Question: Create a data sheet using your assigned S&P 5 0 0 equities and calculate the following metrics : a ) Collect information ( Equity Name,

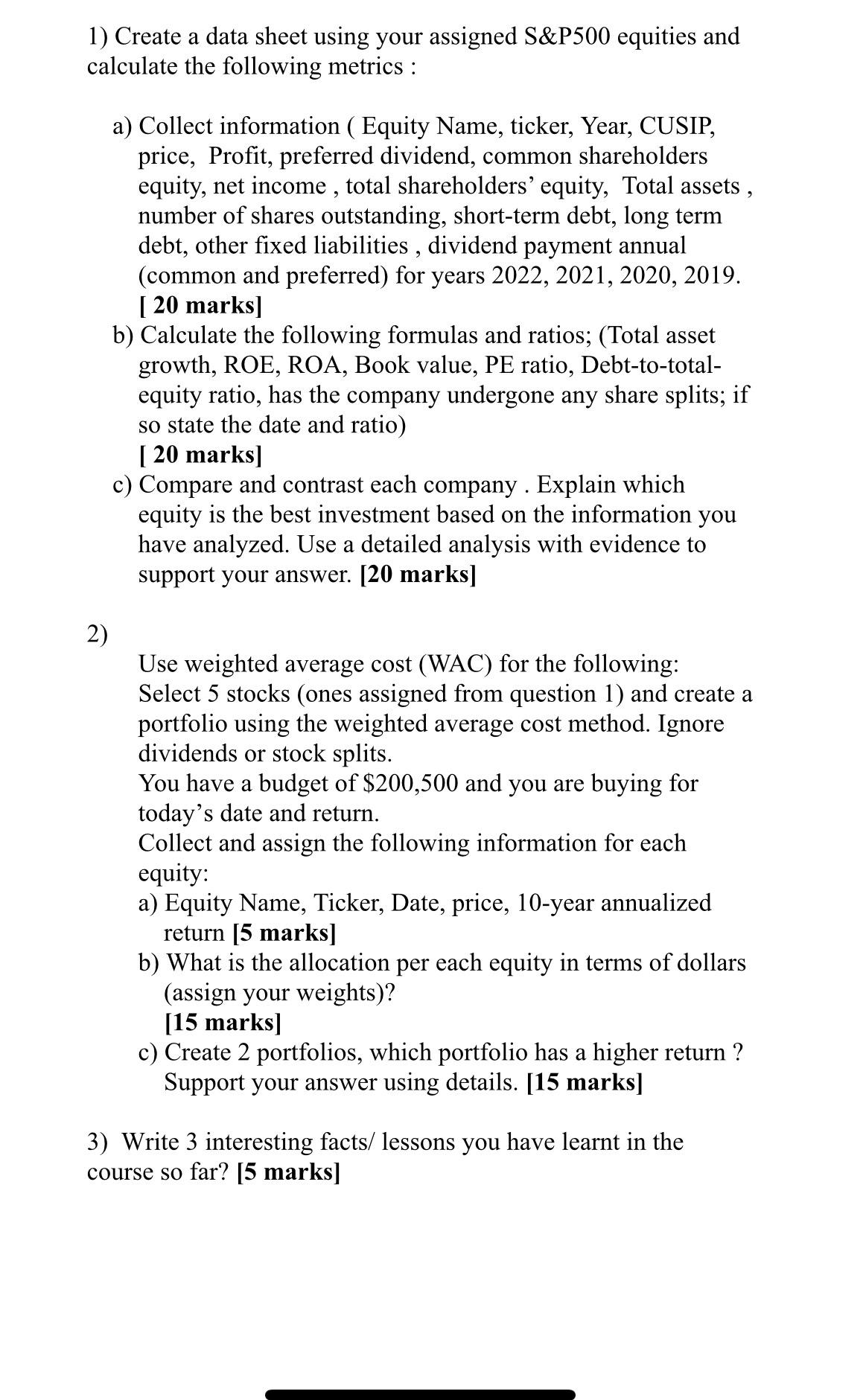

Create a data sheet using your assigned S&P equities and calculate the following metrics :

a Collect information Equity Name, ticker, Year, CUSIP, price, Profit, preferred dividend, common shareholders equity, net income, total shareholders' equity, Total assets number of shares outstanding, shortterm debt, long term debt, other fixed liabilities, dividend payment annual common and preferred for years marks

b Calculate the following formulas and ratios; Total asset growth, ROE, ROA, Book value, PE ratio, Debttototalequity ratio, has the company undergone any share splits; if so state the date and ratio

marks

c Compare and contrast each company Explain which equity is the best investment based on the information you have analyzed. Use a detailed analysis with evidence to support your answer. marks

Use weighted average cost WAC for the following: Select stocks ones assigned from question and create a portfolio using the weighted average cost method. Ignore dividends or stock splits.

You have a budget of $ and you are buying for today's date and return.

Collect and assign the following information for each equity:

a Equity Name, Ticker, Date, price, year annualized return marks

b What is the allocation per each equity in terms of dollars assign your weights

marks

c Create portfolios, which portfolio has a higher return? Support your answer using details. marks

Write interesting facts lessons you have learnt in the course so far? marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock