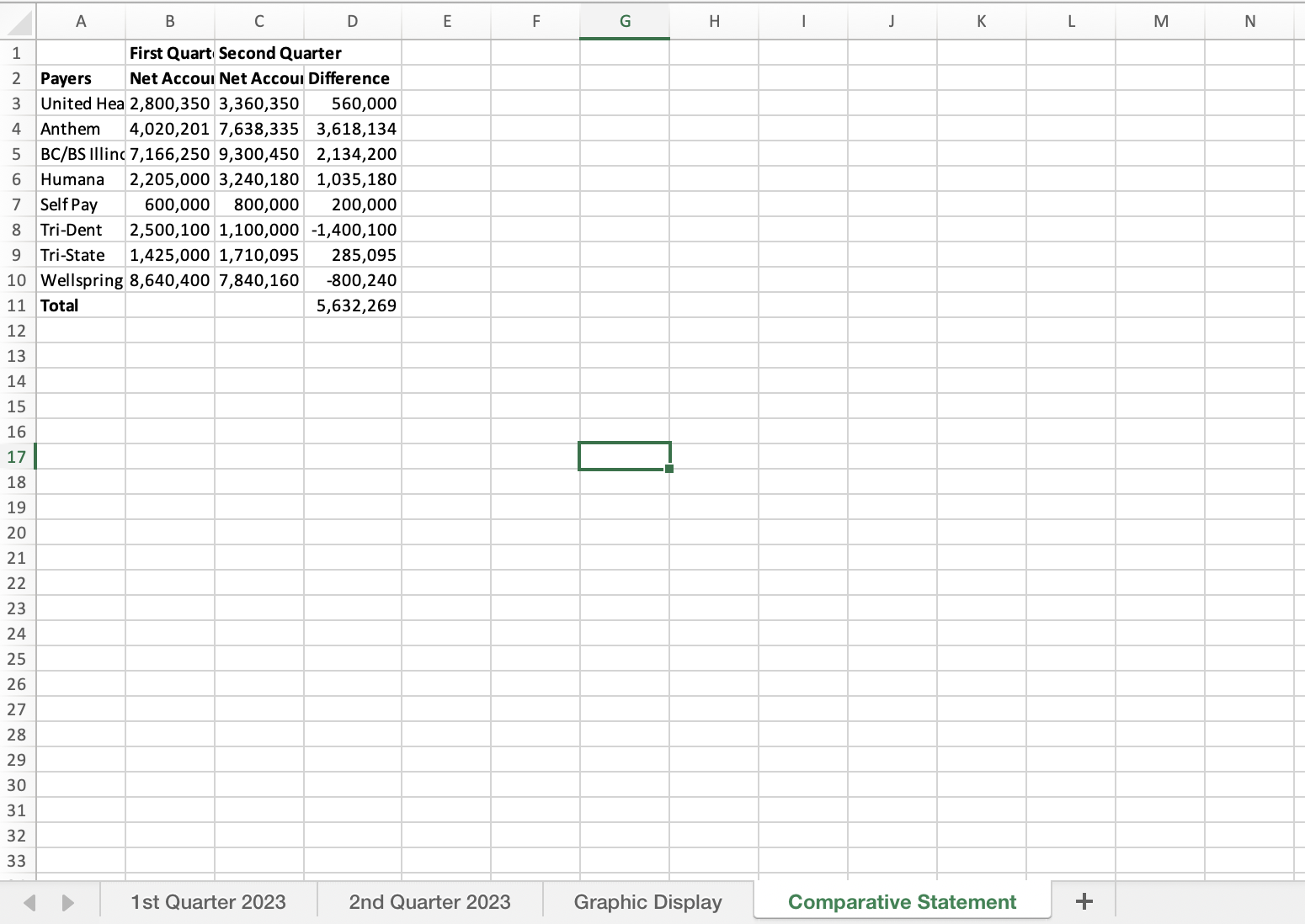

Question: Create a comparative statement within an Excel worksheet comparing the two consecutive quarters of data provided and the impact the net accounts receivable has on

Create a comparative statement within an Excel worksheet comparing the two consecutive quarters of data provided and the impact the net accounts receivable has on the income statement. I attached the data and information needed to create the comparative statement.

- Provide your comparative statement within the worksheet provided in the Excel workbook.

- Utilize your textbook to write a good comparative statement (you do not need to provide your textbook as a reference)

- If you utilize an outside reference (which is not required), provide a working link to that reference.

- Reference: White, Susan (2018). Principles of finance for health information and informatics professionals. (2nd ed.). American Health Information Management Association. Chapters 5 & 6.

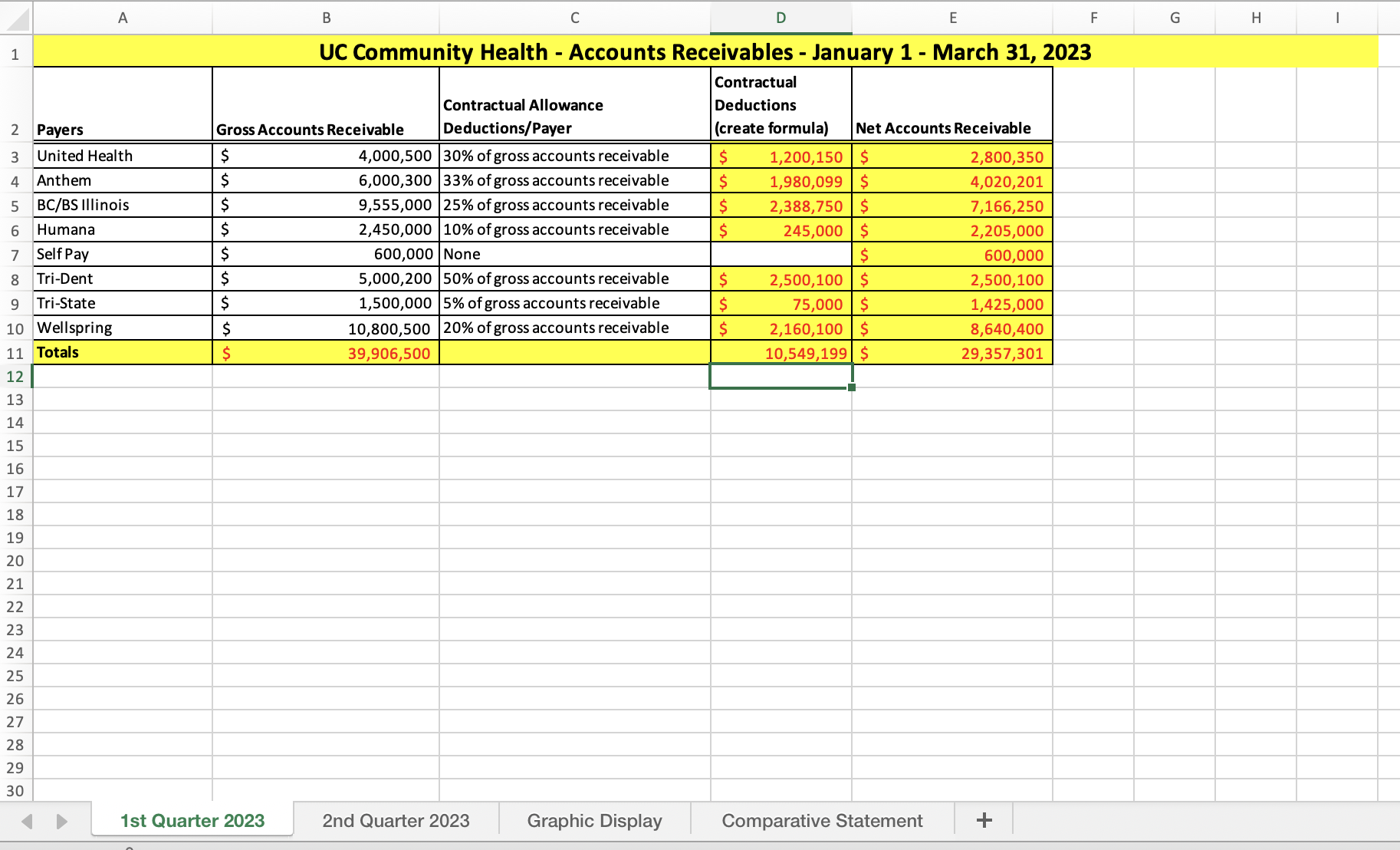

A B 1 C D E UC Community Health - Accounts Receivables - January 1 - March 31, 2023 Contractual 2345678 2 Payers Gross Accounts Receivable Contractual Allowance Deductions/Payer Deductions (create formula) Net Accounts Receivable United Health Anthem $ 4,000,500 30% of gross accounts receivable $ 1,200,150 $ 2,800,350 $ 6,000,300 33% of gross accounts receivable $ 1,980,099 $ 4,020,201 5 BC/BS Illinois $ 9,555,000 25% of gross accounts receivable $ 2,388,750 $ 7,166,250 Humana $ Self Pay $ 2,450,000 10% of gross accounts receivable 600,000 None $ 245,000 $ 2,205,000 $ 600,000 Tri-Dent $ 5,000,200 50% of gross accounts receivable $ 2,500,100 $ 2,500,100 9 Tri-State $ 10 Wellspring $ 11 Totals $ 1,500,000 5% of gross accounts receivable 10,800,500 20% of gross accounts receivable 39,906,500 $ 75,000 $ 1,425,000 $ 2,160,100 $ 8,640,400 10,549,199 $ 29,357,301 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 1st Quarter 2023 2nd Quarter 2023 Graphic Display Comparative Statement + F G H

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts