Question: created a financial plan. Once again, let's assume your retirement age is 65 years old. Either using the number you determine in the Week 2

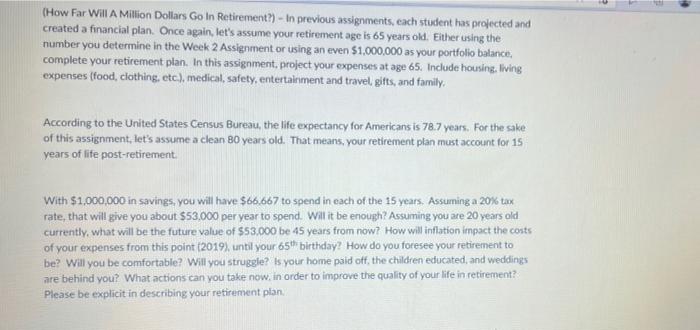

created a financial plan. Once again, let's assume your retirement age is 65 years old. Either using the number you determine in the Week 2 Assignment or using an even $1,000,000 as your portfolio balance, complete your retirement plan. In this assignment, project your expenses at age 65 . Include housing. living expenses (food, clothing, etc), medical, safety, entertairment and travel, gifts, and familly. According to the United States Census Bureau, the life expectancy for Americans is 78.7 years. For the sake of this assignment, let's assume a clean 80 years old. That means, your retirement plan must account for 15 years of life post-retirement. With $1,000,000 in savings, you will have $66,667 to spend in each of the 15 years. Assuming a 20% tax rate, that will give you about $53,000 per year to spend. Will it be enough? Assuming you are 20 years old currently, what will be the future value of $53.000 be 45 years from now? How will inflation impact the conts of your expenses from this point (2019), until your 65th birthday? How do you foresee your retirement to be? Will you be comfortable? Will you struggle? Is your home paid off, the children educated, and weddings are behind you? What actions can you take now, in order to improve the quality of your life in retirement? Please be explicit in describing your retirement plan. created a financial plan. Once again, let's assume your retirement age is 65 years old. Either using the number you determine in the Week 2 Assignment or using an even $1,000,000 as your portfolio balance, complete your retirement plan. In this assignment, project your expenses at age 65 . Include housing. living expenses (food, clothing, etc), medical, safety, entertairment and travel, gifts, and familly. According to the United States Census Bureau, the life expectancy for Americans is 78.7 years. For the sake of this assignment, let's assume a clean 80 years old. That means, your retirement plan must account for 15 years of life post-retirement. With $1,000,000 in savings, you will have $66,667 to spend in each of the 15 years. Assuming a 20% tax rate, that will give you about $53,000 per year to spend. Will it be enough? Assuming you are 20 years old currently, what will be the future value of $53.000 be 45 years from now? How will inflation impact the conts of your expenses from this point (2019), until your 65th birthday? How do you foresee your retirement to be? Will you be comfortable? Will you struggle? Is your home paid off, the children educated, and weddings are behind you? What actions can you take now, in order to improve the quality of your life in retirement? Please be explicit in describing your retirement plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts