Question: Create a user-defined function to solve for a bond's price using a FOR loop to discount cash flows. - The price (PV) of a bond

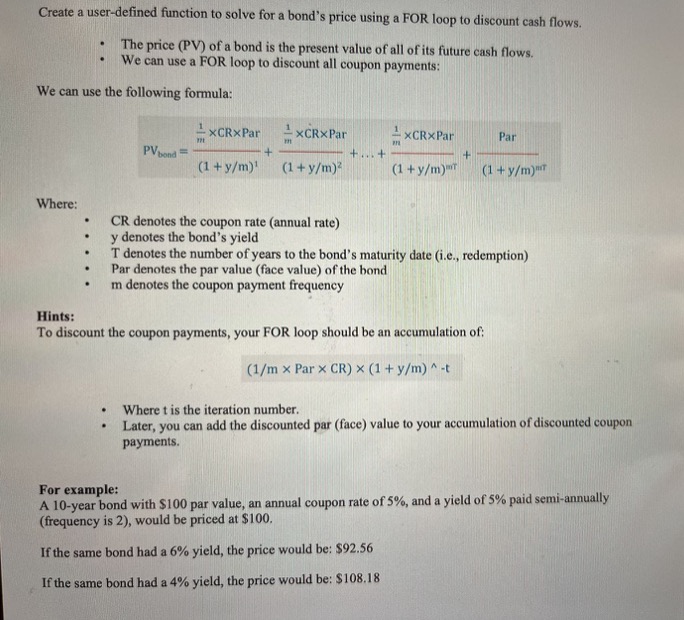

Create a user-defined function to solve for a bond's price using a FOR loop to discount cash flows. - The price (PV) of a bond is the present value of all of its future cash flows. - We can use a FOR loop to discount all coupon payments: We can use the following formula: PVbond=(1+y/m)1m1CRPar+(1+y/m)2m1CRPar++(1+y/m)mitm1CRPar+(1+y/m)mirPar Where: - CR denotes the coupon rate (annual rate) - y denotes the bond's yield - T denotes the number of years to the bond's maturity date (i.e., redemption) - Par denotes the par value (face value) of the bond - m denotes the coupon payment frequency Hints: To discount the coupon payments, your FOR loop should be an accumulation of: (1/mParCR)(1+y/m)t - Where t is the iteration number. - Later, you can add the discounted par (face) value to your accumulation of discounted coupon payments. For example: A 10 -year bond with $100 par value, an annual coupon rate of 5%, and a yield of 5% paid semi-annually (frequency is 2), would be priced at $100. If the same bond had a 6% yield, the price would be: $92.56 If the same bond had a 4% yield, the price would be: $108.18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts