Question: (Critical Thinking & Problem solving) Assignment Question(s): Q.1. Suppose as an investor, you buy properties based on expected future benefits, what is the rationale for

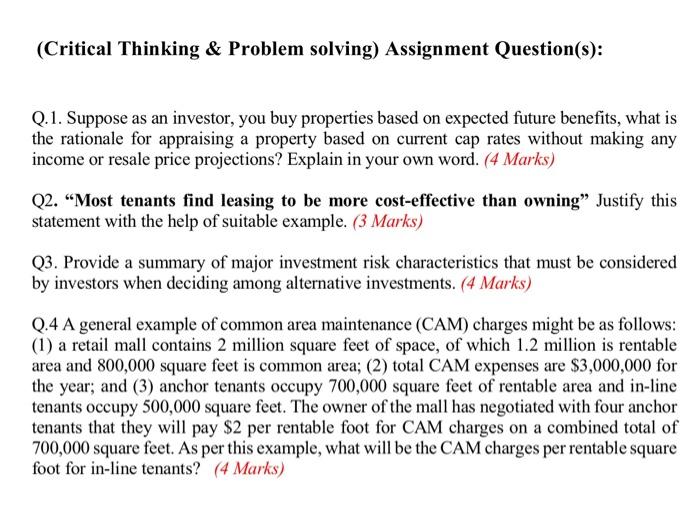

(Critical Thinking \& Problem solving) Assignment Question(s): Q.1. Suppose as an investor, you buy properties based on expected future benefits, what is the rationale for appraising a property based on current cap rates without making any income or resale price projections? Explain in your own word. (4 Marks) Q2. "Most tenants find leasing to be more cost-effective than owning" Justify this statement with the help of suitable example. (3 Marks) Q3. Provide a summary of major investment risk characteristics that must be considered by investors when deciding among alternative investments. (4 Marks) Q.4 A general example of common area maintenance (CAM) charges might be as follows: (1) a retail mall contains 2 million square feet of space, of which 1.2 million is rentable area and 800,000 square feet is common area; (2) total CAM expenses are $3,000,000 for the year; and (3) anchor tenants occupy 700,000 square feet of rentable area and in-line tenants occupy 500,000 square feet. The owner of the mall has negotiated with four anchor tenants that they will pay $2 per rentable foot for CAM charges on a combined total of 700,000 square feet. As per this example, what will be the CAM charges per rentable square foot for in-line tenants? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts