Question: Critical Thinking Problem 13.1 (Algo) Year-End Processing LO 13-1, 13-2, 13-3, 13-4, 13-5, 13-6, 13-7 Programs Plus is a retall firm that sells computer programs

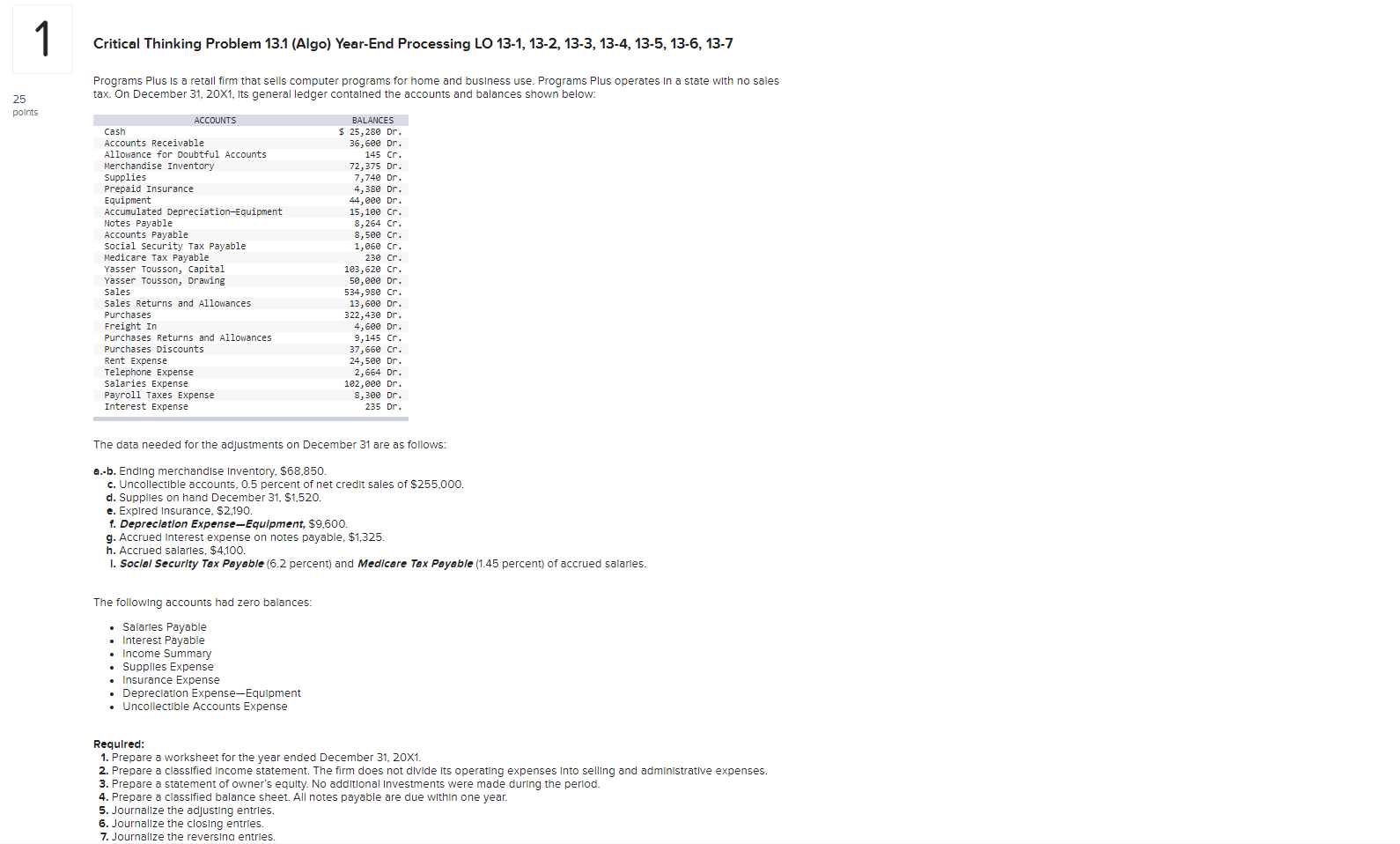

Critical Thinking Problem 13.1 (Algo) Year-End Processing LO 13-1, 13-2, 13-3, 13-4, 13-5, 13-6, 13-7 Programs Plus is a retall firm that sells computer programs for home and business use. Programs Plus operates In a state with no sales tax. On December 31, 20x1, its general ledger contalned the accounts and balances shown below: The data needed for the adjustments on December 31 are as follows: a.-b. Ending merchandise Inventory, $68,850. c. Uncollectible accounts, 0.5 percent of net credit sales of $255,000. d. Supplies on hand December 31,$1,520. e. Expired insurance, $2,190. f. Depreclation Expense-Equlpment, $9,600. g. Accrued Interest expense on notes payable, $1,325. h. Accrued salarles, $4,100. I. Soclal Securlty Tax Payable (6.2 percent) and Medlcare Tax Payable (1.45 percent) of accrued salarles. The following accounts had zero balances: - Salarles Payable - Interest Payable - Income Summary - Supplies Expense - Insurance Expense - Depreclation Expense-Equipment - Uncollectible Accounts Expense Required: 1. Prepare a worksheet for the year ended December 31,201. 2. Prepare a classified Income statement. The firm does not divide its operating expenses Into selling and administrative expenses. 3. Prepare a statement of owner's equlty. No additional Investments were made during the perlod. 4. Prepare a classified balance sheet. All notes payable are due within one year. 5. Journalize the adjusting entries. 6. Journalize the closing entrles. 7. Journalize the reversina entrles. Critical Thinking Problem 13.1 (Algo) Year-End Processing LO 13-1, 13-2, 13-3, 13-4, 13-5, 13-6, 13-7 Programs Plus is a retall firm that sells computer programs for home and business use. Programs Plus operates In a state with no sales tax. On December 31, 20x1, its general ledger contalned the accounts and balances shown below: The data needed for the adjustments on December 31 are as follows: a.-b. Ending merchandise Inventory, $68,850. c. Uncollectible accounts, 0.5 percent of net credit sales of $255,000. d. Supplies on hand December 31,$1,520. e. Expired insurance, $2,190. f. Depreclation Expense-Equlpment, $9,600. g. Accrued Interest expense on notes payable, $1,325. h. Accrued salarles, $4,100. I. Soclal Securlty Tax Payable (6.2 percent) and Medlcare Tax Payable (1.45 percent) of accrued salarles. The following accounts had zero balances: - Salarles Payable - Interest Payable - Income Summary - Supplies Expense - Insurance Expense - Depreclation Expense-Equipment - Uncollectible Accounts Expense Required: 1. Prepare a worksheet for the year ended December 31,201. 2. Prepare a classified Income statement. The firm does not divide its operating expenses Into selling and administrative expenses. 3. Prepare a statement of owner's equlty. No additional Investments were made during the perlod. 4. Prepare a classified balance sheet. All notes payable are due within one year. 5. Journalize the adjusting entries. 6. Journalize the closing entrles. 7. Journalize the reversina entrles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts