The owner of a building supply company has requested a cash budget for June. After examining...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

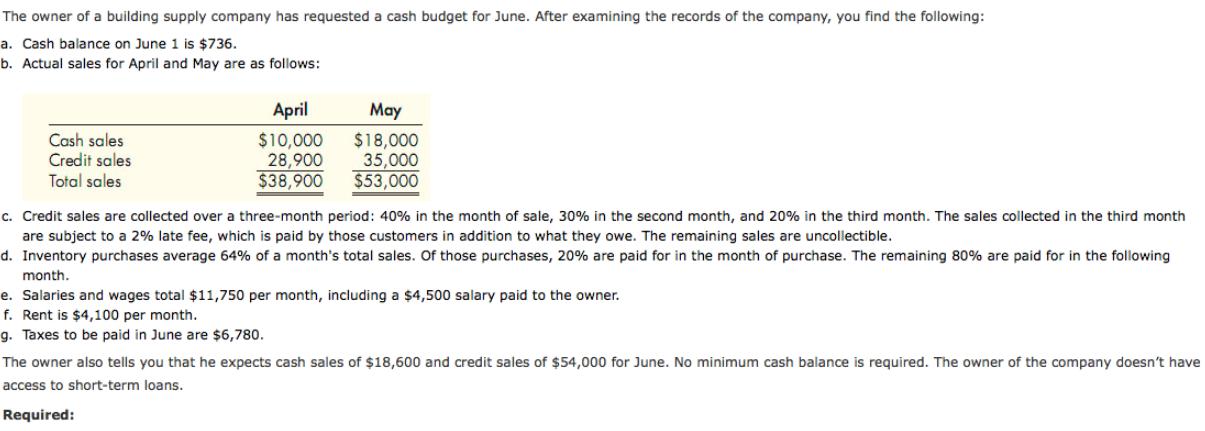

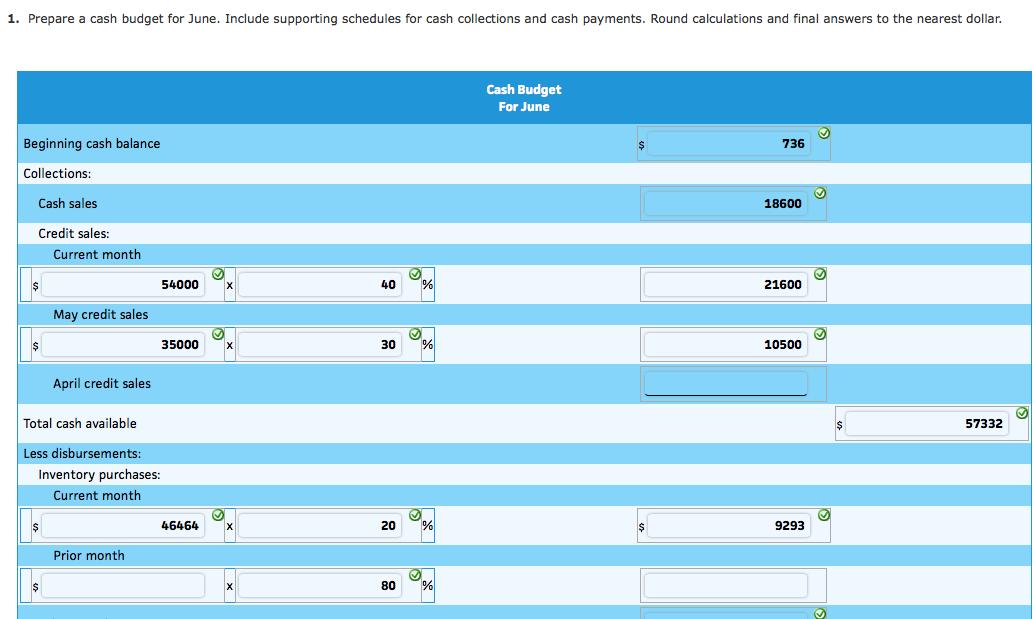

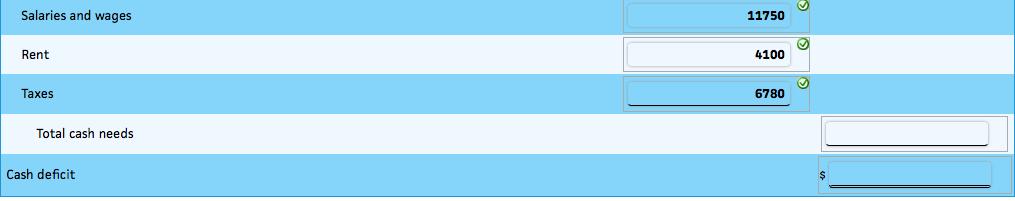

The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following: a. Cash balance on June 1 is $736. b. Actual sales for April and May are as follows: April May Cash sales $10,000 28,900 $38,900 $18,000 35,000 $53,000 Credit sales Total sales c. Credit sales are collected over a three-month period: 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible. d. Inventory purchases average 64% of a month's total sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month. e. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner. f. Rent is $4,100 per month. g. Taxes to be paid in June are $6,780. The owner also tells you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn't have access to short-term loans. Required: 1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round calculations and final answers to the nearest dollar. Cash Budget For June Beginning cash balance 736 Collections: Cash sales 18600 Credit sales: Current month 54000 40 21600 May credit sales 35000 30 10500 April credit sales Total cash available 57332 Less disbursements: Inventory purchases: Current month 46464 9293 Prior month 80 Salaries and wages 11750 Rent 4100 Таxes 6780 Total cash needs Cash deficit The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following: a. Cash balance on June 1 is $736. b. Actual sales for April and May are as follows: April May Cash sales $10,000 28,900 $38,900 $18,000 35,000 $53,000 Credit sales Total sales c. Credit sales are collected over a three-month period: 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible. d. Inventory purchases average 64% of a month's total sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month. e. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner. f. Rent is $4,100 per month. g. Taxes to be paid in June are $6,780. The owner also tells you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn't have access to short-term loans. Required: 1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round calculations and final answers to the nearest dollar. Cash Budget For June Beginning cash balance 736 Collections: Cash sales 18600 Credit sales: Current month 54000 40 21600 May credit sales 35000 30 10500 April credit sales Total cash available 57332 Less disbursements: Inventory purchases: Current month 46464 9293 Prior month 80 Salaries and wages 11750 Rent 4100 Таxes 6780 Total cash needs Cash deficit

Expert Answer:

Answer rating: 100% (QA)

Prepare cash budget for June Beginning cash a Collections 73... View the full answer

Related Book For

Introduction to Accounting An Integrated Approach

ISBN: 978-0078136603

6th edition

Authors: Penne Ainsworth, Dan Deines

Posted Date:

Students also viewed these accounting questions

-

A car dealer sells 150 000 in cars over a three month period and 275 000 over a five month period Find the linear equation in slope intercept form that models this data Then use the equation to...

-

The following information is from Binghamton Film Corporations financial records. Month Sales Purchases April $72,000 $42.00 May 66,000 48,000 June 60 36 July 78,000 54 Collections from customers are...

-

Tinkers cost of goods sold in the year of sale (2016) was $920,000 and 2015 cost of goods sold was $940,000. The inventory at the end of 2016 was $205,000 and at the end of 2015 the inventory was...

-

Jake, a single taxpayer, has $100,000 of ordinary income, a $10,000 net short-term capital loss, and $7,000 of qualified dividends. What is the result?

-

The driving force for fluid flow is the pressure difference, and a pump operates by raising the pressure of a fluid (by converting the mechanical shaft work to flow energy). A gasoline pump is...

-

In what circumstances might a court grant an interlocutory injunction?

-

If a well-behaved investment alternative's internal rate of return (IRR) is equal to MARR, which of the following statements about the other measures of worth for this alternative must be true? 1....

-

Helen Thomas contracted to purchase a pool heater from Sunkissed Pools. As part of the $4,000 contract, Sunkissed agreed to install the pool heater, which was delivered to Thomass home and left in...

-

The homogeneous equation x12x2 x3 = 0 defines a null space U in R. Write the above linear system (of one equation) as a homogeneous matrix problem. Show, by derivation from the matrix above, that a...

-

3. Location Choice There is a new tech company Humbl", with a single consumer market in town A. Humbl uses two inputs, these are obtained from respectively the cities B and C, which are 600...

-

A 2012 survey of 2,254 American adults indicates that 17% of cell phone owners do their browsing on their phone rather than a computer or other device. According to an online article, a report from a...

-

What is the Chart of Accounts?

-

update below code (Currency conversion program) to add loop. (Implement if/else ladder for menu control) Please tell me how to add loop(while) into the code 1) If the user enters an invalid input the...

-

The preliminary cost for a 41,000 ft 2 aircraft hangar must be estimated. The budget limit came in at $4.3 million. Perform two analyses: determine the maximum allowed size to be within budget at the...

-

If the economy booms, the Wildcat Company stock will have a return of 23.4 percent. If the economy goes into a recession, the stock will have a loss of 14.2 percent. The probability of a boom is 65...

-

Why is the production possibility frontier (curve) concave in shape (bows outward)?

-

Assume that the dividend will grow at the rate of 5% (not g=4%) in slide #11, but all other values are the same. a. Find the expected dividends stream for the next 4 years. b. Estimate the present...

-

Pedro Bourbone is the founder and owner of a highly successful small business and, over the past several years, has accumulated a significant amount of personal wealth. His portfolio of stocks and...

-

For each of these three credit purchases, prepare the journal entry to record the payment of the obligation. Assume that purchases were paid within the discount period and that the purchasing firm...

-

Why is cost allocation an issue for income statement users?

-

What is the difference among a trial balance, an adjusted trial balance, and a post- closing trial balance?

-

Graph the levels of real GDP for the United States, Canada, and Germany (data can be found at www.oecd.org under Statistics and then under National Accounts). Are U.S. and Canadian business cycles...

-

An economic variable is persistent if declines in the variable tend to be followed by more declines, and increases by more increases. This question asks you to study the persistence of the civilian...

-

In a particular economy the real money demand function is \[ \frac{M^{d}}{P}=3000+0.1 Y-10,000 i \] Assume that \(M=6000, P=2.0\), and \(\pi^{e}=0.02\). a. What is the real interest rate, \(r\), that...

Study smarter with the SolutionInn App