Question: CRITICALLY ANALYSIS AND DISCUSS STRATEGIES IMPLICATION THAT FITS EMERGING MARKET RELATED TO THE CASE STUDY WITH SUPPORTING EXAMPLES FROM THE CASE. COMPETING IN CHINA'S AUTOMOBILE

CRITICALLY ANALYSIS AND DISCUSS STRATEGIES IMPLICATION THAT FITS EMERGING MARKET RELATED TO THE CASE STUDY WITH SUPPORTING EXAMPLES FROM THE CASE.

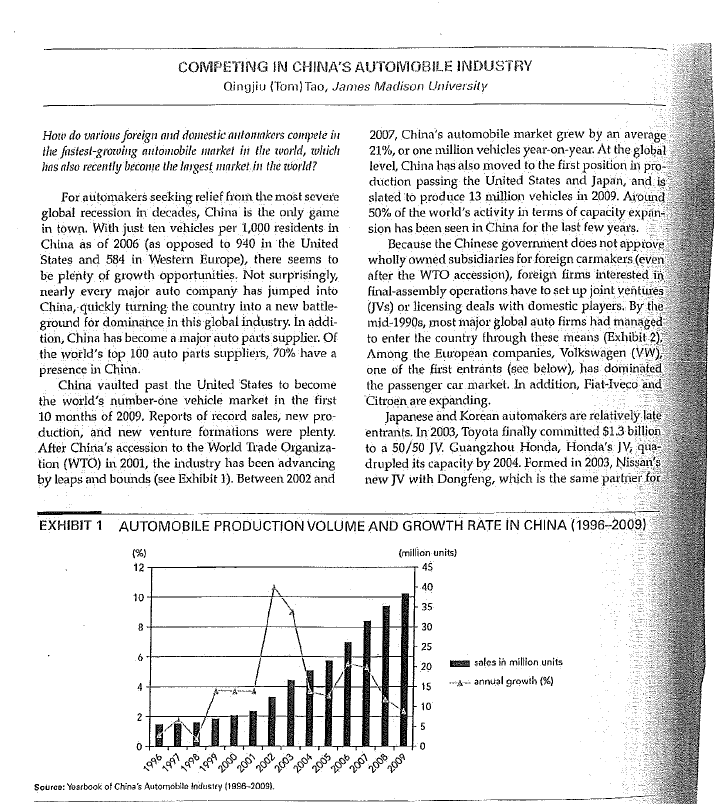

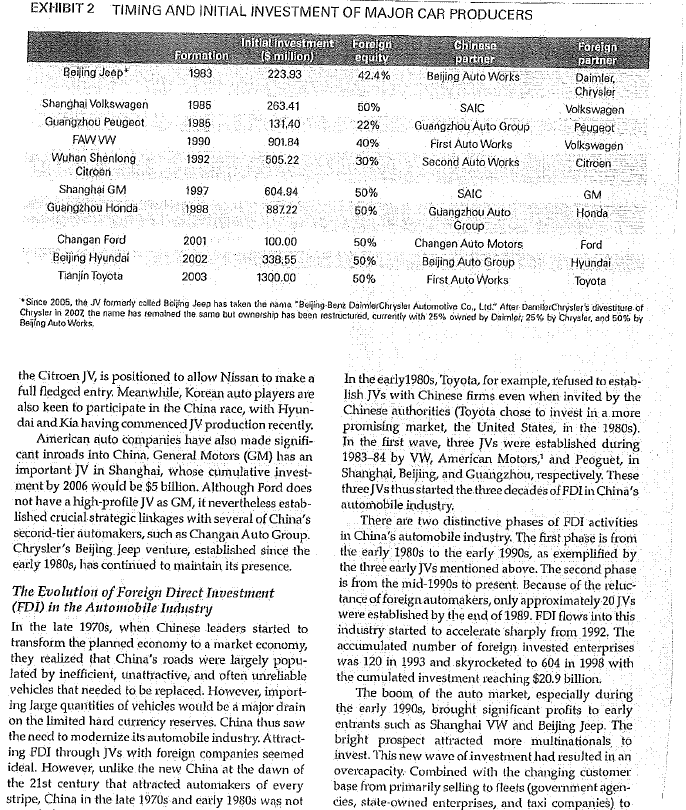

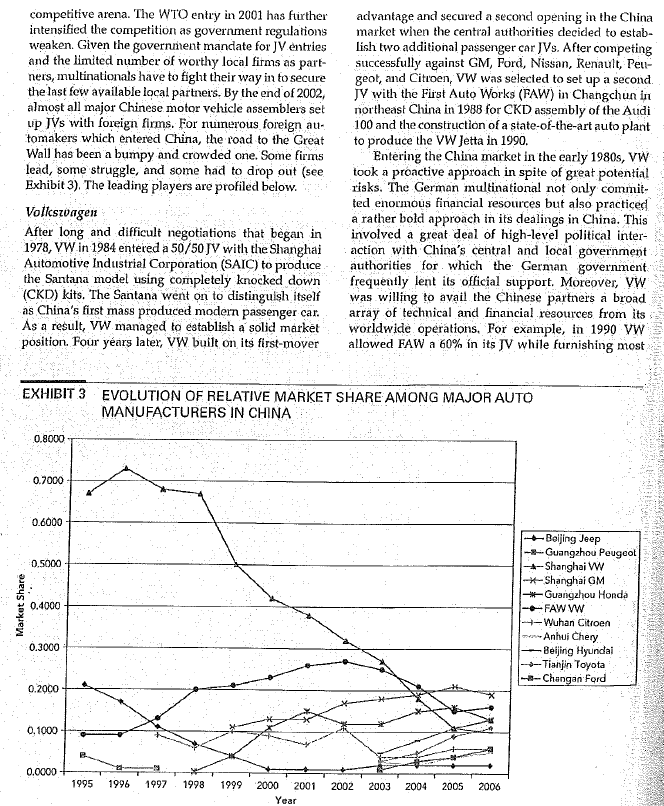

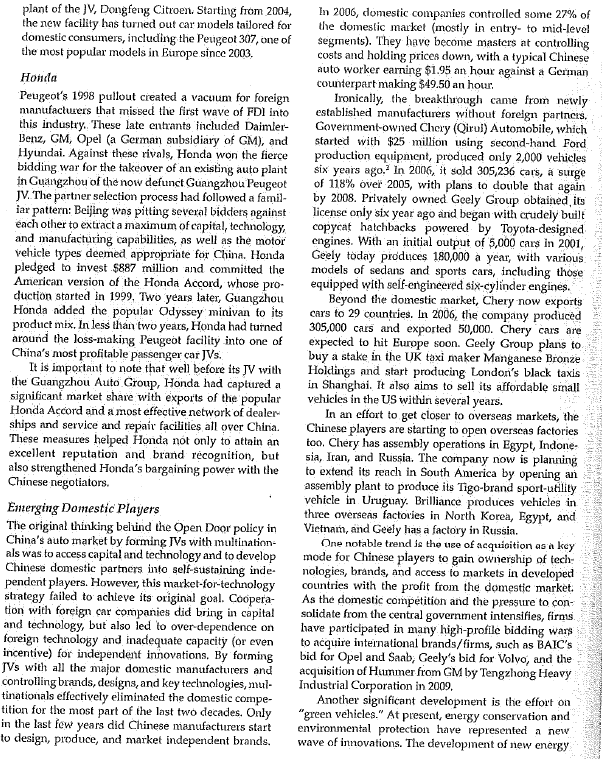

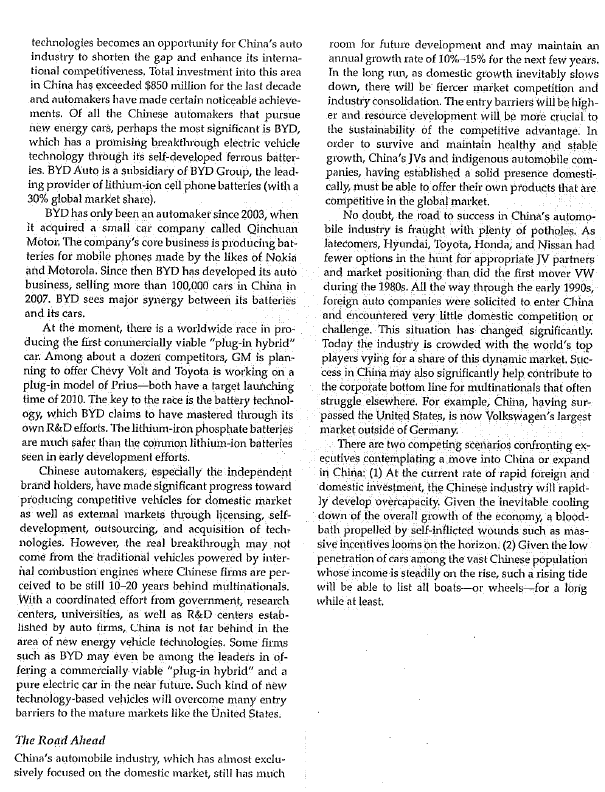

COMPETING IN CHINA'S AUTOMOBILE INDUSTRY Qingjiu (Tom) Tao, James Madison University How do wrious foreign and domestic antonukers compete in the fastesl-growing antomobile market in tle world, which has also recently become the largest market in the world? For automakers seeking relief from the most severe global recession in decades, China is the only game in town. With just ten vehicles per 1,000 residents in China as of 2006 (as opposed to 940 in the United States and 584 in Western Europe), there seems to be plenty of growth opportunities. Not surprisingly, nearly every major auto company has jumped into China, quickly turning the country into a new battle- ground for dominance in this global industry. In addi tion, China has become a major auto parts supplier. Of the world's top 100 auto parts suppliers, 70% have a presence in China. China vaulted past the United States to become the world's number-one vehicle market in the first 10 months of 2009. Reports of record sales, new pro- duction, and new venture formations were plenty. After China's accession to the World Trade Organiza- tion (WTO) in 2001, the industry has been advancing by leaps and bounds (see Exhibit 1). Between 2002 and 2007, China's automobile market grew by an average 21%, or one million vehicles year-on-year. At the global level, China has also moved to the first position in pro- duction passing the United States and Japan, and is slated to produce 13 million vehicles in 2009. Around 50% of the world's activity in terms of capacity expan- sion has been seen in China for the last few years. Because the Chinese government does not approve wholly owned subsidiaries for foreign carmakers (even after the WTO accession), foreign firms interested in final-assembly operations have to set up joint ventures (JVs) or licensing deals with domestic players. By the mid-1990s, most major global auto firms had managed to enter the country through these means (Exhibit-2). Among the European companies, Volkswagen (VW), one of the first entrants (see below), has dominated the passenger car market. In addition, Fiat-Iveco and Citroen are expanding, Japanese and Korean automakers are relatively late entrants. In 2003, Toyota finally committed $1.3 billion to a 50/50 JV. Guangzhou Honda, Honda's IV, qua- drupled its capacity by 2004. Formed in 2003, Nissan's new JV with Dongfeng, which is the same partner for EXHIBIT 1 AUTOMOBILE PRODUCTION VOLUME AND GROWTH RATE IN CHINA (1996-2009) (%) 12 (million units) 45 40 10 35 8 30 25 6 20 e sales in million units annual growth (8) 4 15 10 2 5 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0 +0 2008 1996 2007 2009 Source: Yosrbook of China's Automotsite Industry (1996-2009), EXHIBIT 2 TIMING AND INITIAL INVESTMENT OF MAJOR CAR PRODUCERS Initialinvestment Foreign Chinese Foreign Formation Is millon) equity partner partner Beijing Jeep 1983 223.93 42.4% Beijing Auto Works Daimler, Chrysler Shanghai Volkswagen 1986 263.41 50% SAIC Volkswagen Guangzhou Peugeot 1985 131.40 22% Guangzhou Auto Group Peugeot FAW VW 1990 901.84 40% First Auto Works Volkswagen Wuhen Shenlong 1992 505.22 30% Second Auto Works Citroen Citroen Shanghai GM 1997 604.94 50% SAIC GM Guangzhou Honda 1998 887.22 50% Guangzhou Auto Honda Group Changan Ford 2001 100.00 50% Changan Auto Motors Ford Beijing Hyundai 2002 338,55 50% Beijing Auto Group Hyundai Tianjin Toyota 2003 1300.00 50% First Auto Works Toyota Since 2005, the formerly called Being Jeep has taken the name "Beijing Bere DaimlerChryslel Automotive Co., Ltd." Atsar Danielysler's divestiture of Chrysler in 2007 the name has remained the same but ownership has been restructured, currently with 25% owned by Daimler, 25% by Chrysler, and 50% by Being Auto Works the Citroen JV, is positioned to allow Nissan to make a full fledged entry. Meanwhile, Korean auto players are also keen to participate in the China race, with Hyun- dai and Kia having commenced JV production recently. American auto companies have also made signifi- cant inroads into China. General Motors (GM) has an important JV in Shanghai, whose cumulative invest- ment by 2006 