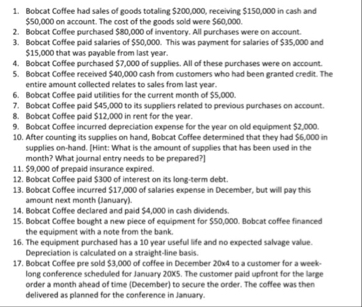

Question: Create a T account for 1 - 1 7 . I will rate thank you! Bobcat Coffee had sales of goods totaling $ 2 0

Create a T account for I will rate thank you! Bobcat Coffee had sales of goods totaling $ receiving $ in cash and $ on account. The cost of the goods sold were $

Bobcat Coffee purchased $ of inventory. All purchases were on account.

Bobcat Coffee paid salaries of $ This was payment for salaries of $ and $ that was payable from last year.

Bobcat Coffee purchased $ of supplies. All of these purchases were on account.

Bobcat Coffee received $ cash from customers who had been granted credit. The entire amount collected relates to sales from last year.

Bobcat Coffee paid utilities for the current month of $

Bobcat Coffee paid $ to its suppliers related to previous purchases on account.

Bobcat Coffee paid $ in rent for the year.

Bobcat Coffee incurred depreciation expense for the year on old equipment $

After counting its supplies on hand, Bobcat Coffee determined that they had $ in supplies onhand. Hint: What is the amount of supplies that has been used in the month? What journal entry needs to be prepared?

$ of prepaid insurance expired.

Bobcat Coffee paid $ of interest on its longterm debt.

Bobcat Coffee incurred $ of salaries expense in December, but will pay this amount next month January

Bobcat Coffee declared and paid $ in cash dividends.

Bobcat Coffee bought a new piece of equipment for $ Bobcat coffee financed the equipment with a note from the bank.

The equipment purchased has a year useful life and no expected salvage value. Depreciation is calculated on a straightline basis.

Bobcat Coffee pre sold $ of coffee in December to a customer for a weeklong conference scheduled for January x The customer paid upfront for the large order a month ahead of time December to secure the order. The coffee was then delivered as planned for the conference in January.

Balance sheet

December

Assets

Current Assets

Canh

Arrounts Receivable

Prepaid Insurance

replin

Inventary

Feal Currer Anets

Property Plant S Aupuent

Land

Empipment

Accumulated Depreciation

Fearly

Total Aveti

Gubdien & Sambiolders' feulty

Curred lividies

Actounds Preplate

Salaries Prepale

Total Cument Liabilites

Lang Ferm Orit

Sterklowlere' Feuty

Retained Earnings

Common Stork

Foeal Stacksoliders' favity

Total Liabilities S Stockholders' Evelty

$

$

$

som non

Batoo

$

$

ane

$

sinnan

$

ssrm

Sterstent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock