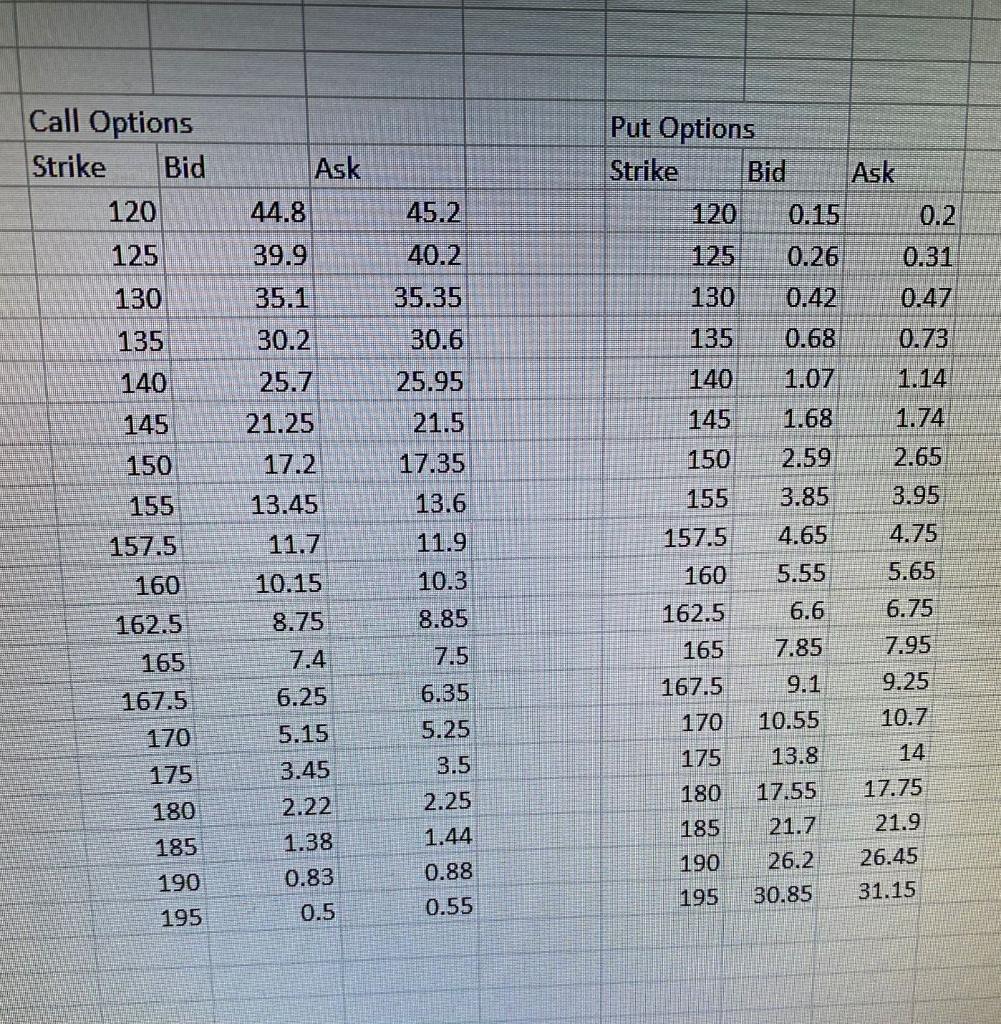

Question: Create a butterfly spread using call options with $160.00 and $165.00 and $170.00 strike prices. Be sure to use the appropriate bid and ask prices.

Create a butterfly spread using call options with $160.00 and $165.00 and $170.00 strike prices. Be sure to use the appropriate bid and ask prices.

- When you set up the position

- the cash inflow is $ ;

- the cash outflow is $

- and the net cash flow is $ .

Call Options Strike Bid 120 Ask 44.8 39.9 Put Options Strike Bid Ask 120 0.15 0.2 0.26 0.31 130 0.42 0.47 125 130 45.2 40.2 35.35 30.6 25.95 135 135 0.68 35.1 30.2 25.7 21.25 0.73 140 140 1.07 145 21.5 145 1.68 2.59 150 17.2 150 155 13.45 13.6 3.85 155 157.5 157.5 11.9 10.3 4.65 5.55 6.6 160 162.5 8.85 160 162.5 165 167.5 170 165 167.5 170 175 11.7 10.15 8.75 7.4 6.25 5.15 3.45 2.22 1.38 7.5 6.35 5.25 3.5 2.25 1.44 0.88 0.55 175 1.74 2.65 3.95 4.75 5.65 6.75 7.95 9.25 10.7 14 17.75 21.9 26.45 31.15 7.85 9.1 10.55 13.8 17.55 21.7 26.2 30.85 180 180 185 190 185 190 195 0.83 195 0.5 Call Options Strike Bid 120 Ask 44.8 39.9 Put Options Strike Bid Ask 120 0.15 0.2 0.26 0.31 130 0.42 0.47 125 130 45.2 40.2 35.35 30.6 25.95 135 135 0.68 35.1 30.2 25.7 21.25 0.73 140 140 1.07 145 21.5 145 1.68 2.59 150 17.2 150 155 13.45 13.6 3.85 155 157.5 157.5 11.9 10.3 4.65 5.55 6.6 160 162.5 8.85 160 162.5 165 167.5 170 165 167.5 170 175 11.7 10.15 8.75 7.4 6.25 5.15 3.45 2.22 1.38 7.5 6.35 5.25 3.5 2.25 1.44 0.88 0.55 175 1.74 2.65 3.95 4.75 5.65 6.75 7.95 9.25 10.7 14 17.75 21.9 26.45 31.15 7.85 9.1 10.55 13.8 17.55 21.7 26.2 30.85 180 180 185 190 185 190 195 0.83 195 0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts