Question: Create a vertical analysis for 2017-2018 for this income statement: WOLVERINE WORLD WIDE, INC. AND SUBSIDIARIES Consolidated Statements of Comprehensive Income Fiscal Year 2017 2018

Create a vertical analysis for 2017-2018 for this income statement:

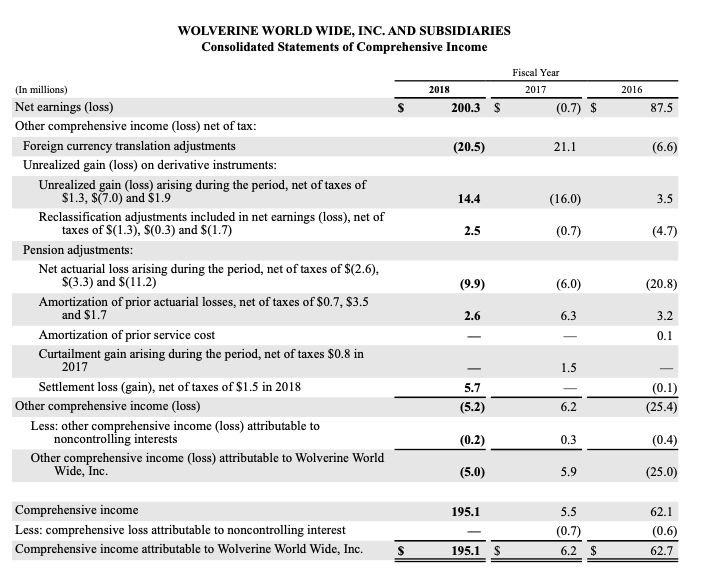

WOLVERINE WORLD WIDE, INC. AND SUBSIDIARIES Consolidated Statements of Comprehensive Income Fiscal Year 2017 2018 2016 $ 200.3 $ (0.7) $ 87.5 (20.5) 21.1 (6.6) (16.0) 3.5 (0.7) (4.7) (In millions) Net earnings (loss) Other comprehensive income (loss) net of tax: Foreign currency translation adjustments Unrealized gain (loss) on derivative instruments: Unrealized gain (loss) arising during the period, net of taxes of $1.3, $(7.0) and $1.9 Reclassification adjustments included in net earnings (loss), net of taxes of $(1.3), S(0.3) and $(1.7) Pension adjustments: Net actuarial loss arising during the period, net of taxes of $(2.6), $(3.3) and $(11.2) Amortization of prior actuarial losses, net of taxes of $0.7, $3.5 and $1.7 Amortization of prior service cost Curtailment gain arising during the period, net of taxes $0.8 in 2017 Settlement loss (gain), net of taxes of $1.5 in 2018 Other comprehensive income (loss) Less: other comprehensive income (loss) attributable to noncontrolling interests Other comprehensive income (loss) attributable to Wolverine World Wide, Inc. (6.0) (20.8) 3.2 0.1 (0.1) 2 (25.4) (0.4) (5.0) (25.0) 195.1 5.5 Comprehensive income Less: comprehensive loss attributable to noncontrolling interest Comprehensive income attributable to Wolverine World Wide, Inc. (0.7) 6.2 62.1 (0.6) 62.7 $ 195.1 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts