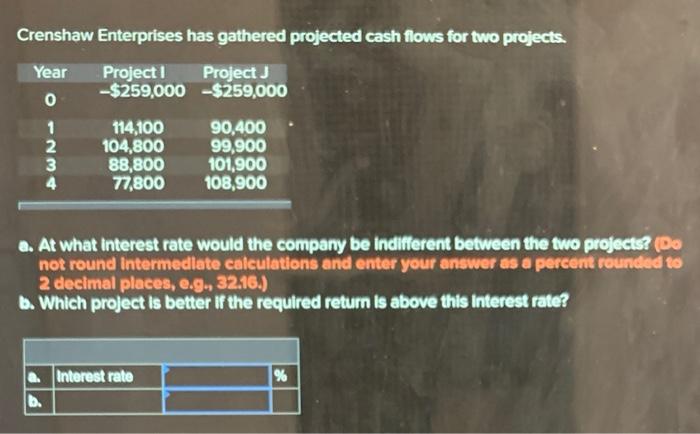

Question: Crenshaw Enterprises has gathered projected cash flows for two projects. a. At what interest rate would the company be indifierent between the two prejects? not

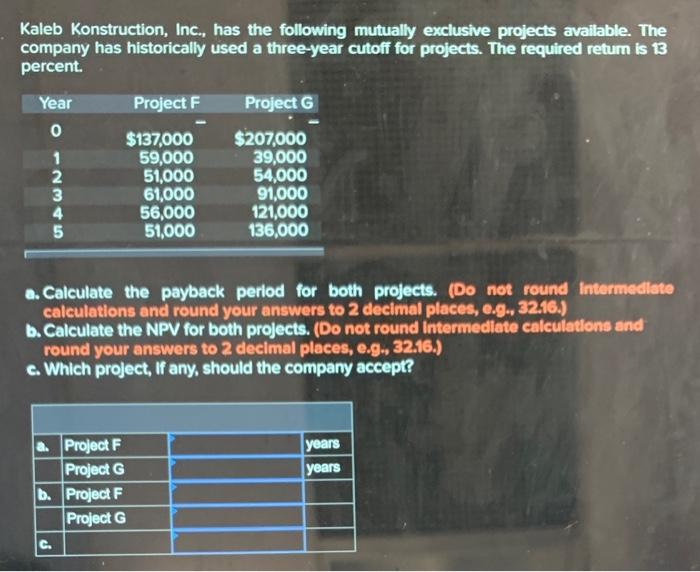

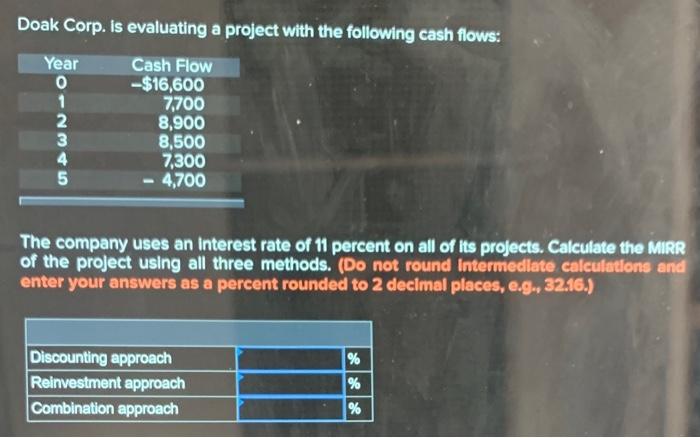

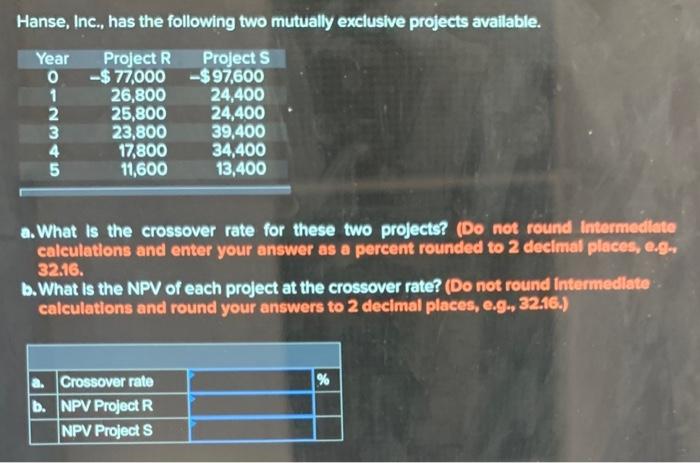

Crenshaw Enterprises has gathered projected cash flows for two projects. a. At what interest rate would the company be indifierent between the two prejects? not round intermedlate calculations and enter your answer as a percent roundid to 2 decimal places, e.gn, 32.10.) b. Which project is better if the required return is above this interest rate? Kaleb Konstruction, Inc., has the following mutually exclusive projects available. The company has historically used a three-year cutoff for projects. The required return is 13 percent. a. Calculate the payback period for both projects. (Do not round Intermediate calculatlons and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the NPV for both projects. (Do not round Intermedlate calculations and round your answers to 2 declmal places, e.g., 32.16.) c. Which project, If any, should the company accept? Doak Corp. Is evaluating a project with the following cash flows: The company uses an interest rate of 11 percent on all of lts projects. Calculate the MiRR of the project using all three methods. (Do not round intermedlate calculatlons and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Hanse, Inc., has the following two mutually excluslve projects avallable. a. What is the crossover rate for these two projects? (Do not round intermedtate calculatlons and enter your answer as a percent rounded to 2 deelmal places, e.gr, 32.16. b. What is the NPV of each project at the crossover rate? (Do not round Intermedlate calculations and round your answers to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts