Question: create adjusting journal entries Problem 3-7B Adjusting entries (annual) L04 Kazz Industries' year-end is May 31. Based on an analysis of the unadjusted trial balance

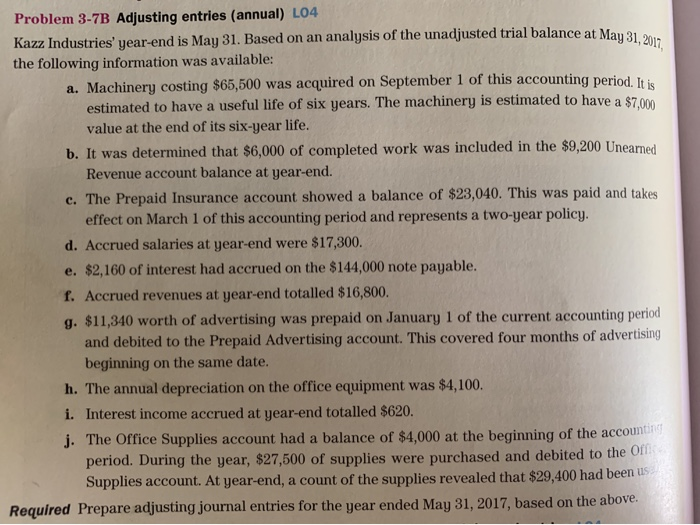

Problem 3-7B Adjusting entries (annual) L04 Kazz Industries' year-end is May 31. Based on an analysis of the unadjusted trial balance at Mau 31 the following information was available: a. Machinery costing $65,500 was acquired on September 1 of this accounting period. It he estimated to have a useful life of six years. The machinery is estimated to have a $7.000 value at the end of its six-year life. b. It was determined that $6,000 of completed work was included in the $9,200 Uneared Revenue account balance at year-end. c. The Prepaid Insurance account showed a balance of $23,040. This was paid and takes effect on March 1 of this accounting period and represents a two-year policy. d. Accrued salaries at year-end were $17,300. e. $2,160 of interest had accrued on the $144,000 note payable. f. Accrued revenues at year-end totalled $16,800. g. $11,340 worth of advertising was prepaid on January 1 of the current accounting period and debited to the Prepaid Advertising account. This covered four months of advertising beginning on the same date. h. The annual depreciation on the office equipment was $4,100. i. Interest income accrued at year-end totalled $620. j. The Office Supplies account had a balance of $4,000 at the beginning of the account period. During the year, $27,500 of supplies were purchased and debited to the on Supplies account. At year-end, a count of the supplies revealed that $29,400 had been us Required Prepare adjusting journal entries for the year ended May 31, 2017, based on the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts