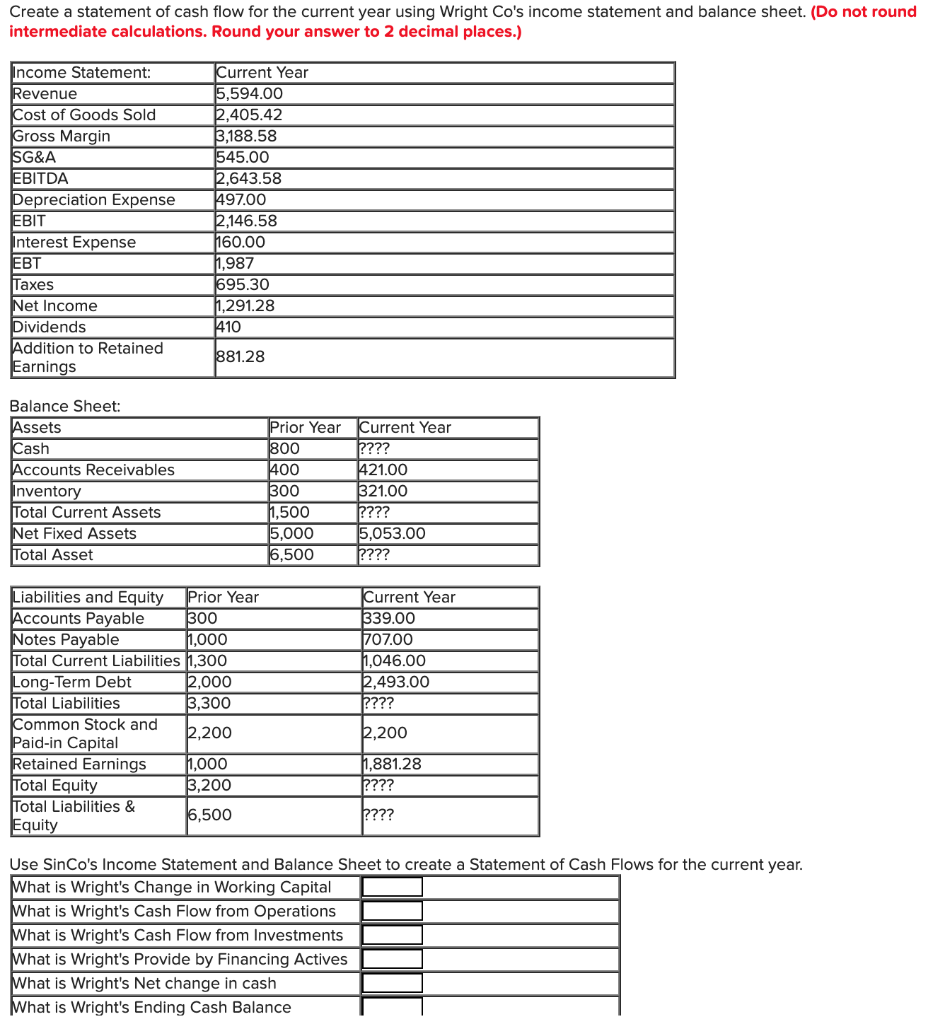

Question: Create a statement of cash flow for the current year using Wright Co's income statement and balance sheet. (Do not round intermediate calculations. Round your

Create a statement of cash flow for the current year using Wright Co's income statement and balance sheet. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Income Statement: Revenue Cost of Goods Sold Gross Margin SG&A EBITDA Depreciation Expense EBIT Interest Expense Taxes Net Income Dividends Addition to Retained Earnings Current Year 5,594.00 2,405.42 3,188.58 545.00 2,643.58 1497.00 2,146.58 160.00 11,987 695.30 11,291.28 410 881.28 Balance Sheet: Assets Cash Accounts Receivables Inventory Total Current Assets Net Fixed Assets Total Asset Prior Year 800 400 300 11,500 15,000 16,500 Current Year ???? 421.00 321.00 ???? 5,053.00 ???? Current Year 339.00 707.00 1,046.00 12,493.00 ???? Liabilities and Equity Prior Year Accounts Payable 300 Notes Payable 11,000 Total Current Liabilities 1,300 Long-Term Debt 12,000 Total Liabilities 3,300 Common Stock and 12,200 Paid-in Capital Retained Earnings 11,000 Total Equity 3,200 Total Liabilities & 6,500 Equity 1,200 1,881.28 ???? ???? Use Sin Co's Income Statement and Balance Sheet to create a Statement of Cash Flows for the current year. What is Wright's Change in Working Capital What is Wright's Cash Flow from Operations What is Wright's Cash Flow from Investments What is Wright's Provide by Financing Actives What is Wright's Net change in cash What is Wright's Ending Cash Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts