Question: Create a spreadsheet model that helps their employees determine costs under each of the options. The employee will enter the following inputs: A company offers

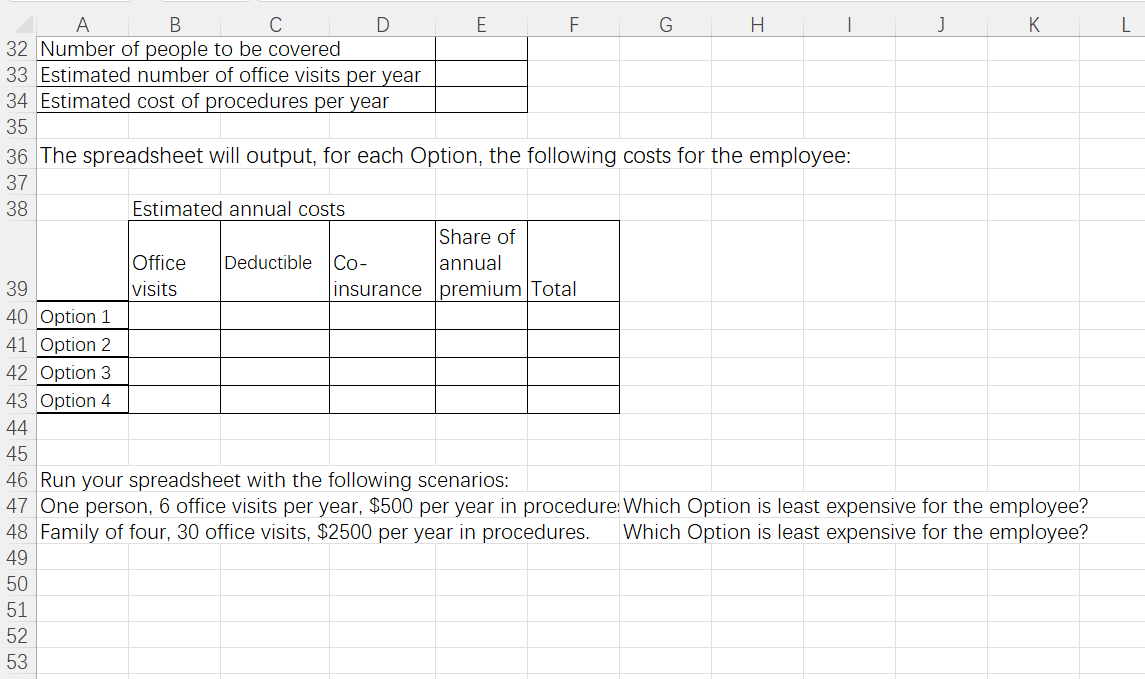

Create a spreadsheet model that helps their employees determine costs under each of the options. The employee will enter the following inputs:

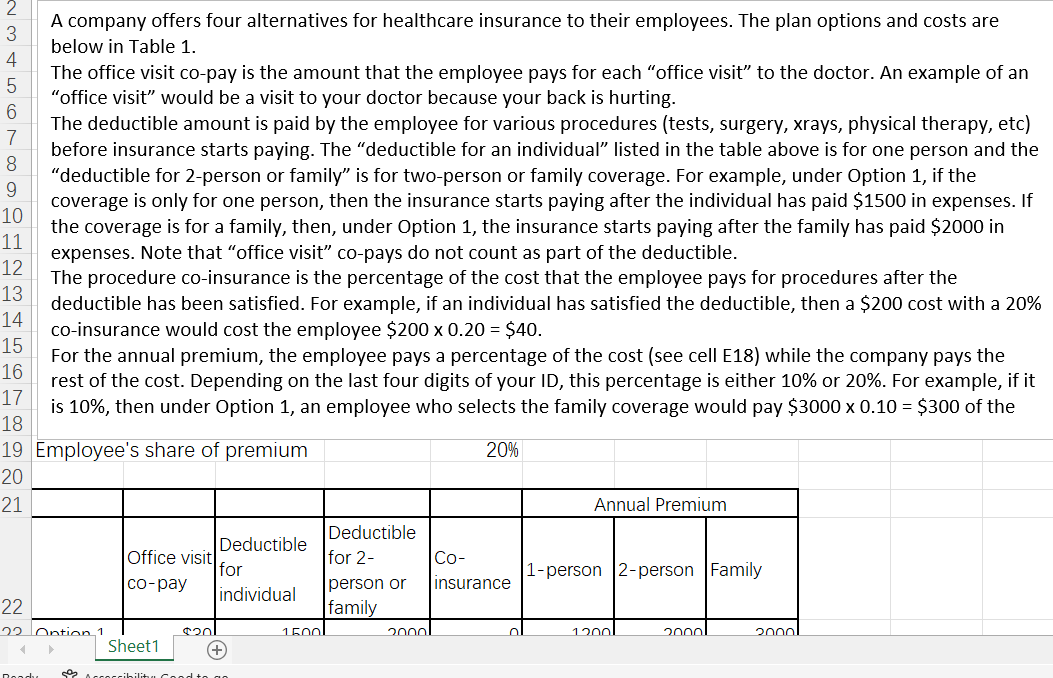

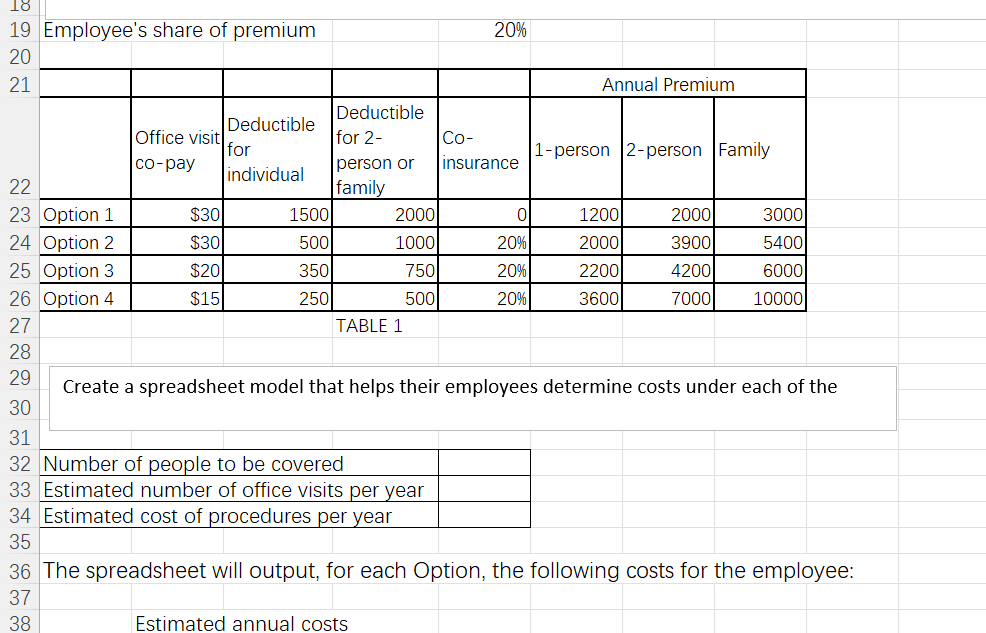

A company offers four alternatives for healthcare insurance to their employees. The plan options and costs are below in Table 1. The office visit co-pay is the amount that the employee pays for each "office visit" to the doctor. An example of an "office visit" would be a visit to your doctor because your back is hurting. The deductible amount is paid by the employee for various procedures (tests, surgery, xrays, physical therapy, etc) before insurance starts paying. The "deductible for an individual" listed in the table above is for one person and the "deductible for 2-person or family" is for two-person or family coverage. For example, under Option 1, if the coverage is only for one person, then the insurance starts paying after the individual has paid $1500 in expenses. If the coverage is for a family, then, under Option 1, the insurance starts paying after the family has paid \$2000 in expenses. Note that "office visit" co-pays do not count as part of the deductible. The procedure co-insurance is the percentage of the cost that the employee pays for procedures after the deductible has been satisfied. For example, if an individual has satisfied the deductible, then a $200 cost with a 20% co-insurance would cost the employee $2000.20=$40. For the annual premium, the employee pays a percentage of the cost (see cell E18) while the company pays the rest of the cost. Depending on the last four digits of your ID, this percentage is either 10% or 20%. For example, if it is 10%, then under Option 1 , an employee who selects the family coverage would pay $30000.10=$300 of the Create a spreadsheet model that helps their employees determine costs under each of the A company offers four alternatives for healthcare insurance to their employees. The plan options and costs are below in Table 1. The office visit co-pay is the amount that the employee pays for each "office visit" to the doctor. An example of an "office visit" would be a visit to your doctor because your back is hurting. The deductible amount is paid by the employee for various procedures (tests, surgery, xrays, physical therapy, etc) before insurance starts paying. The "deductible for an individual" listed in the table above is for one person and the "deductible for 2-person or family" is for two-person or family coverage. For example, under Option 1, if the coverage is only for one person, then the insurance starts paying after the individual has paid $1500 in expenses. If the coverage is for a family, then, under Option 1, the insurance starts paying after the family has paid \$2000 in expenses. Note that "office visit" co-pays do not count as part of the deductible. The procedure co-insurance is the percentage of the cost that the employee pays for procedures after the deductible has been satisfied. For example, if an individual has satisfied the deductible, then a $200 cost with a 20% co-insurance would cost the employee $2000.20=$40. For the annual premium, the employee pays a percentage of the cost (see cell E18) while the company pays the rest of the cost. Depending on the last four digits of your ID, this percentage is either 10% or 20%. For example, if it is 10%, then under Option 1 , an employee who selects the family coverage would pay $30000.10=$300 of the Create a spreadsheet model that helps their employees determine costs under each of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts