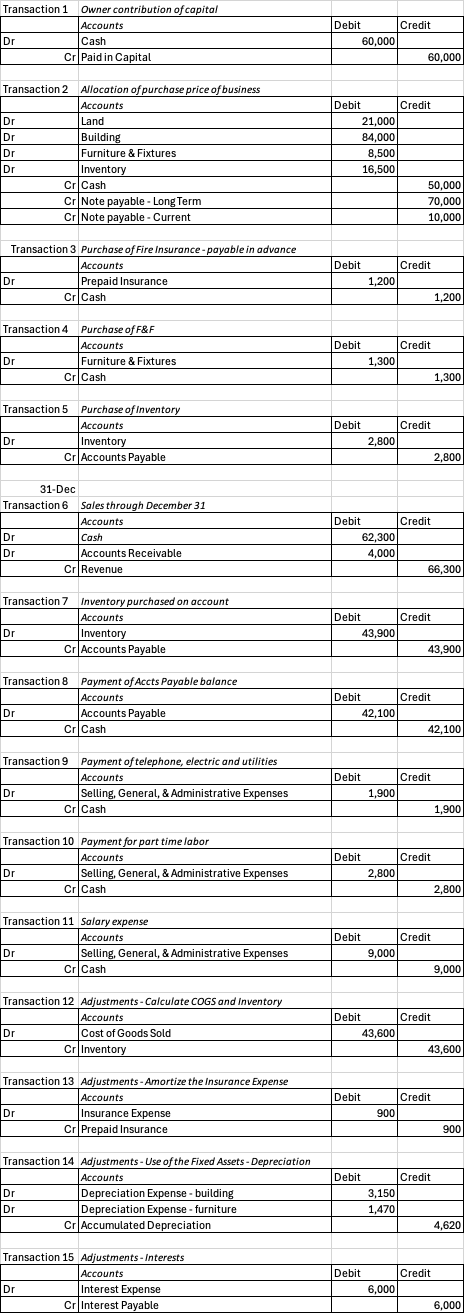

Question: create balance sheet based off these entries: Transaction 1 Owner contribution of capital Accounts Debit CreditDr Cash 60,000 Cr Paid in Capital 60,000 Transaction 2

create balance sheet based off these entries: Transaction 1 Owner contribution of capital Accounts Debit CreditDr Cash 60,000 Cr Paid in Capital 60,000 Transaction 2 Allocation of purchase price of business Accounts Debit CreditDr Land 21,000 Dr Building 84,000 Dr Furniture & Fixtures 8,500 Dr Inventory 16,500 Cr Cash 50,000Cr Note payable - Long Term 70,000Cr Note payable - Current 10,000 Transaction 3 Purchase of Fire Insurance - payable in advance Accounts Debit CreditDr Prepaid Insurance 1,200 Cr Cash 1,200 Transaction 4 Purchase of F&F Accounts Debit CreditDr Furniture & Fixtures 1,300 Cr Cash 1,300 Transaction 5 Purchase of Inventory Accounts Debit CreditDr Inventory 2,800 Cr Accounts Payable 2,800 31-Dec Transaction 6 Sales through December 31 Accounts Debit CreditDr Cash 62,300 Dr Accounts Receivable 4,000 Cr Revenue 66,300 Transaction 7 Inventory purchased on account Accounts Debit CreditDr Inventory 43,900 Cr Accounts Payable 43,900 Transaction 8 Payment of Accts Payable balance Accounts Debit CreditDr Accounts Payable 42,100 Cr Cash 42,100 Transaction 9 Payment of telephone, electric and utilities Accounts Debit CreditDr Selling, General, & Administrative Expenses 1,900 Cr Cash 1,900 Transaction 10 Payment for part time labor Accounts Debit CreditDr Selling, General, & Administrative Expenses 2,800 Cr Cash 2,800 Transaction 11 Salary expense Accounts D

Transaction 1 Owner contribution of capital Accounts Debit Credit Dr Cash 60,000 Cr Paid in Capital 60,00 Transaction 2 Allocation of purchase price of business Accounts Debit Credit Dr Land 21,000 Dr Building 84,000 Dr Furniture & Fixtures 3,500 Pr Inventory 16,500 Cr Cash 50,000 Cr Note payable - Long Term 70,000 Cr Note payable - Current 10,00 Transaction 3 Purchase of Fire Insurance - payable in advance Accounts Debit Credit Prepaid Insurance 1,200 Cr Cash 1,20 Transaction 4 Purchase of F&F Accounts Debit Credit Dr Furniture & Fixtures 1,300 Cr Cash 1,30 Transaction 5 Purchase of Inventory Accounts Debit Credit Dr nventory 2,800 Cr Accounts Payable 2,80 31-Dec Transaction 6 Sales through December 31 Accounts Debit Credit Dr Cash 62,300 Dr Accounts Receivable 4,000 Cr Revenue 66,300 Transaction 7 Inventory purchased on account Accounts Debit Credit D nventory 13.900 Cr Accounts Payable 13,900 Transaction 8 Payment of Accts Payable balance Accounts Debit Credit Dr Accounts Payable 12,100 Cr Cast 12.10 Transaction 9 Payment of telephone, electric and utilities Accounts Debit Credit D Selling, General, & Administrative Expenses 1,900 Cr Cash 1,900 Transaction 10 Payment for part time labor Accounts Debit Credit Dr Selling, General, & Administrative Expenses 2,800 Cr Cash 2,80 Transaction 11 Salary expense Accounts Debit Credit Dr Selling, General, & Administrative Expenses 9,000 Cr Cash 9,000 Transaction 12 Adjustments - Calculate COGS and Inventory Accounts Debit Credit Dr Cost of Goods Sold 43,600 Cr Inventory 43,600 Transaction 13 Adjustments - Amortize the Insurance Expense Accounts Debit Credit Dr Insurance Expense 900 Cr Prepaid Insurance 90 Transaction 14 Adjustments - Use of the Fixed Assets - Depreciation Accounts Debit Credit Dr Depreciation Expense - building 3,150 Dr Depreciation Expense - furniture 1,470 Cr Accumulated Depreciation 4,620 Transaction 15 Adjustments - Interests Accounts Debit Credit Dr Interest Expense 5,000 Cr Interest Payable 6,000