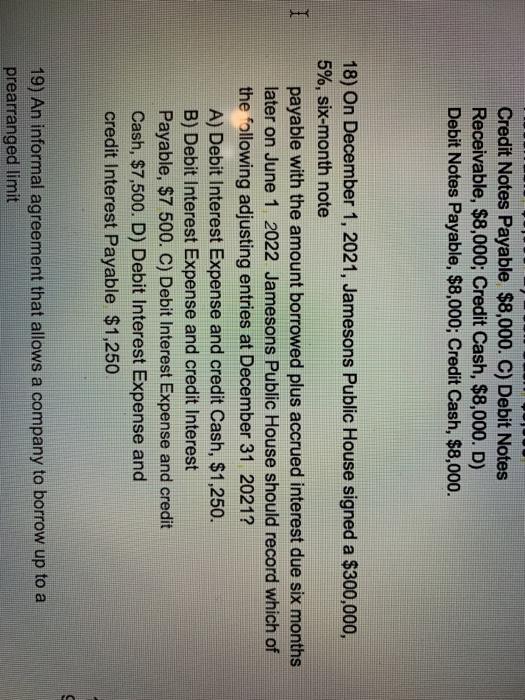

Question: Credit Notes Payable $8,000. C) Debit Notes Receivable, $8,000; Credit Cash, $8,000. D) Debit Notes Payable, $8,000; Credit Cash, $8,000. I 18) On December 1,

Credit Notes Payable $8,000. C) Debit Notes Receivable, $8,000; Credit Cash, $8,000. D) Debit Notes Payable, $8,000; Credit Cash, $8,000. I 18) On December 1, 2021, Jamesons Public House signed a $300,000, 5%, six-month note payable with the amount borrowed plus accrued interest due six months later on June 1 2022 Jamesons Public House should record which of the following adjusting entries at December 31 2021? A) Debit Interest Expense and credit Cash, $1,250. B) Debit Interest Expense and credit Interest Payable, $7 500. C) Debit Interest Expense and credit Cash, $7,500. D) Debit Interest Expense and credit Interest Payable $1,250 19) An informal agreement that allows a company to borrow up to a prearranged limit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts