Question: create a journal entry, profit/loss statement, and balance sheet. All entries should be dated Aug 31. 2021 STEP ONE: Enter the following entries for the

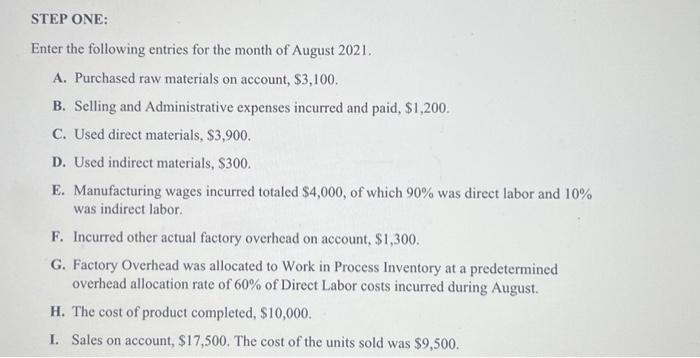

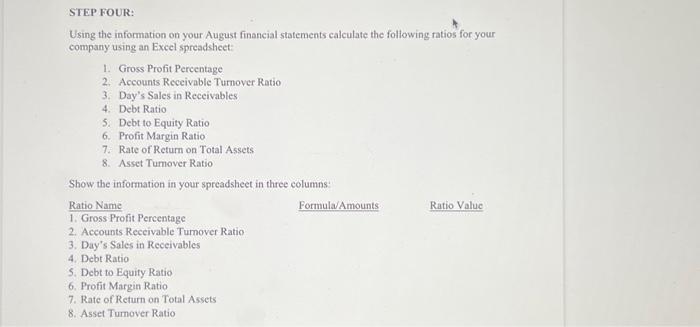

STEP ONE: Enter the following entries for the month of August 2021. A. Purchased raw materials on account, $3,100. B. Selling and Administrative expenses incurred and paid, $1,200. C. Used direct materials, $3,900. D. Used indirect materials, $300. E. Manufacturing wages incurred totaled $4,000, of which 90% was direct labor and 10% was indirect labor. F. Incurred other actual factory overhead on account, $1,300. G. Factory Overhead was allocated to Work in Process Inventory at a predetermined overhead allocation rate of 60% of Direct Labor costs incurred during August. H. The cost of product completed, $10,000. I. Sales on account, $17,500. The cost of the units sold was $9,500. STEP FOUR: Using the information on your August financial statements calculate the following ratios for your company using an Excel spreadsheet: 1. Gross Profit Percentage 2. Accounts Receivable Tumover Ratio 3. Day's Sales in Receivables 4. Debt Ratio 5. Debt to Equity Ratio 6. Profit Margin Ratio 7. Rate of Return on Total Assets 8. Asset Tumover Ratio Show the information in your spreadsheet in three columns: Ratio Name Formula/Amounts Ratio Value 1. Gross Profit Percentage 2. Accounts Receivable Tumover Ratio 3. Day's Sales in Receivables 4. Debt Ratio 5. Debt to Equity Ratio 6. Profit Margin Ratio 7. Rate of Return on Total Assets 8. Asset Tumover Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts