Question: Create an asset register outlining the current cost base elements of each property pursuant to the income tax legislation. (Hint: create a table with the

Create an asset register outlining the current cost base elements of each property pursuant to the income tax legislation.

(Hint: create a table with the following four columns: (i) cost base element (ii) amount ($) (iii) date (iv) explanation).

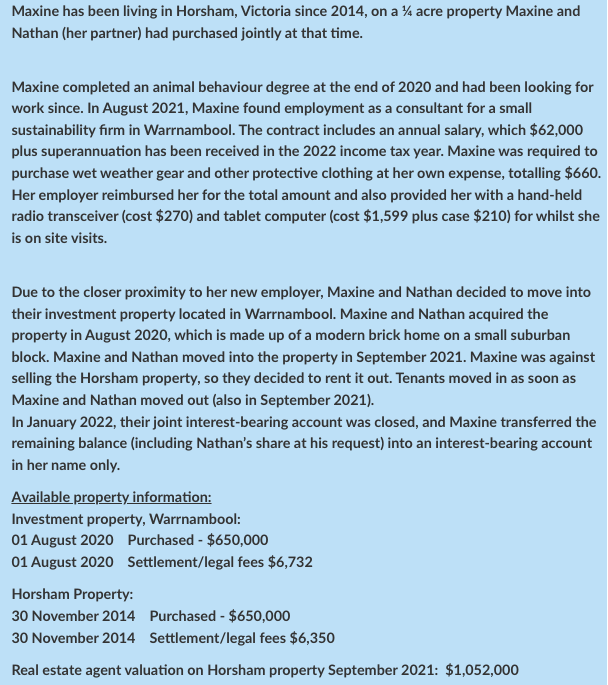

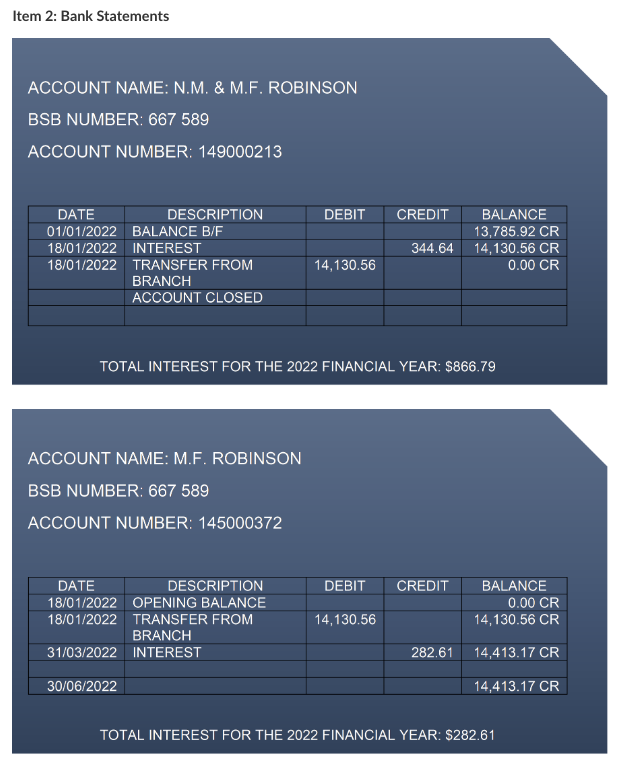

Maxine has been living in Horsham, Victoria since 2014 , on a 1/4 acre property Maxine and Nathan (her partner) had purchased jointly at that time. Maxine completed an animal behaviour degree at the end of 2020 and had been looking for work since. In August 2021, Maxine found employment as a consultant for a small sustainability firm in Warrnambool. The contract includes an annual salary, which $62,000 plus superannuation has been received in the 2022 income tax year. Maxine was required to purchase wet weather gear and other protective clothing at her own expense, totalling $660. Her employer reimbursed her for the total amount and also provided her with a hand-held radio transceiver (cost $270 ) and tablet computer (cost $1,599 plus case $210 ) for whilst she is on site visits. Due to the closer proximity to her new employer, Maxine and Nathan decided to move into their investment property located in Warrnambool. Maxine and Nathan acquired the property in August 2020, which is made up of a modern brick home on a small suburban block. Maxine and Nathan moved into the property in September 2021. Maxine was against selling the Horsham property, so they decided to rent it out. Tenants moved in as soon as Maxine and Nathan moved out (also in September 2021). In January 2022, their joint interest-bearing account was closed, and Maxine transferred the remaining balance (including Nathan's share at his request) into an interest-bearing account in her name only. Available property information: Investment property, Warrnambool: 01 August 2020 Purchased - $650,000 01 August 2020 Settlement/legal fees $6,732 Horsham Property: 30 November 2014 Purchased - $650,000 30 November 2014 Settlement/legal fees $6,350 Real estate agent valuation on Horsham property September 2021:$1,052,000 Item 2: Bank Statements ACCOUNT NAME: N.M. \& M.F. ROBINSON BSB NUMBER: 667589 ACCOUNT NUMBER: 149000213 TOTAL INTEREST FOR THE 2022 FINANCIAL YEAR: \$866.79 TOTAL INTEREST FOR THE 2022 FINANCIAL YEAR: \$282.61 Maxine has been living in Horsham, Victoria since 2014 , on a 1/4 acre property Maxine and Nathan (her partner) had purchased jointly at that time. Maxine completed an animal behaviour degree at the end of 2020 and had been looking for work since. In August 2021, Maxine found employment as a consultant for a small sustainability firm in Warrnambool. The contract includes an annual salary, which $62,000 plus superannuation has been received in the 2022 income tax year. Maxine was required to purchase wet weather gear and other protective clothing at her own expense, totalling $660. Her employer reimbursed her for the total amount and also provided her with a hand-held radio transceiver (cost $270 ) and tablet computer (cost $1,599 plus case $210 ) for whilst she is on site visits. Due to the closer proximity to her new employer, Maxine and Nathan decided to move into their investment property located in Warrnambool. Maxine and Nathan acquired the property in August 2020, which is made up of a modern brick home on a small suburban block. Maxine and Nathan moved into the property in September 2021. Maxine was against selling the Horsham property, so they decided to rent it out. Tenants moved in as soon as Maxine and Nathan moved out (also in September 2021). In January 2022, their joint interest-bearing account was closed, and Maxine transferred the remaining balance (including Nathan's share at his request) into an interest-bearing account in her name only. Available property information: Investment property, Warrnambool: 01 August 2020 Purchased - $650,000 01 August 2020 Settlement/legal fees $6,732 Horsham Property: 30 November 2014 Purchased - $650,000 30 November 2014 Settlement/legal fees $6,350 Real estate agent valuation on Horsham property September 2021:$1,052,000 Item 2: Bank Statements ACCOUNT NAME: N.M. \& M.F. ROBINSON BSB NUMBER: 667589 ACCOUNT NUMBER: 149000213 TOTAL INTEREST FOR THE 2022 FINANCIAL YEAR: \$866.79 TOTAL INTEREST FOR THE 2022 FINANCIAL YEAR: \$282.61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts