in K85; this amount will differ from the amount in cell K74 if that amount is less than $800,000: Years to retirement: $3,120,991 40 Expected rate of return on your retirement fund in an average market: 4.95% Annual contributions required to accumulate amount needed at retirement: $26,185 Set up the relationship required to determine the amount that must be contnbuted to your retirement fund each year to accumulate the total amount that is needed in the fund when you retire. You can use the PMT function built into the spreadsheet for this computation. The values in cells K79, K81, and K84 will automatically be entered by the spreadsheet from the relationships you created earlier. These values must be used to compute the answer in cell K85. Below-average market conditions Expected rate of return on your retirement fund in a below-average market: 2.75% Annual contributions required to accumulate amount needed at retirement: $43,792 Similar to the procedure above, it is wise to acknowledge any liklihood of "below than average" expectations in the market. In cell K96, enter a rate of retum that is 2.2% less than the average expected retum computed at the beginning of this section. The values in cells K79-681 and K96 must now be used to compute the answer in cel K97. 0 E. Re-compute the contributions that are needed to accumulate the amount of funds required at retirement assuming that you wait to begin your retirement fund so that the number of payments you make (years) will be only 50 percent (1/2) of the years reported in Section II, which is used for the earlier computations in this section. In this section, you must perform the same computation as you did in Part D for the normal, or average, market, except the contributions to the retirement fund will be for a different number of years. This section is to show you the consequence of "waiting" 5 6 Amount above existing funds needed at retirement to meet your needs: Use the value given in cell K106 to compute the value in K111; this amount will differ from the amount in cell K74 if that amount is less than $800,000: Expected rate of return on your retirement fund in an average market: $3,120 991 4.95% 7 8 9 0 1 "Adjusted" years to retirement (50 percent of the original number of years): Annual contributions required to accumulate amount needed at retirement: 20 $94,937 Here you will enter "hall the years until your retirement to the cell of "Adjusted years". This relationship set is to show you the negative effect of most people in society choosing to wait later to start contribting. Cel K111 will be the total amount that is needed in the fund each year to reach the same goal at retirement 2 3 4 5 6 7 8 9 0 1 Above-average market conditions: Expected rate of return on your retirement fund in an above-average market: 8.05% Annual contributions required to accumulate amount needed at retirement: $67,824 In cell K115, enter a rate of retum that is 3.1 percent greater than the average expected retum given in cell K108. This cell should miror cel K89. Below-average market conditions Expected rate of return on your retirement fund in a below-average market: 2.75% Annual contributions required to accumulate amount needed at retirement: $119,134 In MoN K122 antece rate of retum that is 22nement less than the everce Arnected retum non in collK109. This coll should 3 4 Here you will enter "half the years until your retirement to the cell of "Adjusted years. This relationship set is to show you the negative effect of most people in society choosing to wait later to start contbting. Cel K111 will be the total amount that is needed in the fund each year to reach the same goal at retirement Above-average market conditions: Expected rate of return on your retirement fund in an above-average market: Annual contributions required to accumulate amount needed at retirement: 8.05% $67,824 In cel K115, enter a rate of retum that is 3.1 percent greater than the average expected retum given in cel K108. This cell should miror cel K89. O Below-average market conditions Expected rate of return on your retirement fund in a below-average market: 2.75% Annual contributions required to accumulate amount needed at retirement: $119,134 In cell K122, enter a rate of retum that is 2.2 percent less than the average expected retum given in cel K108. This cell should mirror the figure in cel K96. The value in cell K123 is to determine the annual contributions in a consequence scenario in which a worse-than-expected economy exists. 1 ction I: Salary Expectations 3 Years From Now or After Starting Your Career 2 1-5 6-10 11-15 16-20 20-40 5 Salary: $70,000 $100,000 $200,000 $350,000 $500,000 5% Change: 42.86% 100.00% 75.00% 42.86% ter the average annual salaries that you expect to eam during each 10-year period that is applicable to your career expectations. Then, ate the relationship (equation) necessary to compute the percentage change in salary from one period to the next for each 10-year period. 7 ou expect to retire in 20 years or sooner, use five-year increments for the salary estimates. 3 ction II: Life Expectancy J 1 Current age: 2 Retirement age: 3 Life expectancy age: 25 65 85 Years to retirement: Years of retirement: 40 20 ter the requested age information in the blank cells. Your "life expectancy age" should be based on the results of the life-expectancy zzes that you took. Set up the appropriate relationships (equations) to compute the values requested in the cells highlighted in yellow. ction Ill: Risk Preferences u must take the risk tolerance quizzes listed in the general instructions. Input the proportions of your retirement funds that coincides h the risk tolerance results. Section III: Risk Preferences You must take the risk tolerance quizzes listed in the general instructions. Input the proportions of your retirement funds that coincides with the risk tolerance results. Percent (Weight) Cash & short-tem bonds: 40.00% (E.g. Savings account. Little risk involved when regulations are in place to guarantee balances when a bank closes.) Bonds: 30.00% (E.g. Investor acts as creditor. Value is not based on corporate profit but rather predictable cash flows.) Stocks domestic 25.00% (E.g. Ownership holdings in corporations such as Google, Apple, or McDonald's. Higher risk involved as value is based on corporate profits.) Stocks--foreign:! 5.00% E.g. Ownership holdings in foreign corporations such as Toyota or Alibaba. Additional risk involved dealing with currency exhange or political ramifications.) If the total is not equal to 100.0%, change the weights until it is. The weights should be Total: 100.00% based on the results of the nisk tolerance quizzes that you took Section IV: Retirement Goals The expected returns for the following types of investments: Percent Expected Portfolio (Weight) Rate Rate Cash 40.00% 0.10% 0.04% Bonds: 30.00% 6.20% 1.86% Stocks--domestic: 25.00% 9.70% 2.43% Stocks--foreign 5.00% 12.40% 0.62% Total: 100.00% Weighted average 4.95% Using the inputs from the previous section, the "weighted average" is computed using your unique nisk preferences A Retirement income A Average annual income during retirement--stated in today's (current) dollars: $100,000 Average annual inflation rate during your career: 2.10% Years to retirement: 40 Average annual income at retirement --stated in inflation-adjusted dollars: $254,776 Enter your desired "annual retirement income in K53 stated in today's monetary value. The value in cel K55 will be the same as the value shown in cell G22 in Section II. The values in cells K53-K55 must be used to compute the answer in cel K56. The cell highlighted in yellow designates the value of your desired retirement income in the future. For example, living off a $30,000 salary today would be the same standard of living as a $50,000 salary 24 years from now. (a.k.a Effect of Inflation) B. Amount needed in your retirement fund when you retire B. Amount needed in your retirement fund when you retire Average annual income during retirement-stated in inflation-adjusted dollars: Weighted average expected rate of return on your retirement fund: Years of retirement (how long you expect to be retired): Total amount neeeded at retirement to meet your retirement goals: ($254,776) 4.95% 20 ($3,189,930) Using the inputs you provided in previous sections; the value in cel K64 determines the total amount to which your retirement fund must grow to during your working years. (a.k.a. Require Future Value prior to taking Retirement) C. Value of current "retirement investments at retirement (if you do not have an existing retirement fund, input $10,000 in cell K69 and complete the rest of this section) Present (current) value of any retirement funds that you currently have: $10,000 Expected rate of return on your retirement fund in an average market: 4.95% Years to retirement: 40 Total amount neeeded at retirement (in all retirement funds): ($3,189,930) Value of current (existing) retirement funds at the time you retire: $68,939.81 Additional amount needed at retirement to meet your retirement needs ($3,120,991) For cell K69, enter the present day value for all retirement accounts. (Mute Funds, Plans in vest, 401k, 403b, IRAs, etc.) , , The relationships above are to determine how much any funds that you currently have invested for retirement will be worth at your retirement if these funds are invested at the average rate computed in cel H48. D. Required annual contributions to your retirement fund Amount above existing funds needed at retirement to meet your needs: Use the value given in cell K80 to compute the value in K85; this amount will differ from the amount in cell K74 if that amount is less than $800,000: Years to retirement: $3,120,991 40 Expected rate of return on your retirement fund in an average market: 4.95% Annual contributions required to accumulate amount needed at retirement: $26,185 Set up the relationship required to determine the amount that must be contnbuted to your retirement fund each year to accumulate the total amount that is needed in the fund when you retire. You can use the PMT function built into the spreadsheet for this computation. The values in cells K79, K81, and K84 will automatically be entered by the spreadsheet from the relationships you created earlier. These values must be used to compute the answer in cell K85. Below-average market conditions Expected rate of return on your retirement fund in a below-average market: 2.75% Annual contributions required to accumulate amount needed at retirement: $43,792 Similar to the procedure above, it is wise to acknowledge any liklihood of "below than average" expectations in the market. In cell K96, enter a rate of retum that is 2.2% less than the average expected retum computed at the beginning of this section. The values in cells K79-681 and K96 must now be used to compute the answer in cel K97. 0 E. Re-compute the contributions that are needed to accumulate the amount of funds required at retirement assuming that you wait to begin your retirement fund so that the number of payments you make (years) will be only 50 percent (1/2) of the years reported in Section II, which is used for the earlier computations in this section. In this section, you must perform the same computation as you did in Part D for the normal, or average, market, except the contributions to the retirement fund will be for a different number of years. This section is to show you the consequence of "waiting" 5 6 Amount above existing funds needed at retirement to meet your needs: Use the value given in cell K106 to compute the value in K111; this amount will differ from the amount in cell K74 if that amount is less than $800,000: Expected rate of return on your retirement fund in an average market: $3,120 991 4.95% 7 8 9 0 1 "Adjusted" years to retirement (50 percent of the original number of years): Annual contributions required to accumulate amount needed at retirement: 20 $94,937 Here you will enter "hall the years until your retirement to the cell of "Adjusted years". This relationship set is to show you the negative effect of most people in society choosing to wait later to start contribting. Cel K111 will be the total amount that is needed in the fund each year to reach the same goal at retirement 2 3 4 5 6 7 8 9 0 1 Above-average market conditions: Expected rate of return on your retirement fund in an above-average market: 8.05% Annual contributions required to accumulate amount needed at retirement: $67,824 In cell K115, enter a rate of retum that is 3.1 percent greater than the average expected retum given in cell K108. This cell should miror cel K89. Below-average market conditions Expected rate of return on your retirement fund in a below-average market: 2.75% Annual contributions required to accumulate amount needed at retirement: $119,134 In MoN K122 antece rate of retum that is 22nement less than the everce Arnected retum non in collK109. This coll should 3 4 Here you will enter "half the years until your retirement to the cell of "Adjusted years. This relationship set is to show you the negative effect of most people in society choosing to wait later to start contbting. Cel K111 will be the total amount that is needed in the fund each year to reach the same goal at retirement Above-average market conditions: Expected rate of return on your retirement fund in an above-average market: Annual contributions required to accumulate amount needed at retirement: 8.05% $67,824 In cel K115, enter a rate of retum that is 3.1 percent greater than the average expected retum given in cel K108. This cell should miror cel K89. O Below-average market conditions Expected rate of return on your retirement fund in a below-average market: 2.75% Annual contributions required to accumulate amount needed at retirement: $119,134 In cell K122, enter a rate of retum that is 2.2 percent less than the average expected retum given in cel K108. This cell should mirror the figure in cel K96. The value in cell K123 is to determine the annual contributions in a consequence scenario in which a worse-than-expected economy exists

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts