Question: Create a model with Year 0 followed by five years (Years 1 through 5) of Income Statement and Balance sheet projections for a (hypothetical) company

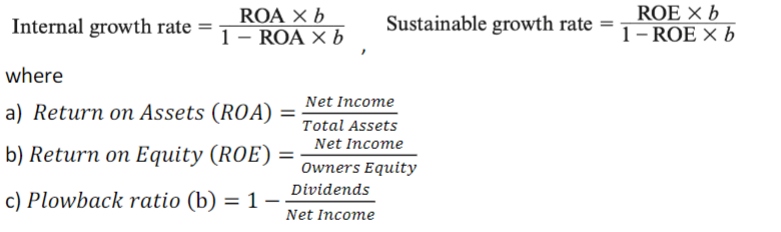

Create a model with Year 0 followed by five years (Years 1 through 5) of Income Statement and Balance sheet projections for a (hypothetical) company with the following assumptions: Sales in year 0: $1,000 Common stock at the end of year 0: $400 Accumulated retained earnings at the end of year 0: $100 (Net) Fixed assets to sales: 70% Current assets (including cash) to sales: 15% Current liabilities to sales: 7% Cost of goods sold to sales: 70% Interest rate on debt: 10% Dividend payout ratio: 60% Effective tax rate: 40% Keep it simple. No preferred stock and only one kind of debt. Assume yearly interest paid on beginning debt balance. Follow Model 1 in our class forecasting exercises for everything else. Recall the internal growth rate (IGR) and the sustainable growth rate (SGR), defined as:  Do these formulas for Internal Growth Rate (IGR) and Sustainable Growth Rate (SGR) work in the model you built using the above assumptions? If and where the above formulas do not work, calculate the IGRs and/or SGRs using Excel tools: in other words, instead of relying on the formulas, find what the right IGRs and SGRs should be.

Do these formulas for Internal Growth Rate (IGR) and Sustainable Growth Rate (SGR) work in the model you built using the above assumptions? If and where the above formulas do not work, calculate the IGRs and/or SGRs using Excel tools: in other words, instead of relying on the formulas, find what the right IGRs and SGRs should be.

Internal growth rate =1ROAbROAb Sustainable growth rate =1ROEbROEb where a) Return on Assets (ROA)=TotalAssetsNetIncome b) Return on Equity (ROE)=OwnersEquityNetIncome c) Plowback ratio (b)=1NetIncomeDividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts