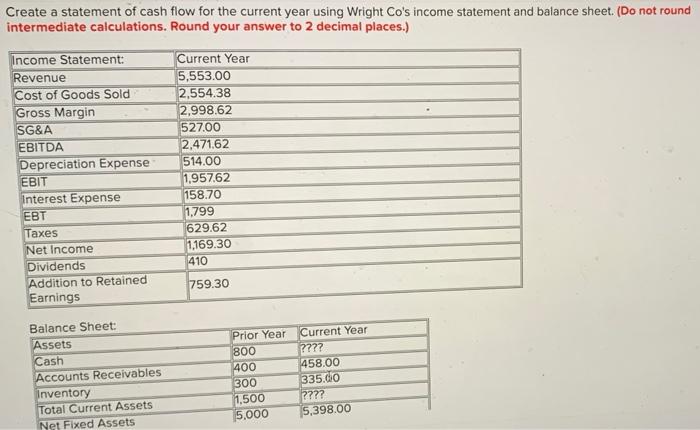

Question: Create a statement of cash flow for the current year using Wright Co's income statement and balance sheet. (Do not round intermediate calculations. Round your

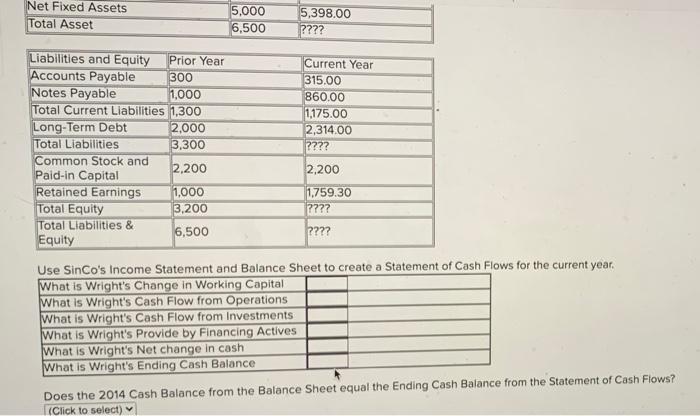

Create a statement of cash flow for the current year using Wright Co's income statement and balance sheet. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Income Statement: Revenue Cost of Goods Sold Gross Margin SG&A EBITDA Depreciation Expense EBIT Interest Expense EBT Taxes Net Income Dividends Addition to Retained Earnings Current Year 5,553.00 2,554.38 2,998.62 527.00 2,471.62 514.00 1,957.62 158.70 1,799 629.62 1.169.30 410 759.30 Balance Sheet: Assets Cash Accounts Receivables Inventory Total Current Assets Net Fixed Assets Prior Year Current Year 800 ???? 400 458.00 300 335.do 1,500 ???? 5.000 5,398.00 Net Fixed Assets Total Asset 5,000 6,500 5,398.00 ???? Liabilities and Equity Prior Year Accounts Payable 300 Notes Payable 1,000 Total Current Liabilities 1,300 Long-Term Debt 2.000 Total Liabilities 3,300 Common Stock and 2,200 Paid-in Capital Retained Earnings 1.000 Total Equity 3,200 Total Liabilities & 6,500 Equity Current Year 315.00 860.00 1,175.00 2,314.00 ???? 2,200 1.759.30 ???? ???? Use SinCo's Income Statement and Balance Sheet to create a Statement of Cash Flows for the current year. What is Wright's Change in Working Capital What is Wright's Cash Flow from Operations What is Wright's Cash Flow from Investments What is Wright's Provide by Financing Actives What is Wright's Net change in cash What is Wright's Ending Cash Balance Does the 2014 Cash Balance from the Balance Sheet equal the Ending Cash Balance from the Statement of Cash Flows? (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts