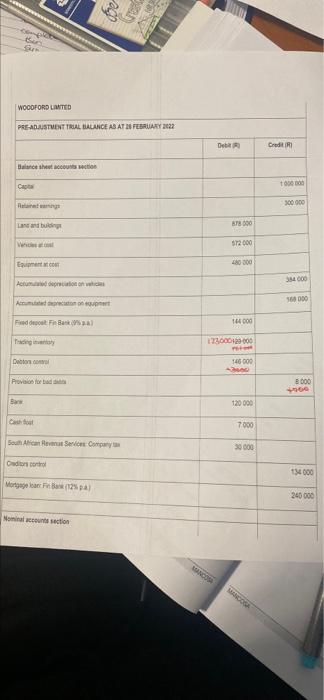

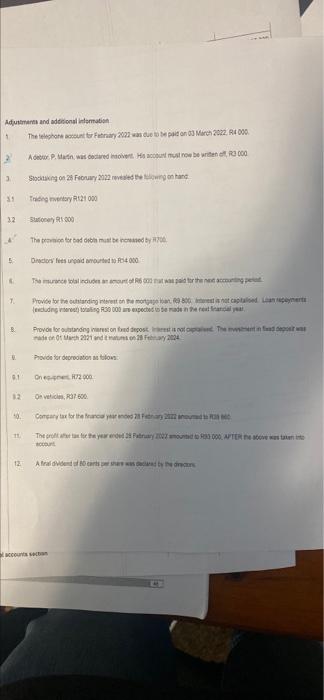

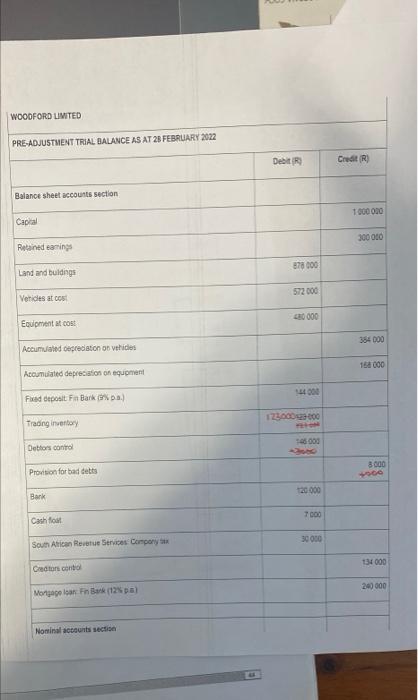

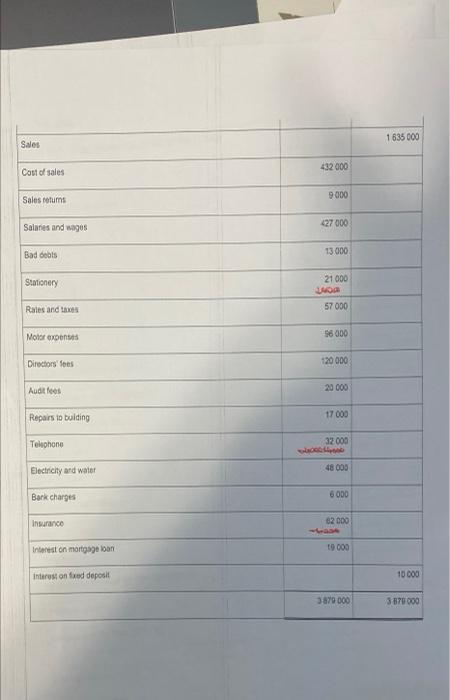

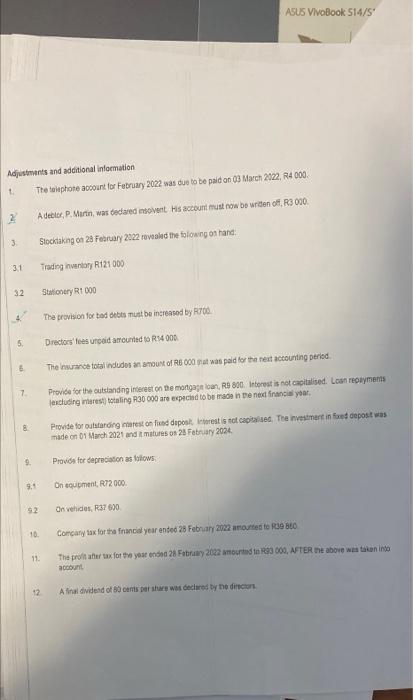

Question: create a financial statement create a statement of financial position Ben Surn WOODFORD LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts

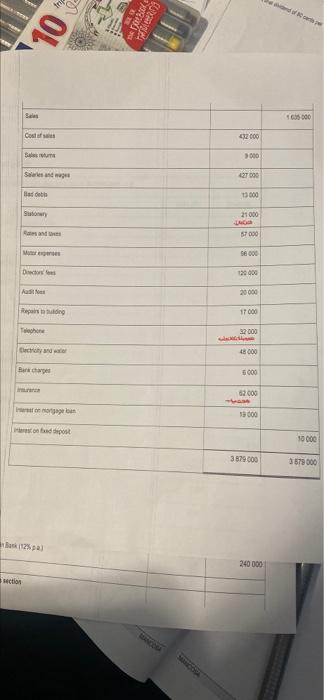

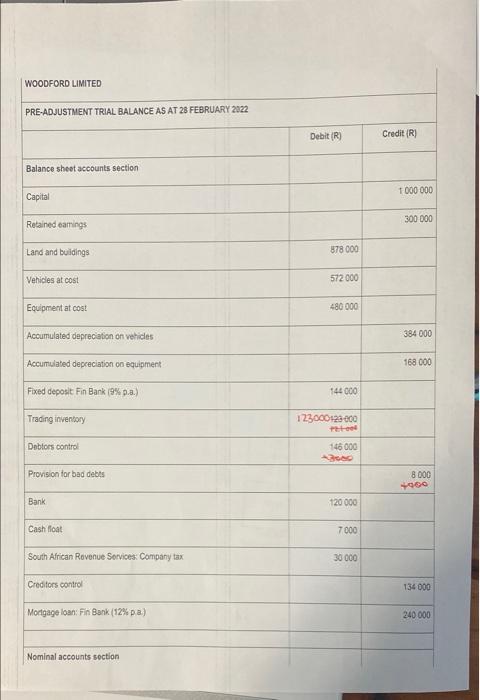

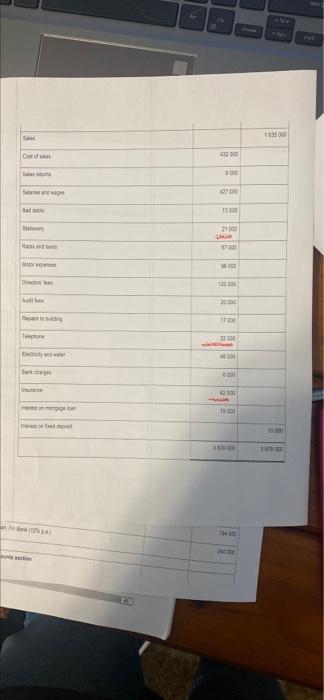

Ben Surn WOODFORD LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts section Capta Land and buildings Vict Equipment to Acumulated depreciation on c Accumulated deprecat Fixed depot Fin Bank) Trading y Provision for bad d Barw South African Revenue Services Company Creditors control Mortgage lean Fin Bank (12%) Nominal accounts section Debit (R) 878.000 MANCOSA $72 000 480 000 144 000 123000129-000 reten 146000 13600 120 000 7.000 30 000 MANCOSA Credit R 1000000 300 000 384 000 160 000 8000 +000 134 000 240 000 Sales Cost of 10 Salesu Salaries and wages Badde section Stationery Rand Directors A Repairstoulding Bank charges Interest on mortgage loan interest on fixed depos Bank (12%) MARCOSA 432 000 000 427000 13000 21000 JAGA 57000 56 000 120 000 20000 17000 32 000 Slackly 48 000 000 9 62.000 -ham 19000 3879 000 240 000 and of 30 cap 1635-000 10 000 3679 000 WOODFORD LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts section Capital Retained earnings Land and buildings Vehicles at cost Equipment at cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Fixed deposit Fin Bank (9% p.a.) Trading inventory Debtors control Provision for bad debts Bank Cash float South African Revenue Services: Company tax Creditors control Mortgage loan: Fin Bank (12% p.a.). Nominal accounts section Debit (R) 878 000 572 000 480 000 144 000 123000123000 petool 146 000 +3000 120 000 7.000 30 000 Credit (R) 1 000 000 300 000 384 000 168.000 8 000 +000 134 000 240 000 Sa Cost of Sa S GORE Motor Ord Aut and bung Telephone Buty and war Bank charges est an engage non fed depos action (12) 201 432000 $:000 427000 13000 21000 ANG $7000 000 120 000 30 000 17.000 12.000 40 000 12 000 19:000 AVE 34-00 ODONE 1635 000 to 500 1879000 Adjustments and additional information 3 31 32 5 K 7. B 9.1 12 10. 11 12 The telephone account for February 2022 was due to be paid on 03 March 2022, R4 000 A debtor P. Martin, was declared insolvent. His account must now be written R3000 Stocktaking on 28 February 2022 revealed the flowing on hand Trading eventory R121000 Stationery 1 000 The provision for bad debis must be increased by R200 Directors fees unpaid amoured to 4000 The murance total includes an amount of R6 000 that was paid for the next accounting pe Provide for the outstanding interest on the mortgage loan R9 800 test is not capitalised Loan repeyt (excluding interest) totaling R30 000 are expected to be made in the next financial year Provide for outstanding interest on fixed deposit rest is not cpad The mostment in few made on 01 March 2021 and it matures on 28 February 2024 Provide for depreciation as w On ese R72 000 On vehicles, R37 600 Company tax for the financial year ended 21 February 222 anoured to R The profit after tax for the year ended 28 February 2002 amounted to R3 000 AFTER E A firal dividend of t0 carts per s accounts sect by the direct above was taken into WOODFORD LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts section Capital Retained earings Land and buildings Vehicles at cost Equipment at cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Fixed deposit Fin Bark (% pa) Trading inventory Debtors control Provision for bad detts Bark Cash float South African Revenue Services Company tax Creditors control Mortgage loan Fin Bank (12% pa) Nominal accounts section Debit (R) 878 000 572 000 480 000 144 000 123,0000-000 TELON 145 000 120.000 7.000 30 000 Credit (R) 1000000 300 000 384 000 168 000 8000 134 000 240 000 Sales Cost of sales Sales returns Salaries and wages Bad debts Stationery Rates and taxes Motor expenses Directors fees Audit fees Repairs to building Telephone Electricity and water Bark charges Insurance Interest on mortgage loan Interest on fixed deposit 432 000 co 9000 427 000 13 000 21 000 JADR 57 000 56 000 120 000 20 000 17 000 32 000 48 000 6 000 62 000 46334 19 000 3879 000 1635 000 10 000 3 870 000 Adjustments and additional information 1. 2 3 31 32 5. 6 7. 8 9. The telephone account for February 2022 was due to be paid on 03 March 2022, R4 000. A deblor, P. Martin, was declared insolvent His account must now be written off, R3 000 Stocktaking on 28 February 2022 revealed the following on hand: Trading inventory R121 000 9.1 92 10. 11. N Stationery R1 000 ASUS VivoBook S14/S The provision for bad debts must be increased by R700 Directors' fees unpaid amounted to R14 000 The insurance total includes an amount of R6 000 shat was paid for the next accounting period. Provide for the outstanding interest on the mortgage loan, RB 800. Interest is not capitalised. Loan repayments (excluding interest) totaling R30 000 are expected to be made in the next financial year. Provide for outstanding interest on fixed deposit. Interest is not capitalised. The investment in fixed deposit was made on 01 March 2021 and it matures on 28 February 2024 Provide for depreciation as follows On equipment, R72 000. On vehicles, R37 600 Company tax for the financial year ended 28 February 2022 amounted to R39 860 The profit after tax for the year ended 28 February 2022 amounted to 1933 000, AFTER the above was taken into account A final dividend of 80 cents per share was declared by the directors Ben Surn WOODFORD LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts section Capta Land and buildings Vict Equipment to Acumulated depreciation on c Accumulated deprecat Fixed depot Fin Bank) Trading y Provision for bad d Barw South African Revenue Services Company Creditors control Mortgage lean Fin Bank (12%) Nominal accounts section Debit (R) 878.000 MANCOSA $72 000 480 000 144 000 123000129-000 reten 146000 13600 120 000 7.000 30 000 MANCOSA Credit R 1000000 300 000 384 000 160 000 8000 +000 134 000 240 000 Sales Cost of 10 Salesu Salaries and wages Badde section Stationery Rand Directors A Repairstoulding Bank charges Interest on mortgage loan interest on fixed depos Bank (12%) MARCOSA 432 000 000 427000 13000 21000 JAGA 57000 56 000 120 000 20000 17000 32 000 Slackly 48 000 000 9 62.000 -ham 19000 3879 000 240 000 and of 30 cap 1635-000 10 000 3679 000 WOODFORD LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts section Capital Retained earnings Land and buildings Vehicles at cost Equipment at cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Fixed deposit Fin Bank (9% p.a.) Trading inventory Debtors control Provision for bad debts Bank Cash float South African Revenue Services: Company tax Creditors control Mortgage loan: Fin Bank (12% p.a.). Nominal accounts section Debit (R) 878 000 572 000 480 000 144 000 123000123000 petool 146 000 +3000 120 000 7.000 30 000 Credit (R) 1 000 000 300 000 384 000 168.000 8 000 +000 134 000 240 000 Sa Cost of Sa S GORE Motor Ord Aut and bung Telephone Buty and war Bank charges est an engage non fed depos action (12) 201 432000 $:000 427000 13000 21000 ANG $7000 000 120 000 30 000 17.000 12.000 40 000 12 000 19:000 AVE 34-00 ODONE 1635 000 to 500 1879000 Adjustments and additional information 3 31 32 5 K 7. B 9.1 12 10. 11 12 The telephone account for February 2022 was due to be paid on 03 March 2022, R4 000 A debtor P. Martin, was declared insolvent. His account must now be written R3000 Stocktaking on 28 February 2022 revealed the flowing on hand Trading eventory R121000 Stationery 1 000 The provision for bad debis must be increased by R200 Directors fees unpaid amoured to 4000 The murance total includes an amount of R6 000 that was paid for the next accounting pe Provide for the outstanding interest on the mortgage loan R9 800 test is not capitalised Loan repeyt (excluding interest) totaling R30 000 are expected to be made in the next financial year Provide for outstanding interest on fixed deposit rest is not cpad The mostment in few made on 01 March 2021 and it matures on 28 February 2024 Provide for depreciation as w On ese R72 000 On vehicles, R37 600 Company tax for the financial year ended 21 February 222 anoured to R The profit after tax for the year ended 28 February 2002 amounted to R3 000 AFTER E A firal dividend of t0 carts per s accounts sect by the direct above was taken into WOODFORD LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts section Capital Retained earings Land and buildings Vehicles at cost Equipment at cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Fixed deposit Fin Bark (% pa) Trading inventory Debtors control Provision for bad detts Bark Cash float South African Revenue Services Company tax Creditors control Mortgage loan Fin Bank (12% pa) Nominal accounts section Debit (R) 878 000 572 000 480 000 144 000 123,0000-000 TELON 145 000 120.000 7.000 30 000 Credit (R) 1000000 300 000 384 000 168 000 8000 134 000 240 000 Sales Cost of sales Sales returns Salaries and wages Bad debts Stationery Rates and taxes Motor expenses Directors fees Audit fees Repairs to building Telephone Electricity and water Bark charges Insurance Interest on mortgage loan Interest on fixed deposit 432 000 co 9000 427 000 13 000 21 000 JADR 57 000 56 000 120 000 20 000 17 000 32 000 48 000 6 000 62 000 46334 19 000 3879 000 1635 000 10 000 3 870 000 Adjustments and additional information 1. 2 3 31 32 5. 6 7. 8 9. The telephone account for February 2022 was due to be paid on 03 March 2022, R4 000. A deblor, P. Martin, was declared insolvent His account must now be written off, R3 000 Stocktaking on 28 February 2022 revealed the following on hand: Trading inventory R121 000 9.1 92 10. 11. N Stationery R1 000 ASUS VivoBook S14/S The provision for bad debts must be increased by R700 Directors' fees unpaid amounted to R14 000 The insurance total includes an amount of R6 000 shat was paid for the next accounting period. Provide for the outstanding interest on the mortgage loan, RB 800. Interest is not capitalised. Loan repayments (excluding interest) totaling R30 000 are expected to be made in the next financial year. Provide for outstanding interest on fixed deposit. Interest is not capitalised. The investment in fixed deposit was made on 01 March 2021 and it matures on 28 February 2024 Provide for depreciation as follows On equipment, R72 000. On vehicles, R37 600 Company tax for the financial year ended 28 February 2022 amounted to R39 860 The profit after tax for the year ended 28 February 2022 amounted to 1933 000, AFTER the above was taken into account A final dividend of 80 cents per share was declared by the directors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts