Question: Critical Inquiry Assignment Assignment: Create a spreadsheet to analyze the following problem. Then create a separate Word document to answer the remaining questions. An electric

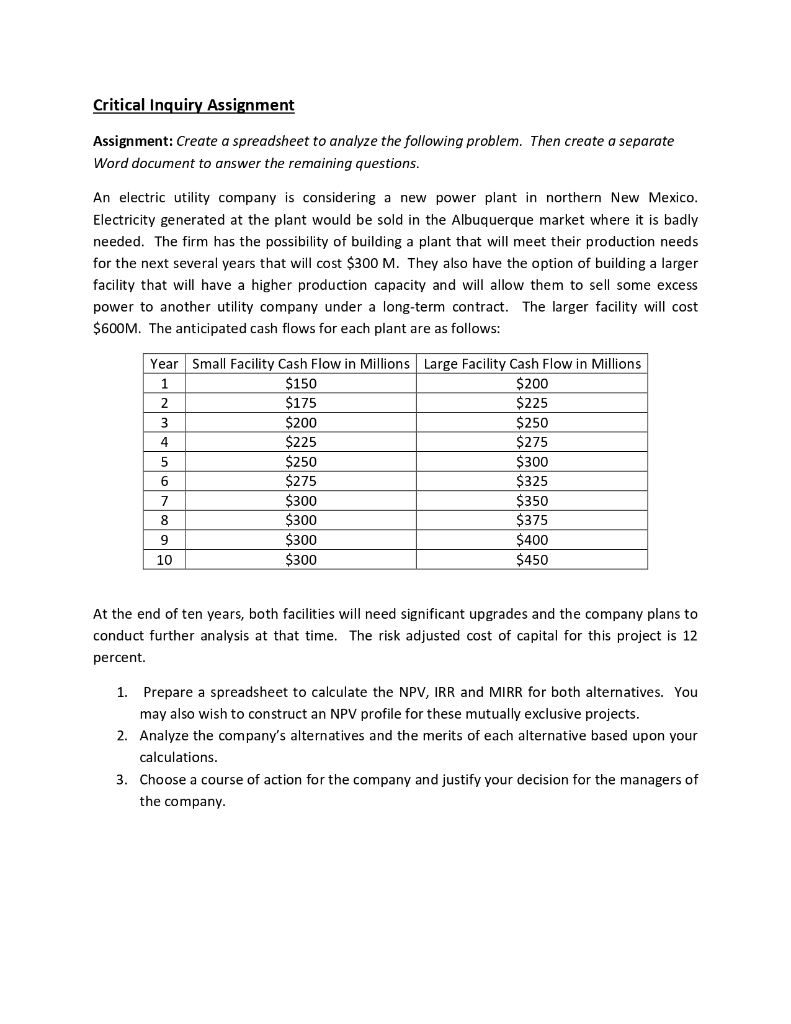

Critical Inquiry Assignment Assignment: Create a spreadsheet to analyze the following problem. Then create a separate Word document to answer the remaining questions. An electric utility company is considering a new power plant in northern New Mexico. Electricity generated at the plant would be sold in the Albuquerque market where it is badly needed. The firm has the possibility of building a plant that will meet their production needs for the next several years that will cost $300 M. They also have the option of building a larger facility that will have a higher production capacity and will allow them to sell some excess power to another utility company under a long-term contract. The larger facility will cost $600M. The anticipated cash flows for each plant are as follows: Year Small Facility Cash Flow in Millions | Large Facility Cash Flow in Millions $150 $200 $175 $225 $200 $250 $225 $275 $250 $300 $275 $325 $300 $350 $300 $375 $300 $400 10 $300 $450 oo|s|a|a|a|a|ae At the end of ten years, both facilities will need significant upgrades and the company plans to conduct further analysis at that time. The risk adjusted cost of capital for this project is 12 percent. 1. Prepare a spreadsheet to calculate the NPV, IRR and MIRR for both alternatives. You may also wish to construct an NPV profile for these mutually exclusive projects. 2. Analyze the company's alternatives and the merits of each alternative based upon your calculations. 3. Choose a course of action for the company and justify your decision for the managers of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts