Question: Create an ANSOFF MATRIX case: Megabrew: creating an undisputed global brewing champion Identify the strategic developement directions that SABMiller has adopted in its development and

Create an ANSOFF MATRIX

case: Megabrew: creating an undisputed global brewing champion

- Identify the strategic developement directions that SABMiller has adopted in its development and the reasons for its success. (Ansoff matrix)

- Identify

- the drivers/reasons that drove SABMiller to adopt an international strategy,

- the type of international strategy it has pursued,

- the modes of entry it has used on each market

- Explain :

- the strategic position in which SABMiller finds itself in 2015 and

- the strategic options SABMiller could pursue prior to the bid. (Is being acquired the best way forward for the company?)

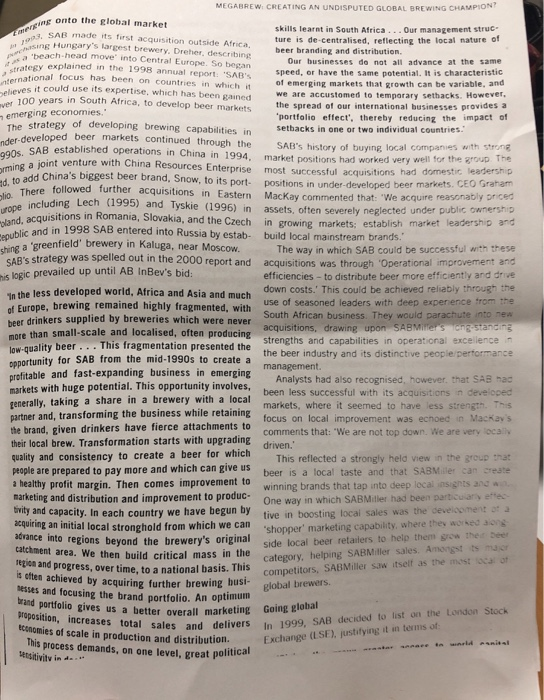

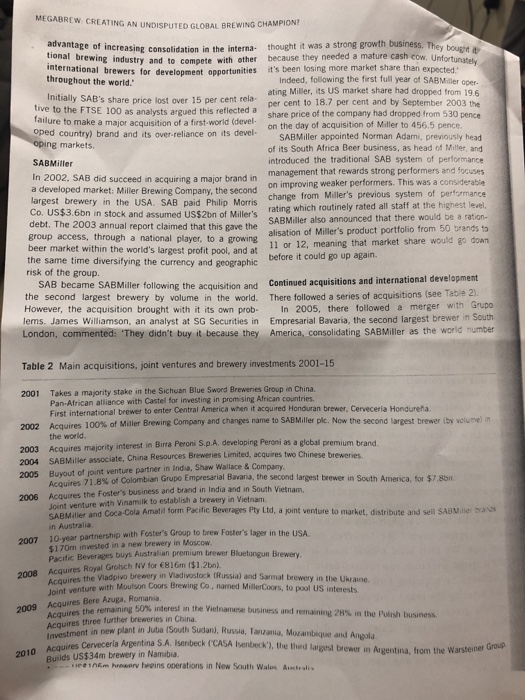

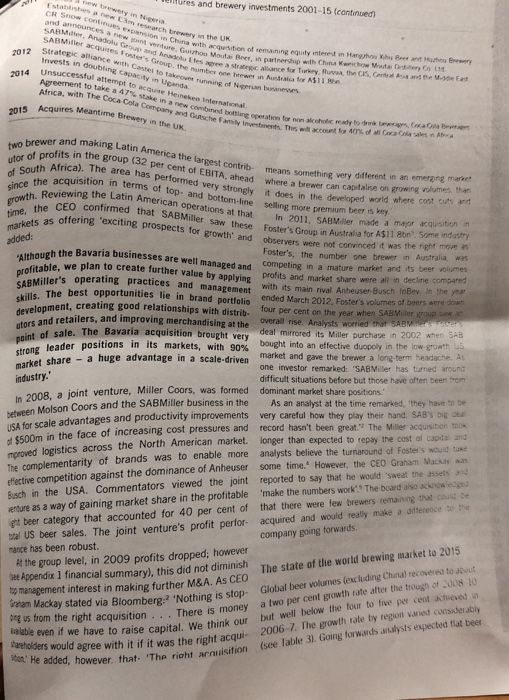

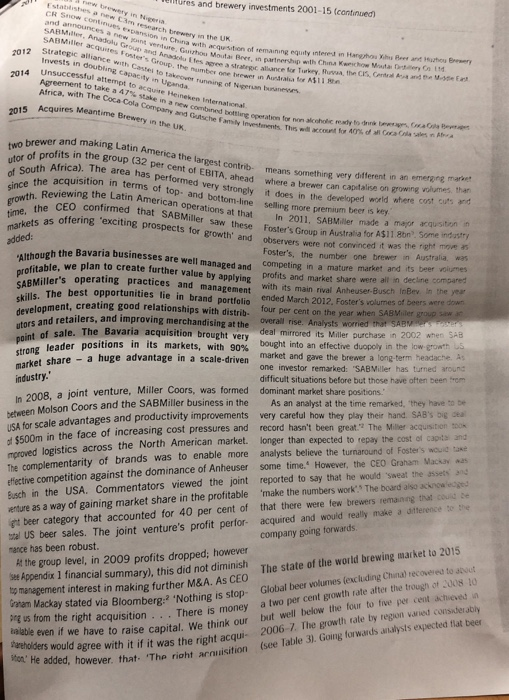

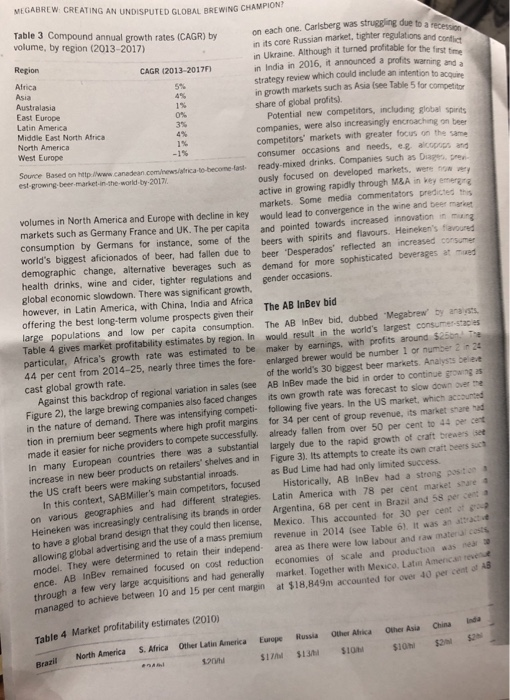

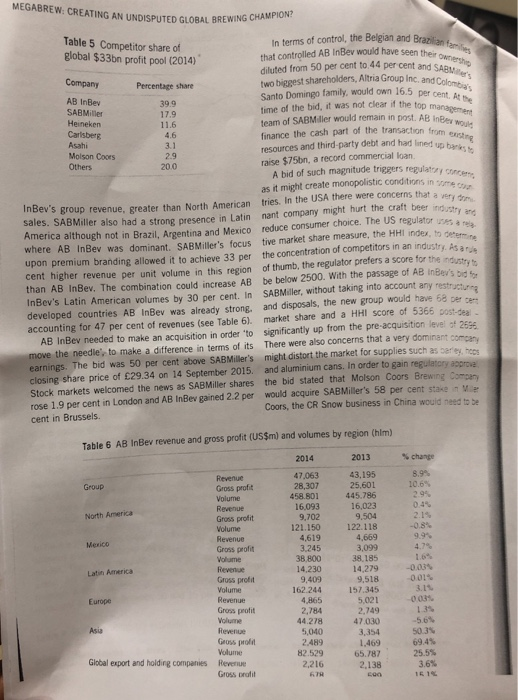

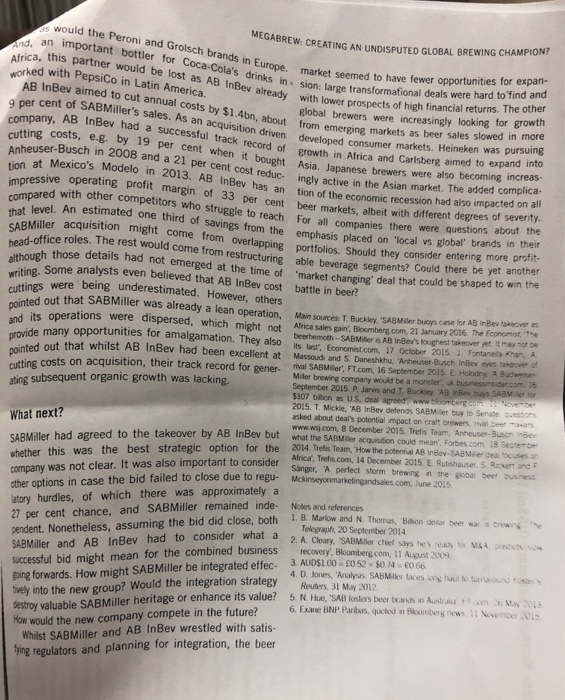

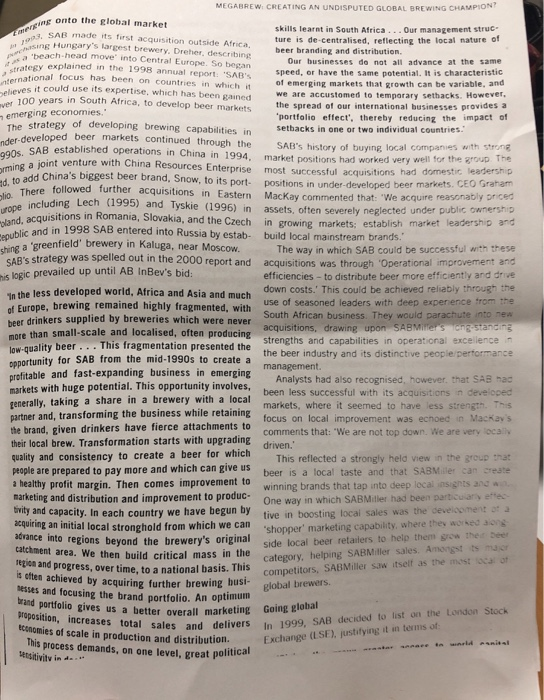

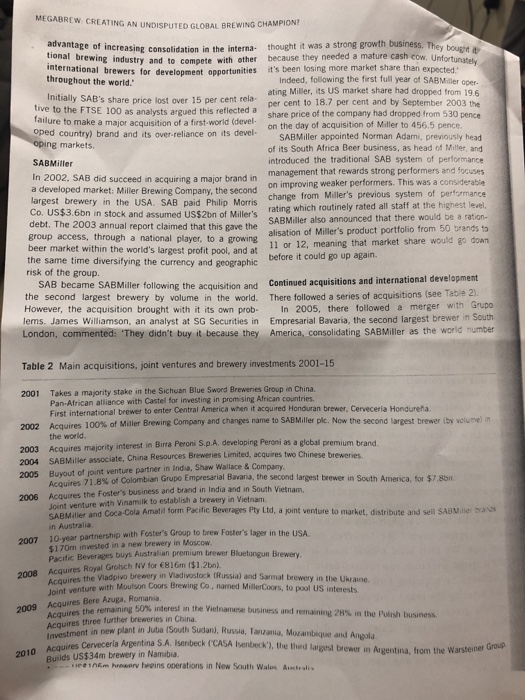

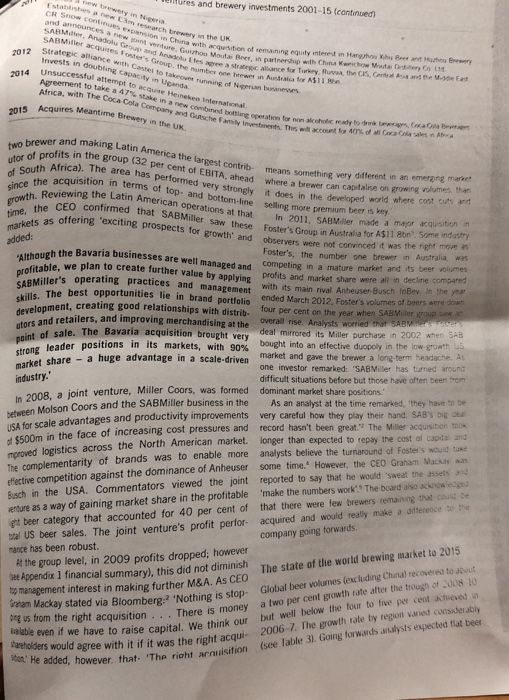

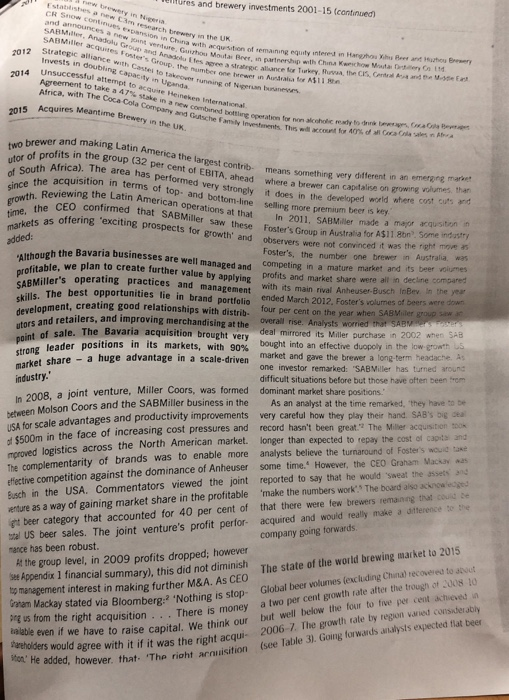

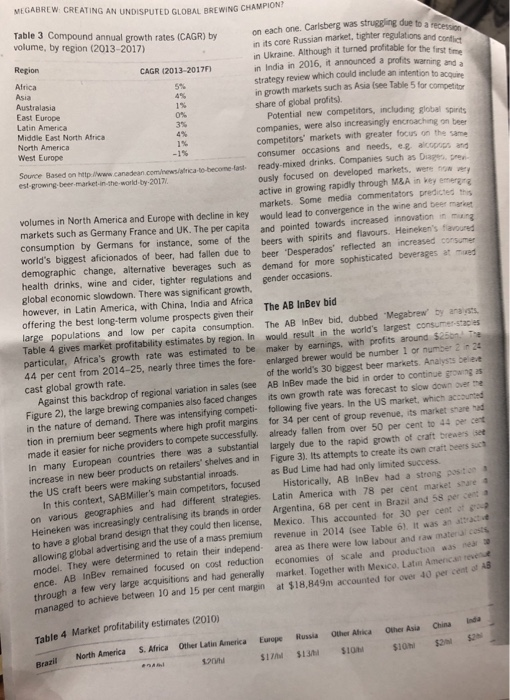

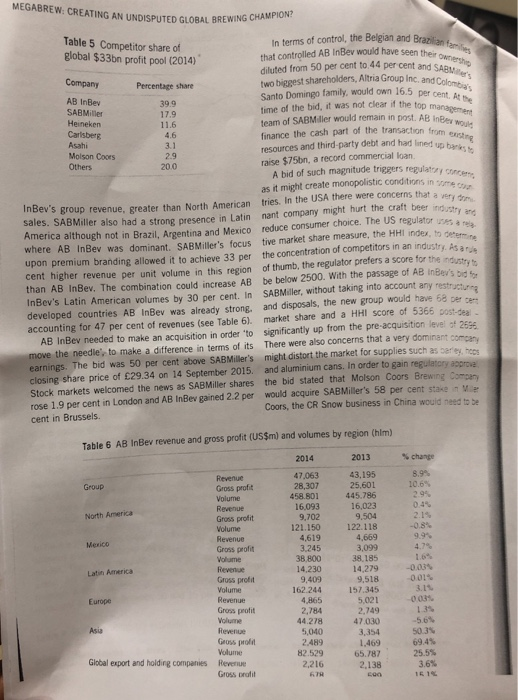

STUDY Megabrew: creating an undisputed global brewing champion? Duncan Angwin In 2015, SABMiller was considering its strategic options for expansion. It had grown successfully upon the basis of its strength in developing markets, first in Africa and then in other parts of the world. However, on 11 November 2015 it received a bid worth $107bn from AB Inbev, the third biggest bid in history. The aim was to create an undisputed global brewing champion controlling around half the world's brewing profits. Although SABMiller had agreed to the deal, had it made the right decision? What other strategic options could SABMiller have pursued? Assuming the deal would be completed later in 2016, subject to overcoming regulatory hurdles, how could AB Inbev integrate SABMiller successfully? Introduction CURTEAN) Kom Source: Douglas Carr/Alamy Images Following its acquisitions of the American brewer Miller in 2002, Grupo Empresarial Bavaria, South America's second largest brewer in 2005, and the Australian Beer Group Fosters in 2011, SABMiller had become the second largest brewer by volume and profits in the world. By 2015, its market share by volume was 12 per cent and its brand portfolio included international brands Pilsner Urquell, Peroni Nastro Azzurro, Miller Genuine Draft and Grolsch along with local country brands such as Aguila, Castle Lager, Miller Lite, VB, Snow and Tyskie. Despite these successes, the dramatic consolidation in the brewing industry continued. In the early 1990s, the five largest brewing companies accounted for just 17 per cent of global beer sales. By 2014, the largest four brewing compa- es accounted for 45.7 per cent of sales and analysts estimated they had captured 80 per cent of the $33bn global profit pool. Moreover, three of SABMiller's main global competitors, Anheuser Busch, Interbrew and Ambev, had merged in 2008, to form AB InBev, to claim market leader- ship with a consolidated 25 per cent of global market share, athough that had fallen to 20 per cent by 2014. In September 2014, SABMiller launched a surprise over bid for Dutch counterpart and third placed rival, Heineken. Charlene de Carvalho-Heineken and her usband Michel de Carvalho are head of one of the chest families in Britain, with a combined fortune esti- mated at more than 6bn. The family controlled more than 50 per cent of Heineken and their response was swift and unequivocal. They rejected the bid and said Tey intended to 'preserve the heritage and identity of Heineken as an independent company. This dealt a blow to SABMiller's ambitions and there was little pont returning with a better offer as the family wasn't mat vated by money. In order to consider their position, SABMille re-examined its four strategic priorities set out in 2010 (see Table 1). This can be seen as a synthesis of the learning the company had developed over its history first weathering the political crises of twentieth-century South African history, then building its operations in emergs and mature markets, where it gained a reputation as a turnaround specialist and subsequently an acquires of major breweries in mature markets. These strategies ad served the company well as SABMiller has show sustained good performance compared with the London Stock Market Beverage index (see Figure 1 1. Creating a balanced and attractive global spread of businesses "Our acquisitions in recent years have given us a wide geographical spread with good exposure to emerging markets without being over-reliant on any single region. This allows us to capture new Snoiqmsno economy to mainstream and premium brands. We also look to identify and exploit opportunities for growth within our existing business portfolio. This can involve a range of activities, from entering into local joint ventures or partnerships, to buying or building breweries, to acquiring local brands to help shape a full, local, portfolio. 2. Developing strong, relevant brand portfolios in the local market "Our aim is to develop an attractive brand portfolio that meets consumers' needs in each of our markets. In many markets, growth is fastest at the top end, as shown by the increasing popularity of our international premium brands. Another rising consumer trend is the shift towards fragmentation. Affluent consumers are varying their choices and becoming more interested in speciality brands, craft beers, foreign imports and other subdivisions of the premium segment. And a third trend is the growing importance of female consumers. 3. Constantly raising the performance of local businesses 'In order to raise our performance, we need to become more efficient, especially in our manufacturing processes. Efficiency is part of our day-to-day management and the rise in commodity costs compels us to do whatever we can to counteract the squeere on our margins All SABMiller operations strive to improve our products' route to market, to remove costs and to ensure that the right products reach the right outlets in the right condition. 4. Leveraging our global scale 'As a global organisation we are constantly eeking to use the benefits of our scale while recognising that beer is essentially a local business and that local managers are in the best position to identify and exploit local opportunities. Our aim is to generate maximum value and advantage from our size without becoming over-centralised and losing our relevance and responsiveness in each market." Source: SABMiller. 5000 Background 4500 4000 3500 3000- 2500 2000 1500 South African Breweries (SAB) predated the state of South Africa itself. It faced the challenge of doing busi ness amidst the upheaval the country experienced during the twentieth century, including the apartheid regime (1948-1994). Worldwide opposition to apartheid included a campaign for economic sanctions on South Africa, aiming to restrict international business from investing in, or trading with, South Africa and restricting South African business from trading with international markets. In 1950, SAB moved its head office from London to Johannesburg and southern Africa became the focus of its business expansion during the subsequent four decades. 1000 500 0 9/12/14 9/12/15 9/12/11 9/12/12 9/12/13 Year Beverages sector -FTSE100 -SABMiller Figure 1 Five-year SABMiller share price vs FTSE 100 and Beverages indexes (rebased) In this time, SAB responded to business restrictions by focusing on dominating domestic beer production While SABMiller was pondering its options in 2015, through acquisition of competitors and rationalisation of rival beer giant AB InBev announced a formal offer to buy production and distribution facilities. By 1979, SAB them for $107bn. The combined group would control controlled an estimated 99 per cent of the market in Heineken with just 11.6 per cent and Carlsberg with only Swaziland, Lesotho, Rhodesia (now Zimbabwe) and 4.6 per cent. Tense private talks between stakeholders Botswana. In 1978, SAB also diversified into hotels and followed until 13 October 2015 when a tentative deal gambling by acquiring the Sun City casino resort was announced. There was some way to go, however, to complete the deal, scheduled for late 2016, with formi- South Africa in the 1990s eased SAB's expansion dable obstacles to overcome, not least dealing with regu- latory interests around the world. In the meantime, the through the rest of Africa. By 2000, SAB's market domi question was whether the deal was the best strategic potential competitors, but there remained little space for nance in southern Africa provided a serious deterrent to The establishment of a multiracial democracy in option for SABMiller? it to expand locally partis 3 MEGABREW: CREATING AN UNDISPUTED GLOBAL BREWING CHAMPIONT Emerging onto the global market 1993, SAB made its first acquisition outside Africa, purching Hungary's largest brewery, Dreher, describing skills learnt in South Africa... Our management struc- ture is de-centralised, reflecting the local nature of beer branding and distribution. it as a beach-head move into Central Europe. So began a strategy explained in the 1998 annual report: 'SAB's nternational focus has been on countries in which it believes it could use its expertise, which has been gained ver 100 years in South Africa, to develop beer markets emerging economies." Our businesses do not all advance at the same speed, or have the same potential. It is characteristic of emerging markets that growth can be variable, and we are accustomed to temporary sethacks. However, the spread of our international businesses provides a 'portfolio effect', thereby reducing the impact of setbacks in one or two individual countries. The strategy of developing brewing capabilities in nder-developed beer markets continued through the 990s. SAB established operations in China in 1994, orming a joint venture with China Resources Enterprise d, to add China's biggest beer brand, Snow, to its port- lio. There followed further acquisitions in Eastern urope including Lech (1995) and Tyskie (1996) in pland, acquisitions in Romania, Slovakia, and the Czech Cepublic and in 1998 SAB entered into Russia by estab- shing a 'greenfield' brewery in Kaluga, near Moscow. SAB's history of buying local companies with strong market positions had worked very well for the group. The most successful acquisitions had domestic leadership positions in under-developed beer markets. CEO Graham MacKay commented that: "We acquire reasonably priced assets, often severely neglected under public ownership in growing markets; establish market leadership and build local mainstream brands." SAB's strategy was spelled out in the 2000 report and his logic prevailed up until AB InBev's bid: The way in which SAB could be successful with these acquisitions was through 'Operational improvement and efficiencies to distribute beer more efficiently and drive down costs.' This could be achieved reliably through the use of seasoned leaders with deep experience from the South African business. They would parachute into new acquisitions, drawing upon SABMiller's long-standing strengths and capabilities in operational excellence in the beer industry and its distinctive people/performance management. Analysts had also recognised, however, that SAB had been less successful with its acquisitions in developed markets, where it seemed to have less strength. This comments that: "We are not top down. We are very locally driven.' In the less developed world, Africa and Asia and much of Europe, brewing remained highly fragmented, with beer drinkers supplied by breweries which were never more than small-scale and localised, often producing low-quality beer... This fragmentation presented the opportunity for SAB from the mid-1990s to create a profitable and fast-expanding business in emerging markets with huge potential. This opportunity involves, generally, taking a share in a brewery with a local partner and, transforming the business while retaining focus on local improvement was echoed in MacKay's the brand, given drinkers have fierce attachments to their local brew. Transformation starts with upgrading quality and consistency to create a beer for which people are prepared to pay more and which can give us a healthy profit margin. Then comes improvement to marketing and distribution and improvement to produc- tivity and capacity. In each country we have begun by acquiring an initial local stronghold from which we can advance into regions beyond the brewery's original catchment area. We then build critical mass in the region and progress, over time, to a national basis. This is often achieved by acquiring further brewing busi- nesses and focusing the brand portfolio. An optimum brand portfolio gives us a better overall marketing Going global proposition, increases total sales and delivers economies of scale in production and distribution. This process demands, on one level, great political This reflected a strongly held view in the group that beer is a local taste and that SABMiller can create winning brands that tap into deep local insights and win One way in which SABMiller had been particularly effec tive in boosting local sales was the development of a 'shopper' marketing capability, where they worked along side local beer retailers to help them grow their beer category, helping SABMiller sales. Amongst its major competitors, SABMiller saw itself as the most local of global brewers. In 1999, SAB decided to list on the London Stock Exchange (LSE), justifying it in terms of: to world manital sensitivity in MEGABREW: CREATING AN UNDISPUTED GLOBAL BREWING CHAMPION? advantage of increasing consolidation in the interna- tional brewing industry and to compete with other international brewers for development opportunities throughout the world." thought it was a strong growth business. They bought because they needed a mature cash cow. Unfortunately it's been losing more market share than expected. Initially SAB's share price lost over 15 per cent rela- tive to the FTSE 100 as analysts argued this reflected a failure to make a major acquisition of a first-world (devel- oped country) brand and its over-reliance on its devel- oping markets. Indeed, following the first full year of SABMiller oper- ating Miller, its US market share had dropped from 19.6 per cent to 18.7 per cent and by September 2003 the share price of the company had dropped from 530 pence on the day of acquisition of Miller to 456.5 pence. SABMiller SABMiller appointed Norman Adami, previously head of its South Africa Beer business, as head of Miller, and introduced the traditional SAB system of performance. management that rewards strong performers and focuses on improving weaker performers. This was a considerable In 2002, SAB did succeed in acquiring a major brand in a developed market: Miller Brewing Company, the second change from Miller's previous system of performance rating which routinely rated all staff at the highest level. largest brewery in the USA. SAB paid Philip Morris Co. US$3.6bn in stock and assumed US$2bn of Miller's debt. The 2003 annual report claimed that this gave the group access, through a national player, to a growing beer market within the world's largest profit pool, and at the same time diversifying the currency and geographic risk of the group. SABMiller also announced that there would be a ration- alisation of Miller's product portfolio from 50 brands to 11 or 12, meaning that market share would go down before it could go up again. Continued acquisitions and international development There followed a series of acquisitions (see Table 2). SAB became SABMiller following the acquisition and the second largest brewery by volume in the world. However, the acquisition brought with it its own prob- lems. James Williamson, an analyst at SG Securities in London, commented: 'They didn't buy it because they In 2005, there followed a merger with Grupo Empresarial Bavaria, the second largest brewer in South America, consolidating SABMiller as the world number Table 2 Main acquisitions, joint ventures and brewery investments 2001-15 2001 Takes a majority stake in the Sichuan Blue Sword Breweries Group in China. Pan-African alliance with Castel for investing in promising African countries. First international brewer to enter Central America when it acquired Honduran brewer, Cervecera Hondurea. 2002 Acquires 100% of Miller Brewing Company and changes name to SABMiller plc. Now the second largest brewer (by volume) in the world. 2003 Acquires majority interest in Birra Peroni S.p.A. developing Peroni as a global premium brand. 2004 SABMiller associate, China Resources Breweries Limited, acquires two Chinese breweries 2005 Buyout of joint venture partner in India, Shaw Wallace & Company. Acquires 71.8% of Colombian Grupo Empresarial Bavaria, the second largest brewer in South America, for $7.8bm 2006 Acquires the Foster's business and brand in India and in South Vietnam, Joint venture with Vinamilk to establish a brewery in Vietnam. SABMiller and Coca-Cola Amatil form Pacific Beverages Pty Ltd, a joint venture to market, distribute and sell SABMiller brands in Australia. 2007 10-year partnership with Foster's Group to brew Foster's lager in the USA. $170m invested in a new brewery in Moscow. Pacific Beverages buys Australian premium brewer Bluetongue Brewery. 2008 Acquires Royal Grolsch NV for 816m ($1.2bm). Acquires the Vladpivo brewery in Vladivostock (Russia) and Sarmat brewery in the Ukraine. Joint venture with Moulson Coors Brewing Co., named MillerCoors, to pool US interests. 2009 Acquires Bere Azuga, Romania, Acquires the remaining 50% interne Vietnamese business and remaining 28% in the Polish business. Acquires three further breweries in China. Investment in new plant in Juba (South Sudan), Russia, Tanzania, Mozambique and Angola Acquires Cervecerla Argentina S.A. Isen 2010 Builds US$34m brewery in Namibia. (CASA Isenbeck), the third largest brewer in Argentina, from the Warsteiner Group ce106m hrewery hepins operations in New South Wales Australis new brewery in Nigeria Establishes a new 3m research brewery in the UK. ires and brewery investments 2001-15 (continued) and announces a new joint venture, Guizhou Moutai Beer, in partnership with China Kerichow Mota Deter CR Snow continues expansion in China with acquisition of remaining equity interest in Hangzhou Xihy Beer and Huzhou Brewery 2012 Strategic alliance with Castes to takeover running of Nigerian business. SABMiller acquires Foster's Group, the number one brewer in Aundrala for A$11 SABMiller, Anadolu Group and Anadolu Efes agree a strategic alliance for Turkey, thusa, the CIS, Central As and the Middle Ea Invests in doubling capacity in Uganda Unsuccessful attempt to acquire Heineken International 2014 Agreement to take a 47% stake in a new combined bottling operation for non alcoholic mady to drink beverages, Coca Cola Beye Africa, with The Coca-Cola Company and Gutsche Family Investments. This will account for 40% of all Coca Cola sales A 2015 Acquires Meantime Brewery in the UK. two brewer and making Latin America the largest contrib means something very different in an emerging market of South Africa). The area has performed very strongly utor of profits in the group (32 per cent of EBITA, ahead where a brewer can capitalise on growing volumes, than since the acquisition in terms of top- and bottom-line selling more premium beer is key. growth. Reviewing the Latin American operations at that time, the CEO confirmed that SABMiller saw these markets as offering 'exciting prospects for growth and observers were not convinced it was the right move as it does in the developed world where cost cuts and In 2011, SABMiller made a major acquisition in Foster's Group in Australia for A$11.8bn. Some industry added: Foster's, the number one brewer in Australia, was "Although the Bavaria businesses are well managed and competing in a mature market and its beer volumes profitable, we plan to create further value by applying profits and market share were all in decline compared SABMiller's operating practices and management skills. The best opportunities lie in brand portfolio development, creating good relationships with distrib- utors and retailers, and improving merchandising at the point of sale. The Bavaria acquisition brought very strong leader positions in its markets, with 90% market share a huge advantage in a scale-driven industry.' with its main rival Anheuser-Busch InBev. In the year ended March 2012, Foster's volumes of beers were down four per cent on the year when SABMiller group saw an overall rise. Analysts worried that SABMiller's Toners deal mirrored its Miller purchase in 2002 when SAB bought into an effective duopoly in the low-growth US market and gave the brewer a long-term headache. As one investor remarked: "SABMiller has turned around difficult situations before but those have often been from dominant market share positions. As an analyst at the time remarked, they have to be In 2008, a joint venture, Miller Coors, was formed between Molson Coors and the SABMiller business in the USA for scale advantages and productivity improvements of $500m in the face of increasing cost pressures and mproved logistics across the North American market. The complementarity of brands was to enable more effective competition against the dominance of Anheuser Busch in the USA. Commentators viewed the joint venture as a way of gaining market share in the profitable ght beer category that accounted for 40 per cent of tal US beer sales. The joint venture's profit perfor- mance has been robust. very careful how they play their hand. SAB's big deal record hasn't been great." The Miller acquisition took longer than expected to repay the cost of capits and analysts believe the turnaround of Foster's would take some time. However, the CEO Graham Mackay was reported to say that he would sweat the assets and 'make the numbers work. The board also acknowledged that there were few brewers remaining that could be acquired and would really make a difference to the company going forwards. The state of the world brewing market to 2015 At the group level, in 2009 profits dropped; however see Appendix 1 financial summary), this did not diminish to management interest in making further M&A. As CEO Graham Mackay stated via Bloomberg: 'Nothing is stop- There is money ping us from the right acquisition available even if we have to raise capital. We think our Global beer volumes (excluding China) recovered to about a two per cent growth rate after the trough of 2008 10 but well below the four to five per cent achieved in (see Table 3). Going forwards analysts expected flat beer shareholders would agree with it if it was the right acqui- 2006-7. The growth rate by region varied considerably ston' He added, however, that. The right acquisition new brewery in Nigeria Establishes a new 3m research brewery in the UK. ires and brewery investments 2001-15 (continued) and announces a new joint venture, Guizhou Moutai Beer, in partnership with China Kerichow Mota Deter CR Snow continues expansion in China with acquisition of remaining equity interest in Hangzhou Xihy Beer and Huzhou Brewery 2012 Strategic alliance with Castes to takeover running of Nigerian business. SABMiller acquires Foster's Group, the number one brewer in Aundrala for A$11 SABMiller, Anadolu Group and Anadolu Efes agree a strategic alliance for Turkey, thusa, the CIS, Central As and the Middle Ea Invests in doubling capacity in Uganda Unsuccessful attempt to acquire Heineken International 2014 Agreement to take a 47% stake in a new combined bottling operation for non alcoholic mady to drink beverages, Coca Cola Beye Africa, with The Coca-Cola Company and Gutsche Family Investments. This will account for 40% of all Coca Cola sales A 2015 Acquires Meantime Brewery in the UK. two brewer and making Latin America the largest contrib means something very different in an emerging market of South Africa). The area has performed very strongly utor of profits in the group (32 per cent of EBITA, ahead where a brewer can capitalise on growing volumes, than since the acquisition in terms of top- and bottom-line selling more premium beer is key. growth. Reviewing the Latin American operations at that time, the CEO confirmed that SABMiller saw these markets as offering 'exciting prospects for growth and observers were not convinced it was the right move as it does in the developed world where cost cuts and In 2011, SABMiller made a major acquisition in Foster's Group in Australia for A$11.8bn. Some industry added: Foster's, the number one brewer in Australia, was "Although the Bavaria businesses are well managed and competing in a mature market and its beer volumes profitable, we plan to create further value by applying profits and market share were all in decline compared SABMiller's operating practices and management skills. The best opportunities lie in brand portfolio development, creating good relationships with distrib- utors and retailers, and improving merchandising at the point of sale. The Bavaria acquisition brought very strong leader positions in its markets, with 90% market share a huge advantage in a scale-driven industry.' with its main rival Anheuser-Busch InBev. In the year ended March 2012, Foster's volumes of beers were down four per cent on the year when SABMiller group saw an overall rise. Analysts worried that SABMiller's Toners deal mirrored its Miller purchase in 2002 when SAB bought into an effective duopoly in the low-growth US market and gave the brewer a long-term headache. As one investor remarked: "SABMiller has turned around difficult situations before but those have often been from dominant market share positions. As an analyst at the time remarked, they have to be In 2008, a joint venture, Miller Coors, was formed between Molson Coors and the SABMiller business in the USA for scale advantages and productivity improvements of $500m in the face of increasing cost pressures and mproved logistics across the North American market. The complementarity of brands was to enable more effective competition against the dominance of Anheuser Busch in the USA. Commentators viewed the joint venture as a way of gaining market share in the profitable ght beer category that accounted for 40 per cent of tal US beer sales. The joint venture's profit perfor- mance has been robust. very careful how they play their hand. SAB's big deal record hasn't been great." The Miller acquisition took longer than expected to repay the cost of capits and analysts believe the turnaround of Foster's would take some time. However, the CEO Graham Mackay was reported to say that he would sweat the assets and 'make the numbers work. The board also acknowledged that there were few brewers remaining that could be acquired and would really make a difference to the company going forwards. The state of the world brewing market to 2015 At the group level, in 2009 profits dropped; however see Appendix 1 financial summary), this did not diminish to management interest in making further M&A. As CEO Graham Mackay stated via Bloomberg: 'Nothing is stop- There is money ping us from the right acquisition available even if we have to raise capital. We think our Global beer volumes (excluding China) recovered to about a two per cent growth rate after the trough of 2008 10 but well below the four to five per cent achieved in (see Table 3). Going forwards analysts expected flat beer shareholders would agree with it if it was the right acqui- 2006-7. The growth rate by region varied considerably ston' He added, however, that. The right acquisition MEGABREW: CREATING AN UNDISPUTED GLOBAL BREWING CHAMPION? Table 3 Compound annual growth rates (CAGR) by volume, by region (2013-2017) Region CAGR (2013-2017) Africa 5% Asia 4% Australasia 1% East Europe 0% 3% Latin America Middle East North Africa North America West Europe 1% -1% Source Based on http://www.canadean.comews/africa-to-become-fast est-growing-beer-market-in-the-world-by-2017/ volumes in North America and Europe with decline in key markets such as Germany France and UK. The per capita consumption by Germans for instance, some of the world's biggest aficionados of beer, had fallen due to demographic change, alternative beverages such as health drinks, wine and cider, tighter regulations and global economic slowdown. There was significant growth, however, in Latin America, with China, India and Africa offering the best long-term volume prospects given their large populations and low per capita consumption. Table 4 gives market profitability estimates by region. In particular, Africa's growth rate was estimated to be 44 per cent from 2014-25, nearly three times the fore- cast global growth rate. Against this backdrop of regional variation in sales (see Figure 2), the large brewing companies also faced changes in the nature of demand. There was intensifying competi- tion in premium beer segments where high profit margins made it easier for niche providers to compete successfully In many European countries there was a substantial increase in new beer products on retailers' shelves and in the US craft beers were making substantial inroads. In this context, SABMiller's main competitors, focused on various geographies and had different strategies. Heineken was increasingly centralising its brands in order to have a global brand design that they could then license, allowing global advertising and the use of a mass premium model. They were determined to retain their independ- ence. AB InBev remained focused on cost reduction through a few very large acquisitions and had generally managed to achieve between 10 and 15 per cent margin Table 4 Market profitability estimates (2010) S. Africa Other Latin America North America Brazil endal 1.2001 on each one. Carlsberg was struggling due to a recession in its core Russian market, tighter regulations and confict in Ukraine. Although it turned profitable for the first time in India in 2016, it announced a profits warning and a strategy review which could include an intention to acquire in growth markets such as Asia (see Table 5 for competitor share of global profits). Potential new competitors, including global spirits companies, were also increasingly encroaching on beer competitors' markets with greater focus on the same consumer occasions and needs, eg alcopops and ready-mixed drinks. Companies such as Diages, previ ously focused on developed markets, were now very active in growing rapidly through M&A in key emerging markets. Some media commentators predicted this would lead to convergence in the wine and beer market and pointed towards increased innovation in mung beers with spirits and flavours. Heineken's favoured beer 'Desperados' reflected an increased consumer demand for more sophisticated beverages at med gender occasions. The AB InBev bid The AB InBev bid, dubbed "Megabrew by analysts would result in the world's largest consumer-staples maker by earnings, with profits around $250 The enlarged brewer would be number 1 or number 2 in 24 of the world's 30 biggest beer markets. Analysts believe AB InBev made the bid in order to continue growing as its own growth rate was forecast to slow down over the following five years. In the US market, which accounted for 34 per cent of group revenue, its market share had already fallen from over 50 per cent to 44 per cent largely due to the rapid growth of craft brewers (see Figure 3). Its attempts to create its own craft beers such as Bud Lime had had only limited success. Historically, AB InBev had a strong position Latin America with 78 per cent market share 4 Argentina, 68 per cent in Brazil and 58 per cent a Mexico. This accounted for 30 per cent of grou area as there were low labour and raw material costs revenue in 2014 (see Table 6). It was an attractive economies of scale and production was near at $18,849m accounted for over 40 per cent of AB market. Together with Mexico, Latin American reve Russia Other Africa Inda China Other Asia Europe $17AM $130 SIOM $ION $2 MEGABREW: CREATING AN UNDISPUTED GLOBAL BREWING CHAMPION? Table 5 Competitor share of global $33bn profit pool (2014) Company Percentage share In terms of control, the Belgian and Brazilian families that controlled AB InBev would have seen their ownership diluted from 50 per cent to 44 per cent and SABMiller's two biggest shareholders, Altria Group Inc. and Colombia's Santo Domingo family, would own 16.5 per cent. At the time of the bid, it was not clear if the top management team of SABMiller would remain in post. AB InBev would finance the cash part of the transaction from exsting resources and third-party debt and had lined up banks to AB InBev 39.9 SABMiller 17.9 Heineken 11.6 Carlsberg 4.6 3.1 Asahi Molson Coors Others 2.9 20.0 raise $75bn, a record commercial loan. A bid of such magnitude triggers regulatory concerns as it might create monopolistic conditions in some coun InBev's group revenue, greater than North American tries. In the USA there were concerns that a very d sales. SABMiller also had a strong presence in Latin nant company might hurt the craft beer industry and America although not in Brazil, Argentina and Mexico where AB InBev was dominant. SABMiller's focus upon premium branding allowed it to achieve 33 per cent higher revenue per unit volume in this region than AB InBev. The combination could increase AB InBev's Latin American volumes by 30 per cent. In developed countries AB InBev was already strong, accounting for 47 per cent of revenues (see Table 6). reduce consumer choice. The US regulator uses a rela tive market share measure, the HHI index, to determine the concentration of competitors in an industry. As a re of thumb, the regulator prefers a score for the industry to be below 2500. With the passage of AB InBev's bid for SABMiller, without taking into account any restructuring and disposals, the new group would have 68 per cent market share and a HHI score of 5366 post-deal- significantly up from the pre-acquisition level of 2696. There were also concerns that a very dominant company might distort the market for supplies such as barley, hops and aluminium cans. In order to gain regulatory approval the bid stated that Molson Coors Brewing Company would acquire SABMiller's 58 per cent stake in Mar Coors, the CR Snow business in China would need to be AB InBev needed to make an acquisition in order to move the needle', to make a difference in terms of its earnings. The bid was 50 per cent above SABMiller's closing share price of 29.34 on 14 September 2015. Stock markets welcomed the news as SABMiller shares rose 1.9 per cent in London and AB InBev gained 2.2 per cent in Brussels. % change 8.9% 10.6% 0.4% 2.1% -0.8% 9.9% -0.03% -0.01% 3.1% -0.03% 1.3% -5.6% 50.3% 69.4% 25.5% 3.6% 16,1% Table 6 AB InBev revenue and gross profit (US$m) and volumes by region (hlm) 2014 2013 Revenue 47,063 43,195 Group Gross profit 28,307 25,601 Volume 458.801 445.786 Revenue 16,093 16,023 North America Gross profit 9,702 9,504 121.150 122.118 Volume Revenue 4,619 4,669 Mexico Gross profit 3,245 3,099 Volume 38,800 38,185 Latin America Revenue 14,230 14,279 Gross profit 9,409 9,518 162.244 Volume Revenue 157.345 Europe 4,865 5,021 Gross profit 2,784 2,749 Volume 44.278 47.030 Asia Revenue 5,040 3,354 Gross profit 2,489 1,469 Volume 82.529 65.787 Global export and holding companies Revenue 2,216 2,138 Gross profil 678 con MEGABREW: CREATING AN UNDISPUTED GLOBAL BREWING CHAMPION? as would the Peroni and Grolsch brands in Europe. market seemed to have fewer opportunities for expan- Africa, this partner would be lost as AB InBev already with lower prospects of high financial returns. The other And, an important bottler for Coca-Cola's drinks in sion: large transformational deals were hard to find and worked with PepsiCo in Latin America. AB InBev aimed to cut annual costs by $1.4bn, about global brewers were increasingly looking for growth from emerging markets as beer sales slowed in more growth in Africa and Carlsberg aimed to expand into 9 per cent of SABMiller's sales. As an acquisition driven developed consumer markets. Heineken was pursuing company, AB InBev had a successful track record of cutting costs, e.g. by 19 per cent when it bought Asia. Japanese brewers were also becoming increas- Anheuser-Busch in 2008 and a 21 per cent cost reduc- tion at Mexico's Modelo in 2013. AB InBev has an impressive operating profit margin of 33 per cent compared with other competitors who struggle to reach For all companies there were questions about the that level. An estimated one third of savings from the emphasis placed on local vs global brands in their SABMiller acquisition might come from overlapping portfolios. Should they consider entering more profit- head-office roles. The rest would come from restructuring able beverage segments? Could there be yet another although those details had not emerged at the time of writing. Some analysts even believed that AB InBev cost battle in beer? cuttings were being underestimated. However, others ingly active in the Asian market. The added complica- tion of the economic recession had also impacted on all beer markets, albeit with different degrees of severity. 'market changing' deal that could be shaped to win the pointed out that SABMiller was already a lean operation, Main sources: T. Buckley, SABMiler buys case for The Economist, The and its operations were dispersed, which might not provide many opportunities for amalgamation. They also pointed out that whilst AB InBev had been excellent at cutting costs on acquisition, their track record for gener- ating subsequent organic growth was lacking. Africa sales gain', Bloomberg.com, 21 January 2016. beerhemoth-SABMiller is AB InBev's toughest takeover yet it may not be its last, Economist.com, 17 October 2015. Fontanella Khan, A Massoudi and S. Daneshkhu, Anheuser-Busch InBev eyes takeover of rival SABMiller, FT.com, 16 September 2015 E. Holodry A Budweser Miler brewing company would be a monster, uk businessinsider.com 16 September 2015. P. Jarvis and T. Buckley, AB InBev buys SABMiler for $107 billion as U.S. deal agreed, www.bloomberg com 11 November 2015. T. Mickle, AB InBev defends SABMiler buy to Senate questions asked about deal's potential impact on craft brewers, mal beer makars www.wsj.com, 8 December 2015. Trefis Team, Anheuser-Busch InBer what the SABMiller acquisition could mean, Forbes.com 18 September 2014. Trefis Team, How the potential AB InBev-SABMiller deal focuses on Africa', Trefis.com, 14 December 2015. E. Rutshauser, S. Rickert and F Snger, A perfect storm brewing in the global beer business What next? Notes and references SABMiller had agreed to the takeover by AB InBev but whether this was the best strategic option for the company was not clear. It was also important to consider other options in case the bid failed to close due to regu- Mckinseyonmarketingandsales.com, June 2015 latory hurdles, of which there was approximately a 27 per cent chance, and SABMiller remained inde- pendent. Nonetheless, assuming the bid did close, both SABMiller and AB InBev had to consider what a successful bid might mean for the combined business going forwards. How might SABMiller be integrated effec- tively into the new group? Would the integration strategy 1. B. Marlow and N. Thomas, Billion dolar beer wars brewing Telegraph, 20 September 2014. 2. A. Cleary, "SABMiller chiel says he's ready for M&A predicts sow recovery, Bloomberg.com, 11 August 2009 3. AUD$1.00-0.52-$0.74-0.66 4. D. Jones, Analysis SABMiller faces long had to turnaround Foster's Reuters, 31 May 2012. destroy valuable SABMiller heritage or enhance its value? 5. N. Hue, "SAB losters beer brands in Australa, FT com. 26 May 2013 6. Exane BNP Paribas, quoted in Bloomberg news, 11 November 2015 How would the new company compete in the future? Whilst SABMiller and AB InBev wrestled with satis- integration, the beer fying regulators and planning