Question: Creating journal entries ? 1. Assuming in its first year of operations in 2015, that AG sold 50,000 shar of 1.00 par stock to an

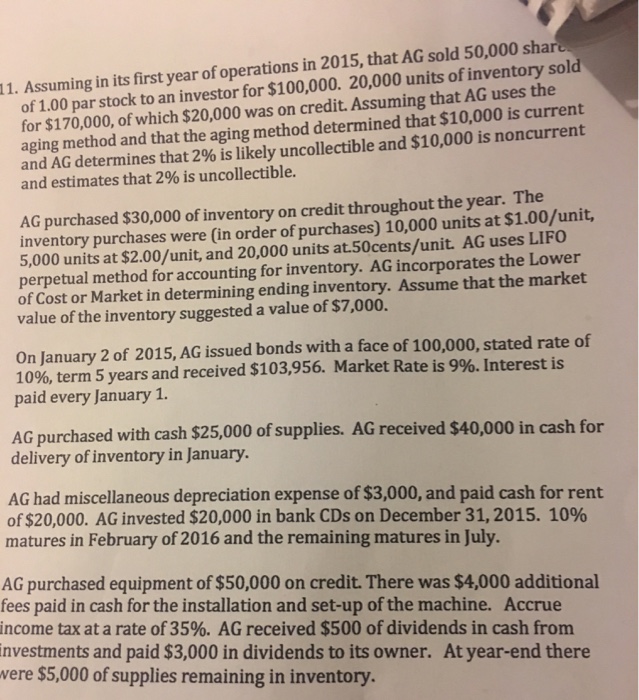

1. Assuming in its first year of operations in 2015, that AG sold 50,000 shar of 1.00 par stock to an investor for $100,000. 20,000 units of inventory sold for $170,000, of which $20,000 was on credit. Assuming that AG uses the aging method and that the aging method determined that $10,000 is current and AG determines that 2% is likely uncollectible and $10,000 is noncurrent and estimates that 2% is uncollectible. AG purchased $30,000 of inventory on credit throughout the year. The inventory purchases were (in order of purchases) 10,000 units at $1.00/unit, 5,000 units at $2.00/unit, and 20,000 units at.50cents/unit. AG uses LIFO perpetual method for accounting for inventory. AG incorporates the Lower of Cost or Market in determining ending inventory. Assume that the market value of the inventory suggested a value of $7,000. On January 2 of 2015, AG issued bonds with a face of 100,000, stated rate of 1096, term 5 years and received $103,956. Market Rate is 9%. Interest is paid every January 1 AG purchased with cash $25,000 of supplies. AG received $40,000 in cash for delivery of inventory in January AG had miscellaneous depreciation expense of $3,000, and paid cash for rent of $20,000. AG invested $20,000 in bank CDs on December 31,2015. 10% matures in February of 2016 and the remaining matures in July. AG purchased equipment of $50,000 on credit. There was $4,000 additional fees paid in cash for the installation and set-up of the machine. Accrue income tax at a rate of 35%. AG received $500 of dividends in cash from nvestments and paid $3,000 in dividends to its owner. At year-end there vere $5,000 of supplies remaining in inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts