Question: Critical Thinking Cases CASE 1 6 . 1 Effect on Income Statement of Errors in Handling Manufacturing Costs LO 1 6 - 3 , LO

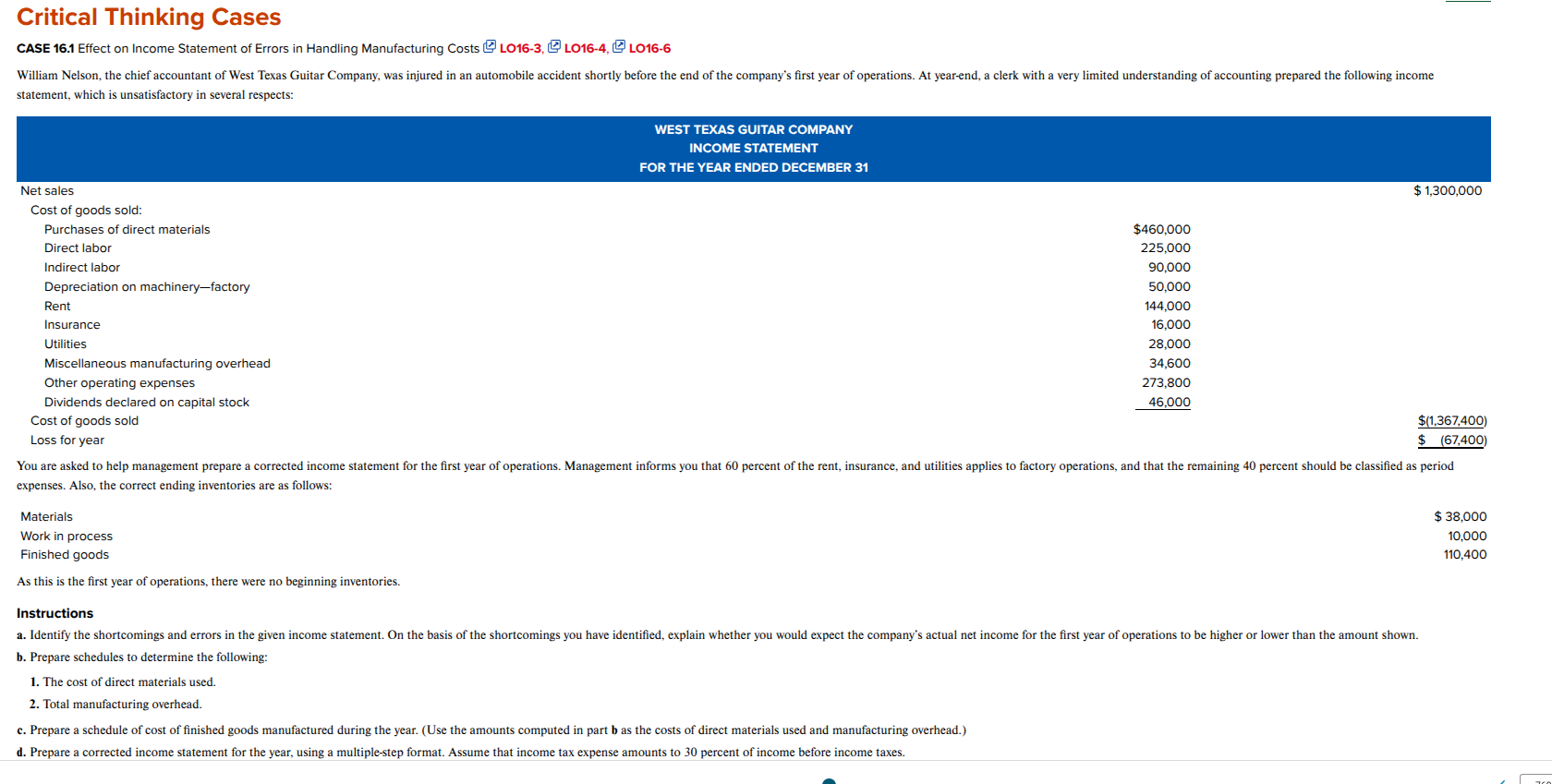

Critical Thinking Cases CASE Effect on Income Statement of Errors in Handling Manufacturing Costs LO LO LO statement, which is unsatisfactory in several respects:WEST TEXAS GUITAR COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER expenses. Also, the correct ending inventories are as follows: As this is the first year of operations, there were no beginning inventories. Instructions b Prepare schedules to determine the following: The cost of direct materials used. Total manufacturing overhead. c Prepare a schedule of cost of finished goods manufactured during the year. Use the amounts computed in part mathbfb as the costs of direct materials used and manufacturing overhead. d Prepare a corrected income statement for the year, using a multiplestep format. Assume that income tax expense amounts to percent of income before income taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock