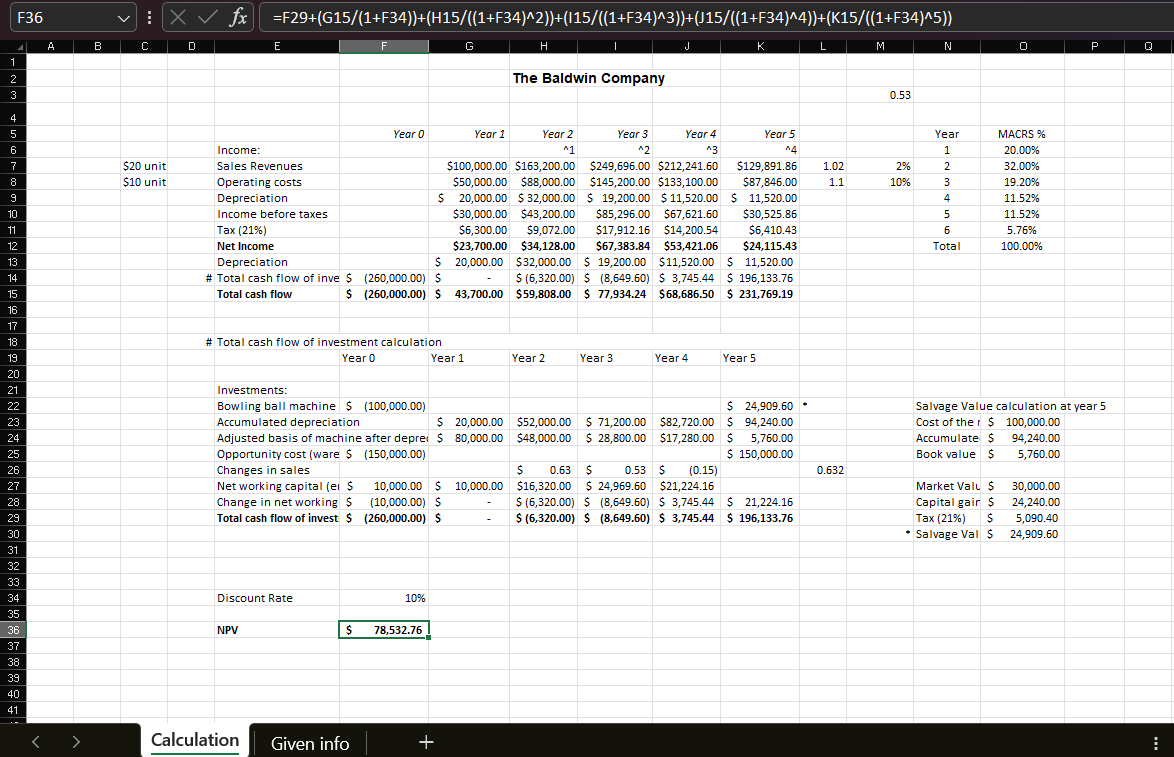

Question: create new excel project using the information given via the Baldwin company the excel file is used as an example change the figures as needed

create new excel project using the information given via the "Baldwin company" the excel file is used as an example change the figures as needed

using a discount rate of 10% calculate the NPV of project

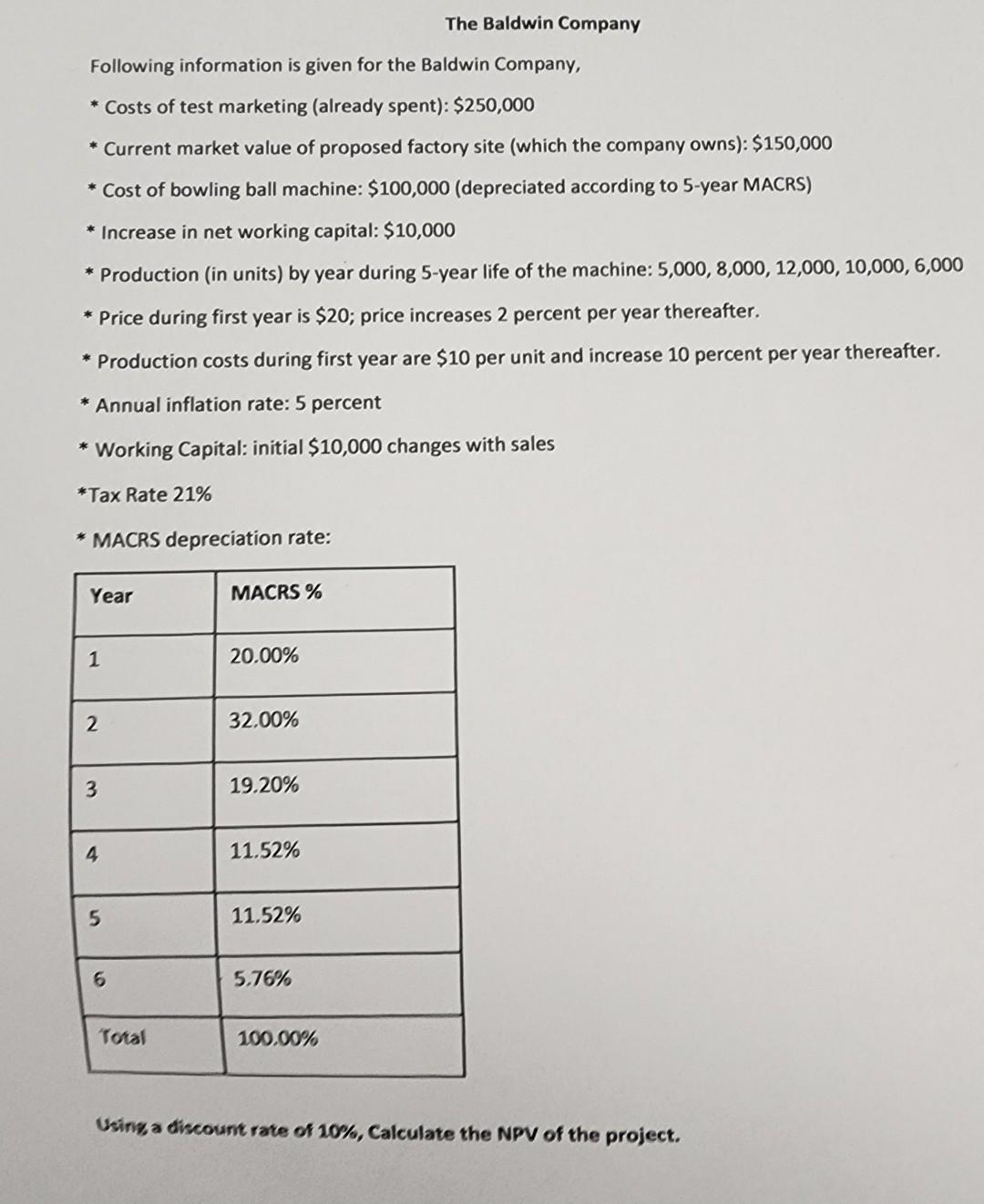

The Baldwin Company Following information is given for the Baldwin Company, * Costs of test marketing (already spent): $250,000 * Current market value of proposed factory site (which the company owns): $150,000 * Cost of bowling ball machine: $100,000 (depreciated according to 5-year MACRS) * Increase in net working capital: $10,000 * Production (in units) by year during 5-year life of the machine: 5,000, 8,000, 12,000, 10,000, 6,000 * Price during first year is $20; price increases 2 percent per year thereafter. * Production costs during first year are $10 per unit and increase 10 percent per year thereafter. * Annual inflation rate: 5 percent * Working Capital: initial $10,000 changes with sales *Tax Rate 21% * MACRS depreciation rate: Using a discount rate of 10%, Calculate the NPV of the project. F36 fx=F29+(G15/(1+F34))+(H15/((1+F34)2))+(I15/((1+F34)3))+(J15/((1+F34)4))+(K15/((1+F34)5)) A B E G H K L M N 0.53 \begin{tabular}{c} \hline 1 \\ \hline 2 \\ \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline 6 \\ \hline 7 \\ \hline 8 \\ \hline 9 \\ \hline 10 \\ \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline 16 \\ \hline 17 \\ \hline 18 \\ \hline 19 \\ \hline 20 \\ \hline 21 \\ \hline 22 \\ \hline 23 \\ \hline 24 \\ \hline 25 \\ \hline 26 \\ \hline 27 \\ \hline 28 \\ \hline 29 \\ \hline 30 \\ \hline 31 \\ \hline 32 \\ \hline 33 \\ \hline 34 \\ \hline 35 \\ \hline 36 \\ \hline 38 \\ \hline 39 \\ \hline \end{tabular} The Baldwin Company Year 0 Year 1 Income: $20 unit Sales Revenues Operating costs Depreciation Income before taxes Tax(21%) Net Income Depreciation \# Total cash flow of inve $ Total cash flow Year 2 $100,000.00$163,200.00 \begin{tabular}{|l|l|l|l|l|} $50,000.00 & $88,000.00 & $249,696.00 & $212,241.60 & $129,891.86 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|r|r|} \hline$387,846.00 \\ \hline & 20,000.00 & $32,000.00 & $19,200.00 & $11,520.00 & $ & 11,520.00 \\ \hline \end{tabular} $30,000.00$43,200.00 $6,300.00$9,072.00 $23,700.00$34,128.00 20,000.00 (260,000.00)$ $(6,320.00)$(8,649.60)$3,745.44$196,133.76 \# Total cash flow of investment calculation Discount Rate NPV $78,532.76 Salvage Value calculation at year 5 Cost of the i $100,000.00 Accumulate $94,240.00 Book value $5,760.00 Market Valu \$ 30,000.00 Capital gair $24,240.00 Tax(21%)$5,090.40 - Salvage Val \$ 24,909.60 The Baldwin Company Following information is given for the Baldwin Company, * Costs of test marketing (already spent): $250,000 * Current market value of proposed factory site (which the company owns): $150,000 * Cost of bowling ball machine: $100,000 (depreciated according to 5-year MACRS) * Increase in net working capital: $10,000 * Production (in units) by year during 5-year life of the machine: 5,000, 8,000, 12,000, 10,000, 6,000 * Price during first year is $20; price increases 2 percent per year thereafter. * Production costs during first year are $10 per unit and increase 10 percent per year thereafter. * Annual inflation rate: 5 percent * Working Capital: initial $10,000 changes with sales *Tax Rate 21% * MACRS depreciation rate: Using a discount rate of 10%, Calculate the NPV of the project. F36 fx=F29+(G15/(1+F34))+(H15/((1+F34)2))+(I15/((1+F34)3))+(J15/((1+F34)4))+(K15/((1+F34)5)) A B E G H K L M N 0.53 \begin{tabular}{c} \hline 1 \\ \hline 2 \\ \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline 6 \\ \hline 7 \\ \hline 8 \\ \hline 9 \\ \hline 10 \\ \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline 16 \\ \hline 17 \\ \hline 18 \\ \hline 19 \\ \hline 20 \\ \hline 21 \\ \hline 22 \\ \hline 23 \\ \hline 24 \\ \hline 25 \\ \hline 26 \\ \hline 27 \\ \hline 28 \\ \hline 29 \\ \hline 30 \\ \hline 31 \\ \hline 32 \\ \hline 33 \\ \hline 34 \\ \hline 35 \\ \hline 36 \\ \hline 38 \\ \hline 39 \\ \hline \end{tabular} The Baldwin Company Year 0 Year 1 Income: $20 unit Sales Revenues Operating costs Depreciation Income before taxes Tax(21%) Net Income Depreciation \# Total cash flow of inve $ Total cash flow Year 2 $100,000.00$163,200.00 \begin{tabular}{|l|l|l|l|l|} $50,000.00 & $88,000.00 & $249,696.00 & $212,241.60 & $129,891.86 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|r|r|} \hline$387,846.00 \\ \hline & 20,000.00 & $32,000.00 & $19,200.00 & $11,520.00 & $ & 11,520.00 \\ \hline \end{tabular} $30,000.00$43,200.00 $6,300.00$9,072.00 $23,700.00$34,128.00 20,000.00 (260,000.00)$ $(6,320.00)$(8,649.60)$3,745.44$196,133.76 \# Total cash flow of investment calculation Discount Rate NPV $78,532.76 Salvage Value calculation at year 5 Cost of the i $100,000.00 Accumulate $94,240.00 Book value $5,760.00 Market Valu \$ 30,000.00 Capital gair $24,240.00 Tax(21%)$5,090.40 - Salvage Val \$ 24,909.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts