Question: create a fomula driven excel sheet. please include excel fomulas 5. Portnoy, Inc. has decided to sell some aging equipment; although the book value of

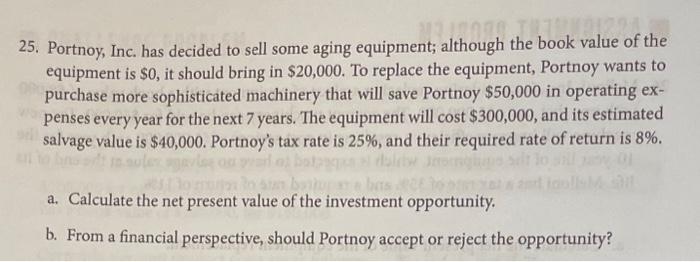

5. Portnoy, Inc. has decided to sell some aging equipment; although the book value of the equipment is $0, it should bring in $20,000. To replace the equipment, Portnoy wants to purchase more sophisticated machinery that will save Portnoy $50,000 in operating expenses every year for the next 7 years. The equipment will cost $300,000, and its estimated salvage value is $40,000. Portnoy's tax rate is 25%, and their required rate of return is 8%. a. Calculate the net present value of the investment opportunity. b. From a financial perspective, should Portnoy accept or reject the opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts