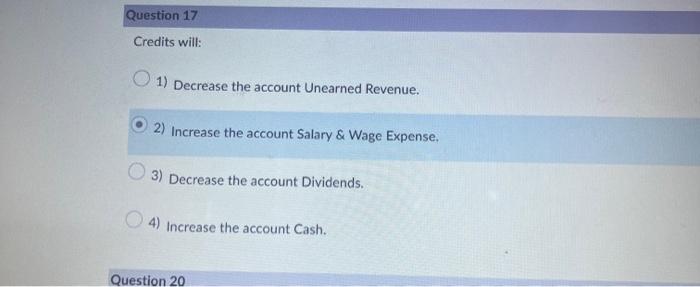

Question: Credits will: 1) Decrease the account Unearned Revenue. 2) Increase the account Salary & Wage Expense. 3) Decrease the account Dividends. 4) Increase the account

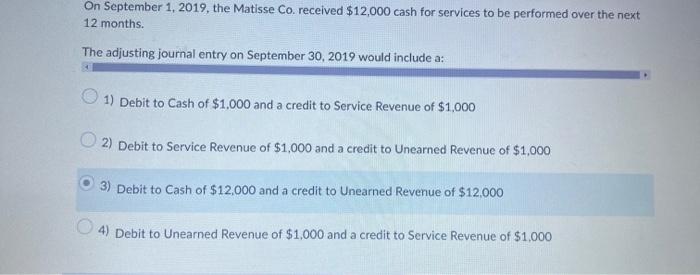

Credits will: 1) Decrease the account Unearned Revenue. 2) Increase the account Salary \& Wage Expense. 3) Decrease the account Dividends. 4) Increase the account Cash. On September 1, 2019, the Matisse Co. received $12,000 cash for services to be performed over the next 12 months. The adjusting journal entry on September 30,2019 would include a: 1) Debit to Cash of $1,000 and a credit to Service Revenue of $1,000 2) Debit to Service Revenue of $1,000 and a credit to Unearned Revenue of $1,000 3) Debit to Cash of $12,000 and a credit to Unearned Revenue of $12,000 4) Debit to Unearned Revenue of $1,000 and a credit to Service Revenue of $1,000 Credits will: 1) Decrease the account Unearned Revenue. 2) Increase the account Salary \& Wage Expense. 3) Decrease the account Dividends. 4) Increase the account Cash. On September 1, 2019, the Matisse Co. received $12,000 cash for services to be performed over the next 12 months. The adjusting journal entry on September 30,2019 would include a: 1) Debit to Cash of $1,000 and a credit to Service Revenue of $1,000 2) Debit to Service Revenue of $1,000 and a credit to Unearned Revenue of $1,000 3) Debit to Cash of $12,000 and a credit to Unearned Revenue of $12,000 4) Debit to Unearned Revenue of $1,000 and a credit to Service Revenue of $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts