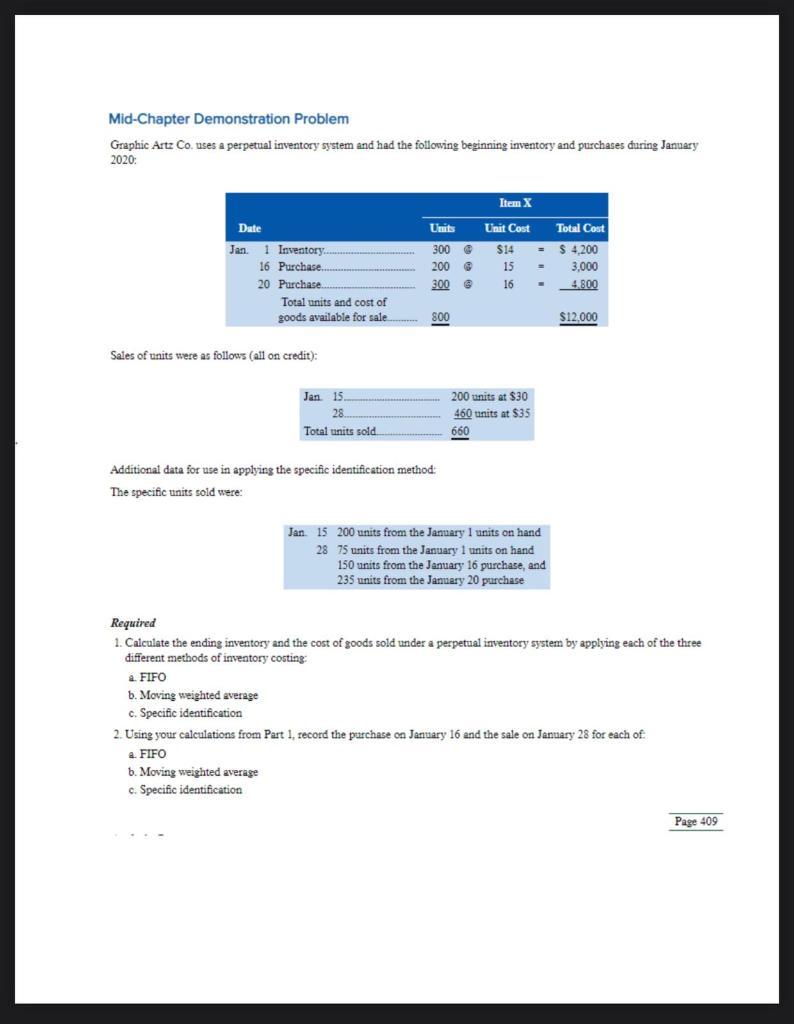

Question: Mid-Chapter Demonstration Problem Graphic Artz Co. uses a perpetual inventory system and had the following beginning inventory and purchases during January 2020: Date Jan.

Mid-Chapter Demonstration Problem Graphic Artz Co. uses a perpetual inventory system and had the following beginning inventory and purchases during January 2020: Date Jan. 1 Inventory.. 16 Purchase.. 20 Purchase.... Total units and cost of goods available for sale... Sales of units were as follows (all on credit): Jan. 15.. 28. Total units sold. Units 300 @ 200 @ 300 800 Additional data for use in applying the specific identification method: The specific units sold were: Item X Unit Cost $14 15 16 200 units at $30 460 units at $35 660 = = Jan 15 200 units from the January 1 units on hand 28 75 units from the January 1 units on hand 150 units from the January 16 purchase, and 235 units from the January 20 purchase Total Cost $4,200 3,000 4,800 $12,000 Required 1. Calculate the ending inventory and the cost of goods sold under a perpetual inventory system by applying each of the three different methods of inventory costing: a FIFO b. Moving weighted average c. Specific identification 2. Using your calculations from Part 1, record the purchase on January 16 and the sale on January 28 for each of a. FIFO b. Moving weighted average c. Specific identification Page 409

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Answer to Question 1a Cost of goods sold9760 Ending Inventory 2240 Workings FIFO Method of In... View full answer

Get step-by-step solutions from verified subject matter experts