Question: Create excel document with this problems. Premium Manufacturing Company is evaluating two forklift systems to use in its plant that produces the towers for a

Create excel document with this problems.

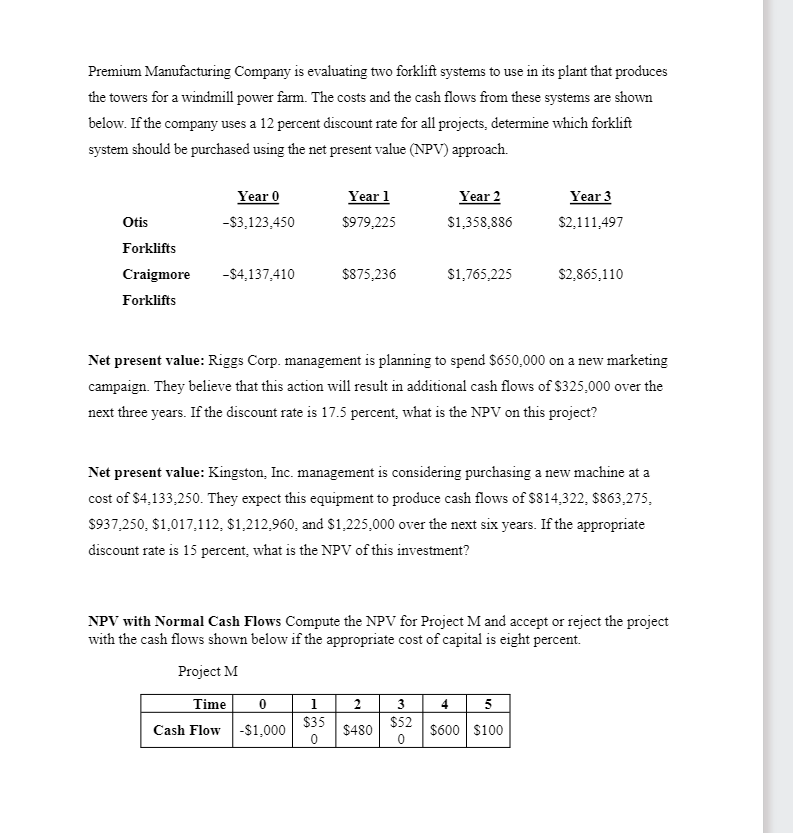

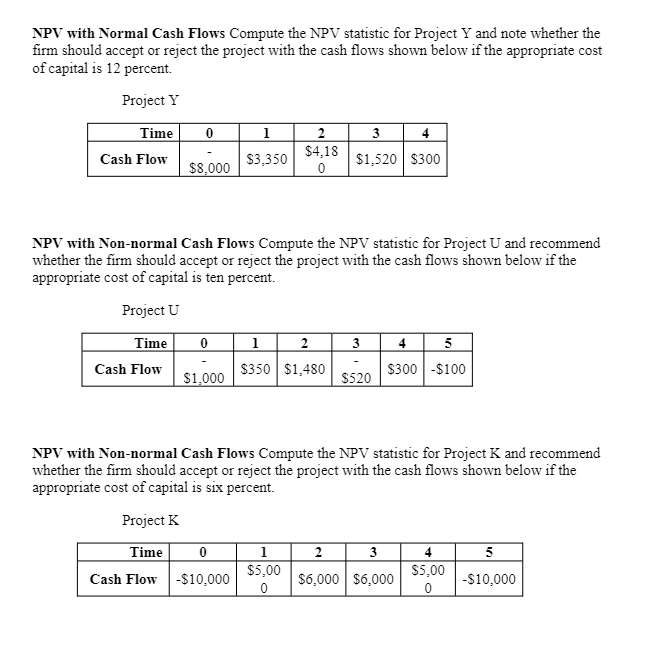

Premium Manufacturing Company is evaluating two forklift systems to use in its plant that produces the towers for a windmill power farm. The costs and the cash flows from these systems are shown below. If the company uses a 12 percent discount rate for all projects, determine which forklift system should be purchased using the net present value (NPV) approach. Net present value: Riggs Corp. management is planning to spend $650,000 on a new marketing campaign. They believe that this action will result in additional cash flows of $325,000 over the next three years. If the discount rate is 17.5 percent, what is the NPV on this project? Net present value: Kingston, Inc. management is considering purchasing a new machine at a cost of $4,133,250. They expect this equipment to produce cash flows of $814,322,$863,275, $937,250,$1,017,112,$1,212,960, and $1,225,000 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? NPV with Normal Cash Flows Compute the NPV for Project M and accept or reject the project with the cash flows shown below if the appropriate cost of capital is eight percent. Project M NPV with Normal Cash Flows Compute the NPV statistic for Project Y and note whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is 12 percent. Project Y NPV with Non-normal Cash Flows Compute the NPV statistic for Project U and recommend whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is ten percent. Project U NPV with Non-normal Cash Flows Compute the NPV statistic for Project K and recommend whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is six percent. Project K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts