Question: Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below] The fixed budget

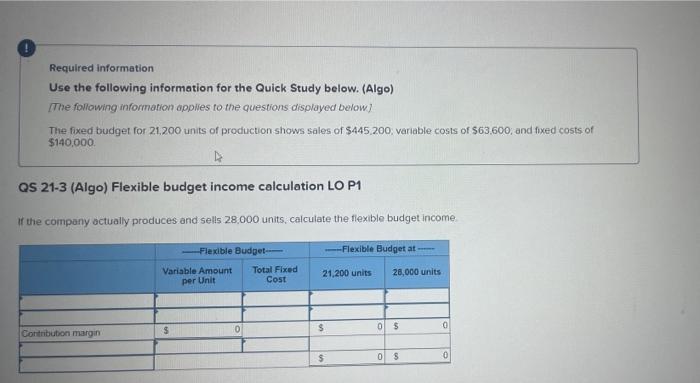

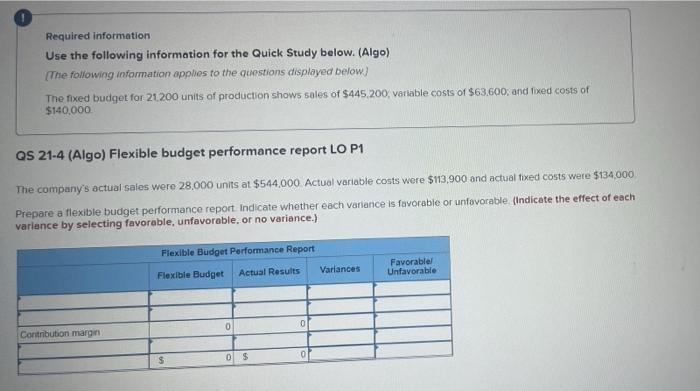

Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below] The fixed budget for 21,200 units of production shows sales of $445,200, variable costs of $63,600, and fixed costs of $140,000. 4 QS 21-3 (Algo) Flexible budget income calculation LO P1 If the company actually produces and sells 28,000 units, calculate the flexible budget income Contribution margin -Flexible Budget- Variable Amount per Unit $ 0 Total Fixed Cost --Flexible Budget at - 21,200 units $ $ 28,000 units 0 $ 0 S 0 0 Required information Use the following information for the Quick Study below. (Algo) (The following information applies to the questions displayed below] The fixed budget for 21,200 units of production shows sales of $445,200, variable costs of $63,600; and fixed costs of $140,000 QS 21-4 (Algo) Flexible budget performance report LO P1 The company's actual sales were 28,000 units at $544,000 Actual variable costs were $113,900 and actual fixed costs were $134,000 Prepare a flexible budget performance report Indicate whether each variance is favorable or unfavorable. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Contribution margin Flexible Budget Performance Report Flexible Budget Actual Results $ 0 0 $ 0 0 Variances Favorable! Unfavorable

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

QS 213 Flexible budget Flexible budget at variable amount per unit Total fixed cost 21200 units 2800... View full answer

Get step-by-step solutions from verified subject matter experts