would be $5 billion. Although Ford does not have a high-profile JV as GM, it nevertheless estab- lished crucial strategic linkages with several of China's second-tier automakers, such as Changan Auto Group. Chrysler's Beijing Jeep venture, established since the early 1980s, has continued to maintain its presence. The Evolution of Foreign Direct Investment (FDI) in the Automobile Industry In the late 1970s, when Chinese leaders started to transform the planned economy to a market economy, they realized that China's roads were largely popu- lated by inefficient, unattractive, and often unreliable vehicles that needed to be replaced. However, import- ing large quantities of vehicles would be a major drain on the limited hard currency reserves. China thus saw the need to modernize its automobile industry. Attract- ing FDI through Vs with foreign companies seemed ideal. However, unlike the new China at the dawn of the 21st century that attracted autontakers of every stripe, China in the late 1970s and early 1980s was not In the early 1980s, Toyota, for example, refused to estab lish JVs with Chinese firms even when invited by the Chinese authorities (Toyota chose to invest in a more promising market, the United States, in the 1980s). In the first wave, three JVs were established during 1983-84 by VW, American Motors,' and Peoguet, in Shanghai, Beijing, and Guangzhou, respectively. These three JVsthus started the three decades of FDI in China's automobile industry, There are two distinctive phases of FDI activities in China's automobile industry. The first phase is from the early 1980s to the early 1990s, as exemplified by the three early JVs mentioned above. The second phase is from the mid-1990s to present. Because of the vellic tance of foreign automakers, only approximately 20 JVs were established by the end of 1989. FDI flows into this industry started to accelerate sharply from 1992, The accumulated number of foreign invested enterprises was 120 in 1993 and skyrocketed to 604 in 1998 with the cumulated investment reaching $20.9 billion The boom of the auto market, especially during the early 1990s, brought significant profits to early entrants such as Shanghai VW and Beijing Jeep. The bright prospect attracted more multinationals to invest. This new wave of investment had resulted in an overcapacity. Combined with the changing customer base from primarily selling to fleets (government agen- cies, state-owned enterprises, and taxi companies) to competitive arena. The WTO entry in 2001 has further intensified the competition as government regulations weaken. Given the government mandate for JV entries and the limited number of worthy local firms as part- ners, multinationals have to fight their way in to secure the last few available local partners. By the end of 2002, almost all major Chinese motor vehicle assemblers set up JVs with foreign firms. For nunerous foreign au- tomakers which entered China, the road to the Great Wall has been a bumpy and crowded one. Some firms lead, some struggle, and some had to drop out (see Exhibit 3), The leading players are profiled below. Volkswagen After long and difficult negotiations that began in 1978, VW in 1984 entered a 50/50 JV with the Shanghai Automotive Industrial Corporation (SAIC) to produce the Santana model using completely knocked down (CKD) kits. The Santana went on to distinguish itself as China's first mass produced modern passenger car. As a result, VW managed to establish a solid market position. Four years later, VW built on its first-mover advantage and secured a second opening in the China market when the central authorities decided to estab- lish two additional passenger car JVs. After competing successfully against GM, Ford, Nissan, Renault, Peli- geot, and Citroen, VW was selected to set up a second JV with the First Auto Works (FAW) in Changchun in northeast China in 1988 for CKD assembly of the Audi 100 and the construction of a state-of-the-art auto plant to produce the VW Jetta in 1990. Entering the China market in the early 1980s, VW took a proactive approach in spite of great potential risks. The German multinational not only commit- ted enormous financial resources but also practiced a rather bold approach in its dealings in China. This involved a great deal of high-level political inter- action with China's central and local government authorities for which the German government frequently lent its official support. Moreover, VW was willing to avail the Chinese partners a broad array of technical and financial resources from its worldwide operations. For example, in 1990 VW allowed FAW a 60% in its JV while furnishing most EXHIBIT 3 EVOLUTION OF RELATIVE MARKET SHARE AMONG MAJOR AUTO MANUFACTURERS IN CHINA 0.8000 0.7000 0.6000 0.5000 Market Share 0.4000 Beijing Jeep - Guangzhou Peugeot * Shanghai W *Shanghai GM *Guangzhou Honda -FAW WW -Wuhan Citroen Anhui Chery -Beijing Hyundai - Tianjin Toyota - Changan Ford 0.3000 0.20CO 0.1000 0.0000 1995 1996 1997 1998 1999 2002 2003 2004 2005 2006 2000 2001 Year of the manufacturing technology and equipment for its new FAW-Volkswagen Jetta plant in Changchun. Moreover, VW has endeavored to raise the quality of local produced automotive components and parts. For the remainder of the 1980s and most of the 1990s, VW enjoyed significant first mover advantages. With a market share (Shanghai VW and FAW VW combined) of more than 70% for passenger cars over a decade, VW, together with its Chinese partners, benefited con- siderably from the scarcity of high-quality passenger cars and the persistence of a seller's market However, by the late 1990s, the market became a more competitive buyer's market. As the leading incumbent, VW has been facing vigorous challenges brought by its global rivals which by the late 1990s made serious commitments to compete in China. Con sequently, VW's passenger car market share in China dropped from over 70% in 1999 to 39% in 2004. In 2005, GM took the number one position in China from VW. How to defend VW's market position thuis is of paramount importance. General Motors In 1995, GM and SAIC, which was also VW's partner, signed a 50/50, $1.57 billion JV agreement-GM's first ]V in China-to construct a greenfield plant in Shanghai. The new plant was designed to produce 100,000 sedans per year, and it was decided to produce two Buick models modified for China. The plant was equipped with the latest automotive machinery and robotics and was furnished with process technology transferred from GM's worldwide operations. Initially, Shanghai GM attracted a barrage of criticisms about the huge size of its investment and the significant com- mitments to transfer technology and design capabili- ties to China. These criticisms notwithstanding, GM management reiterated at numerous occasions that China was expected to become the biggest automo- live market in the world within two decades and that China represented the single most important emerging market for GM. Since launching Buick in China in 1998, GM liter ally started from scratch. Unlike its burdens at home, GM is not saddled with billions in pensions and health-care costs. Its costs are competitive with rivals, its reputation does not suffer, and it does not need to shell out $4,000 per vehicle in incentives to lure new buyers--even moribund brands such as Buick are held in high esteem in China. Consequently, profits are at- tractive: The $437 million profits CM inade in 2003 in China, selling just 386,000 cars, compares favorably with $811 million profits it made in North America on sales of 5.6 milion autos. In 2004, GM had about 10,000 employees in China and operated six JVs and two wholly owned foreign enterprises (which were allowed to be set up more recently in non-final assembly operations). Boasting a combined monu- facturing capacity of 530,000 vehicles sold under the Buick, Chevrolet, and Wuling nameplates, GM offers the widest portfolio of products among JV manu- facturers in China. In 2009, the bankruptcy filing of GM in the United States had a minimal impact on its China operations. GM vehicle sales in China, its larg- est overseas market, surged 50% to a monthly record of 151,084 units in April 2009, in contrast with a sharp decline in the United States. Pengeot Together with VW and American Motors (the original partner for the Beijing Jeep JV), Peugeot was one of the first three entrants in the Chinese automobile industry In 1980, it started to search for JV partners. In 1985, it set up a JV, Guangzhou Peugeot, in south China, The JV mainly produced the Peugeot 504 and 505, both out-of-date models of the 1970s. While many domestic users complained about the high fuel consumption, difficult maintenance, and expensive parts, the French car manufacturer netted huge short-term profits at approximately $480 million by selling a large amount of CKD kits and parts. Among its numerous problems, the JV also reportedly repatriated most of its profits and made relatively few changes to its 1970s era products, whereas VW in Shanghai reinvested profits and refined Its production, introducing a new "Santana 2000" model in the mid-1990s. Around 1991, Guangzhou Peugeot ac- counted for nearly 16% share of China's passenger car market. But it began to go into the red in 1994 with its losses amounting to $349 million by 1997, forcing Peu- geot to retreat from China. It sold its interest in the JV to Honda in 1998 (see the following page). While the sour memories of the disappointing per- formance of its previous ) were still there, Peugeot (now part of PSA Peugeot Citroen) decided to return to the battlefield in 2003. This time, the Paris-based carmaker seemed loaded with ambitious expectations to grab a slice of the country's increasingly appealing auto market sparked by the post-WTO boom. One of its latest moves in China is an agreement in 2003 under which PSA Peugeot Citroen would further its partnership with Hubei-based Dongfeng Motor, one of China's top three automakers which originally signed up as a JV partner with Citroen, to produce Peugeot vehicles in China. According to the new deal, a Peugeot production platform will be installed at the Wuhan plant of the ), Dongfeng Citroen. Starting from 2004, the new facility has turned out car models tailored for domestic consumers, including the Peugeot 307, one of the most popular models in Europe since 2003. Honda Peugeot's 1998 pullout created a vacuum for foreign manufactwers that missed the first wave of FDI into this industry. These late entrants included Daimler- Benz, GM, Opel (a German subsidiary of GM), and Hyundai. Against these rivals, Honda won the fierce bidding war for the takeover of an existing auto plant in Guangzhou of the now defunct Guangzhou Peugeot JV. The partner selection process had followed a famil- iar pattern: Beijing was pitting several bidders against each other to extract a maximum of capital, technology, and manufacturing capabilities, as well as the motor vehicle types deemed appropriate for China. Honda pledged to invest $887 million and committed the American version of the Honda Accord, whose pro- duction started in 1999, Two years later, Guangzhou Honda added the popular Odyssey minivan to its product mix, In less than two years, Honda had turned around the loss-making Peugeot facility into one of China's most profitable passenger car JVs. It is important to note that well before its JV with the Guangzhou Auto Group, Honda had captured a significant market share with exports of the popular Honda Accord and a most effective network of dealer ships and service and repair facilities all over China. These measures helped Honda not only to attain an excellent reputation and brand recognition, but also strengthened Honda's bargaining power with the Chinese negotiators. Emerging Domestic Players The original thinking behind the Open Door policy in China's auto market by forming IVs with multination- als was to access capital and technology and to develop Chinese domestic partners into self-sustaining inde pendent players. However, this market-for-technology strategy failed to achieve its original goal. Coopera- tion with foreign car companies did bring in capital and technology, but also led to over-dependence on foreign technology and inadequate capacity (or even incentive) for independent innovations. By forming JVs with all the major domestic manufacturers and controlling brands, designs, and key technologies, mul- tinationals effectively eliminated the domestic compe- tition for the most part of the last two decades. Only in the last few years did Chinese manufacturers start to design, produce, and market independent brands. In 2006, domestic companies controlled some 27% of the domestic market (mostly in entry- to mid-level Segments). They have become masters at controlling costs and holding prices down, with a typical Chinese auto worker earning $1.95 an hour against a German counterpart making $49.50 an hour. Ironically, the breakthrough came from newly established manufacturers without foreign partners. Government-owned Chery (Qirul) Automobile, which started with $25 million using second-hand Ford production equipment, produced only 2,000 vehicles six years ago. In 2006, it sold 305,236 cars, a surge of 118% over 2005, with plans to double that again by 2008. Privately owned Geely Group obtained its license only six year ago and began with crudely built copycat hatchbacks powered by Toyota-designed engines. With an initial output of 5,000 cars in 2001, Geely today produces 180,000 a year, with various models of sedans and sports cars, including those equipped with self-engineered six-cylinder engines. Beyond the domestic market, Chery now exports cars to 29 countries. In 2006, the company produced 305,000 cars and exported 50,000. Chery cars are expected to hit Europe soon. Geely Group plans to buy a stake in the UK taxi maker Manganese Bronze Holdings and start producing London's black taxis in Shanghai. It also aims to sell its affordable small vehicles in the US within several years. In an effort to get closer to overseas markets, the Chinese players are starting to open overseas factories too. Chery has assembly operations in Egypt, Indone sia, Iran, and Russia. The company now is planning to extend its reach in South America by opening an assembly plant to produce its Tigo-brand sport-utility vehicle in Uruguay. Brilliance produces vehicles in three overseas factories in North Korea, Egypt, and Vietnam, and Geely has a factory in Russia. One notable trend is the use of acquisition as a key mode for Chinese players to gain ownership of tech nologies, brands, and access to markets in developed countries with the profit from the domestic market: As the domestic competition and the pressure to con- solidate from the central government intensifies, firmus have participated in many high-profile bidding wars to acquire international brands/firms, such as BAIC's bid for Opel and Saab, Geely's bid for Volvo, and the acquisition of Huummer from GM by Tengzhong Heavy Industrial Corporation in 2009, Another significant development is the effort on "green vehicles." At present, energy conservation and environmental protection have represented a new wave of innovations. The development of new energy call BE technologies becomes an opportunity for China's auto industry to shorten the gap and enhance its interna- tional competitiveness, Total investment into this area in China has exceeded $850 million for the last decade and automakers have made certain noticeable achieve- ments. Of all the Chinese automakers that pursue new energy cars, perhaps the most significant is BYD, which has a promising breakthrough electric vehicle technology through its self-developed ferrous batter- ies. BYD Auto is a subsidiary of BYD Group, the lead- ing provider of lithium-ion cell phone batteries (with a 30% global market share). BYD has only been an automaker since 2003, when it acquired a small car company called Qinchuan Motor. The company's core business is producing bat: teries for mobile phones made by the likes of Nokia and Motorola. Since then BYD has developed its auto business, selling more than 100,000 cars in China in 2007. BYD sees major synergy between its batteries and its cars. At the moment, there is a worldwide race in pro- ducing the first conunercially viable "plug-in hybrid" car: Among about a dozen competitors, GM is plan ning to offer Chevy Volt and Toyota is working on a plug-in model of Prius-both have a target launching time of 2010. The key to the race is the battery technol- ogy, which BYD claims to have mastered through its own R&D efforts. The lithium-ion phosphate batteries are much safer than the common lithium-ion batteries seen in early development efforts. Chinese automakers, especially the independent brand holders, have made significant progress toward producing competitive vehicles for domestic market as well as external markets through licensing, self- development, outsourcing, and acquisition of tech nologies. However, the real breakthrough may not come from the traditional vehicles powered by inter- nal combustion engines where Chinese firms are per ceived to be still 10-20 years behind multinationals. With a coordinated effort from government, research centers, universities, as well as R&D centers estab- lished by auto firms, China is not far behind in the area of new energy vehicle technologies. Some firms such as BYD may even be among the leaders in of- fering a commercially viable "plug-in hybrid" and a pure electric car in the near future. Such kind of new technology-based vehicles will overcome many entry barriers to the mature markets like the United States. The Road Ahead China's automobile industry, which has almost exclu- sively focused on the domestic market, still has much room for future development and may maintain an annual growth rate of 10%-15% for the next few years. In the long run, as domestic growth inevitably slows down, there will be fiercer market competition and industry consolidation. The entry barriers will be high- er and resource development will be more crucial to the sustainability of the competitive advantage. In order to survive and maintain healthy and stable growth, China's JVs and indigenous automobile com- panies, having established a solid presence domesti- cally, must be able to offer their own products that are competitive in the global market. No doubt, the road to success in China's automo- bile industry is fraught with plenty of potholes. As latecomers, Hyundai, Toyota, Honda, and Nissan had fewer options in the hunt for appropriate JV partners and market positioning than did the first mover VW during the 1980s. All the way through the early 1990s, foreign auto companies were solicited to enter China and encountered very little domestic competition or challenge. This situation has changed significantly Today the industry is crowded with the world's top players vying for a share of this dynamic market. Suc- cess in China may also significantly help contribute to the corporate bottom line for multinationals that often struggle elsewhere. For example, China, having sur- passed the United States, is now Volkswagen's largest market outside of Germany. There are two competing scenarios confronting ex- ecutives contemplating a move into China or expand in China: (1) At the current rate of rapid foreign and domestic investment, the Chinese industry will rapid ly develop overcapacity. Given the inevitable cooling down of the overall growth of the economy, a blood- bath propelled by self-inflicted wounds such as mas- sive incentives looms on the horizon (2) Given the low penetration of cars among the vast Chinese population whose income is steadily on the rise, such a rising tide will be able to list all boats-or wheels--for a long while at least. COMPETING IN CHINA'S AUTOMOBILE INDUSTRY Qingjiu (Tom) Tao, James Madison University How do wrious foreign and domestic antonukers compete in the fastesl-growing antomobile market in tle world, which has also recently become the largest market in the world? For automakers seeking relief from the most severe global recession in decades, China is the only game in town. With just ten vehicles per 1,000 residents in China as of 2006 (as opposed to 940 in the United States and 584 in Western Europe), there seems to be plenty of growth opportunities. Not surprisingly, nearly every major auto company has jumped into China, quickly turning the country into a new battle- ground for dominance in this global industry. In addi tion, China has become a major auto parts supplier. Of the world's top 100 auto parts suppliers, 70% have a presence in China. China vaulted past the United States to become the world's number-one vehicle market in the first 10 months of 2009. Reports of record sales, new pro- duction, and new venture formations were plenty. After China's accession to the World Trade Organiza- tion (WTO) in 2001, the industry has been advancing by leaps and bounds (see Exhibit 1). Between 2002 and 2007, China's automobile market grew by an average 21%, or one million vehicles year-on-year. At the global level, China has also moved to the first position in pro- duction passing the United States and Japan, and is slated to produce 13 million vehicles in 2009. Around 50% of the world's activity in terms of capacity expan- sion has been seen in China for the last few years. Because the Chinese government does not approve wholly owned subsidiaries for foreign carmakers (even after the WTO accession), foreign firms interested in final-assembly operations have to set up joint ventures (JVs) or licensing deals with domestic players. By the mid-1990s, most major global auto firms had managed to enter the country through these means (Exhibit-2). Among the European companies, Volkswagen (VW), one of the first entrants (see below), has dominated the passenger car market. In addition, Fiat-Iveco and Citroen are expanding, Japanese and Korean automakers are relatively late entrants. In 2003, Toyota finally committed $1.3 billion to a 50/50 JV. Guangzhou Honda, Honda's IV, qua- drupled its capacity by 2004. Formed in 2003, Nissan's new JV with Dongfeng, which is the same partner for EXHIBIT 1 AUTOMOBILE PRODUCTION VOLUME AND GROWTH RATE IN CHINA (1996-2009) (%) 12 (million units) 45 40 10 35 8 30 25 6 20 e sales in million units annual growth (8) 4 15 10 2 5 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0 +0 2008 1996 2007 2009 Source: Yosrbook of China's Automotsite Industry (1996-2009), EXHIBIT 2 TIMING AND INITIAL INVESTMENT OF MAJOR CAR PRODUCERS Initialinvestment Foreign Chinese Foreign Formation Is millon) equity partner partner Beijing Jeep 1983 223.93 42.4% Beijing Auto Works Daimler, Chrysler Shanghai Volkswagen 1986 263.41 50% SAIC Volkswagen Guangzhou Peugeot 1985 131.40 22% Guangzhou Auto Group Peugeot FAW VW 1990 901.84 40% First Auto Works Volkswagen Wuhen Shenlong 1992 505.22 30% Second Auto Works Citroen Citroen Shanghai GM 1997 604.94 50% SAIC GM Guangzhou Honda 1998 887.22 50% Guangzhou Auto Honda Group Changan Ford 2001 100.00 50% Changan Auto Motors Ford Beijing Hyundai 2002 338,55 50% Beijing Auto Group Hyundai Tianjin Toyota 2003 1300.00 50% First Auto Works Toyota Since 2005, the formerly called Being Jeep has taken the name "Beijing Bere DaimlerChryslel Automotive Co., Ltd." Atsar Danielysler's divestiture of Chrysler in 2007 the name has remained the same but ownership has been restructured, currently with 25% owned by Daimler, 25% by Chrysler, and 50% by Being Auto Works the Citroen JV, is positioned to allow Nissan to make a full fledged entry. Meanwhile, Korean auto players are also keen to participate in the China race, with Hyun- dai and Kia having commenced JV production recently. American auto companies have also made signifi- cant inroads into China. General Motors (GM) has an important JV in Shanghai, whose cumulative invest- ment by 2006 would be $5 billion. Although Ford does not have a high-profile JV as GM, it nevertheless estab- lished crucial strategic linkages with several of China's second-tier automakers, such as Changan Auto Group. Chrysler's Beijing Jeep venture, established since the early 1980s, has continued to maintain its presence. The Evolution of Foreign Direct Investment (FDI) in the Automobile Industry In the late 1970s, when Chinese leaders started to transform the planned economy to a market economy, they realized that China's roads were largely popu- lated by inefficient, unattractive, and often unreliable vehicles that needed to be replaced. However, import- ing large quantities of vehicles would be a major drain on the limited hard currency reserves. China thus saw the need to modernize its automobile industry. Attract- ing FDI through Vs with foreign companies seemed ideal. However, unlike the new China at the dawn of the 21st century that attracted autontakers of every stripe, China in the late 1970s and early 1980s was not In the early 1980s, Toyota, for example, refused to estab lish JVs with Chinese firms even when invited by the Chinese authorities (Toyota chose to invest in a more promising market, the United States, in the 1980s). In the first wave, three JVs were established during 1983-84 by VW, American Motors,' and Peoguet, in Shanghai, Beijing, and Guangzhou, respectively. These three JVsthus started the three decades of FDI in China's automobile industry, There are two distinctive phases of FDI activities in China's automobile industry. The first phase is from the early 1980s to the early 1990s, as exemplified by the three early JVs mentioned above. The second phase is from the mid-1990s to present. Because of the vellic tance of foreign automakers, only approximately 20 JVs were established by the end of 1989. FDI flows into this industry started to accelerate sharply from 1992, The accumulated number of foreign invested enterprises was 120 in 1993 and skyrocketed to 604 in 1998 with the cumulated investment reaching $20.9 billion The boom of the auto market, especially during the early 1990s, brought significant profits to early entrants such as Shanghai VW and Beijing Jeep. The bright prospect attracted more multinationals to invest. This new wave of investment had resulted in an overcapacity. Combined with the changing customer base from primarily selling to fleets (government agen- cies, state-owned enterprises, and taxi companies) to competitive arena. The WTO entry in 2001 has further intensified the competition as government regulations weaken. Given the government mandate for JV entries and the limited number of worthy local firms as part- ners, multinationals have to fight their way in to secure the last few available local partners. By the end of 2002, almost all major Chinese motor vehicle assemblers set up JVs with foreign firms. For nunerous foreign au- tomakers which entered China, the road to the Great Wall has been a bumpy and crowded one. Some firms lead, some struggle, and some had to drop out (see Exhibit 3), The leading players are profiled below. Volkswagen After long and difficult negotiations that began in 1978, VW in 1984 entered a 50/50 JV with the Shanghai Automotive Industrial Corporation (SAIC) to produce the Santana model using completely knocked down (CKD) kits. The Santana went on to distinguish itself as China's first mass produced modern passenger car. As a result, VW managed to establish a solid market position. Four years later, VW built on its first-mover advantage and secured a second opening in the China market when the central authorities decided to estab- lish two additional passenger car JVs. After competing successfully against GM, Ford, Nissan, Renault, Peli- geot, and Citroen, VW was selected to set up a second JV with the First Auto Works (FAW) in Changchun in northeast China in 1988 for CKD assembly of the Audi 100 and the construction of a state-of-the-art auto plant to produce the VW Jetta in 1990. Entering the China market in the early 1980s, VW took a proactive approach in spite of great potential risks. The German multinational not only commit- ted enormous financial resources but also practiced a rather bold approach in its dealings in China. This involved a great deal of high-level political inter- action with China's central and local government authorities for which the German government frequently lent its official support. Moreover, VW was willing to avail the Chinese partners a broad array of technical and financial resources from its worldwide operations. For example, in 1990 VW allowed FAW a 60% in its JV while furnishing most EXHIBIT 3 EVOLUTION OF RELATIVE MARKET SHARE AMONG MAJOR AUTO MANUFACTURERS IN CHINA 0.8000 0.7000 0.6000 0.5000 Market Share 0.4000 Beijing Jeep - Guangzhou Peugeot * Shanghai W *Shanghai GM *Guangzhou Honda -FAW WW -Wuhan Citroen Anhui Chery -Beijing Hyundai - Tianjin Toyota - Changan Ford 0.3000 0.20CO 0.1000 0.0000 1995 1996 1997 1998 1999 2002 2003 2004 2005 2006 2000 2001 Year of the manufacturing technology and equipment for its new FAW-Volkswagen Jetta plant in Changchun. Moreover, VW has endeavored to raise the quality of local produced automotive components and parts. For the remainder of the 1980s and most of the 1990s, VW enjoyed significant first mover advantages. With a market share (Shanghai VW and FAW VW combined) of more than 70% for passenger cars over a decade, VW, together with its Chinese partners, benefited con- siderably from the scarcity of high-quality passenger cars and the persistence of a seller's market However, by the late 1990s, the market became a more competitive buyer's market. As the leading incumbent, VW has been facing vigorous challenges brought by its global rivals which by the late 1990s made serious commitments to compete in China. Con sequently, VW's passenger car market share in China dropped from over 70% in 1999 to 39% in 2004. In 2005, GM took the number one position in China from VW. How to defend VW's market position thuis is of paramount importance. General Motors In 1995, GM and SAIC, which was also VW's partner, signed a 50/50, $1.57 billion JV agreement-GM's first ]V in China-to construct a greenfield plant in Shanghai. The new plant was designed to produce 100,000 sedans per year, and it was decided to produce two Buick models modified for China. The plant was equipped with the latest automotive machinery and robotics and was furnished with process technology transferred from GM's worldwide operations. Initially, Shanghai GM attracted a barrage of criticisms about the huge size of its investment and the significant com- mitments to transfer technology and design capabili- ties to China. These criticisms notwithstanding, GM management reiterated at numerous occasions that China was expected to become the biggest automo- live market in the world within two decades and that China represented the single most important emerging market for GM. Since launching Buick in China in 1998, GM liter ally started from scratch. Unlike its burdens at home, GM is not saddled with billions in pensions and health-care costs. Its costs are competitive with rivals, its reputation does not suffer, and it does not need to shell out $4,000 per vehicle in incentives to lure new buyers--even moribund brands such as Buick are held in high esteem in China. Consequently, profits are at- tractive: The $437 million profits CM inade in 2003 in China, selling just 386,000 cars, compares favorably with $811 million profits it made in North America on sales of 5.6 milion autos. In 2004, GM had about 10,000 employees in China and operated six JVs and two wholly owned foreign enterprises (which were allowed to be set up more recently in non-final assembly operations). Boasting a combined monu- facturing capacity of 530,000 vehicles sold under the Buick, Chevrolet, and Wuling nameplates, GM offers the widest portfolio of products among JV manu- facturers in China. In 2009, the bankruptcy filing of GM in the United States had a minimal impact on its China operations. GM vehicle sales in China, its larg- est overseas market, surged 50% to a monthly record of 151,084 units in April 2009, in contrast with a sharp decline in the United States. Pengeot Together with VW and American Motors (the original partner for the Beijing Jeep JV), Peugeot was one of the first three entrants in the Chinese automobile industry In 1980, it started to search for JV partners. In 1985, it set up a JV, Guangzhou Peugeot, in south China, The JV mainly produced the Peugeot 504 and 505, both out-of-date models of the 1970s. While many domestic users complained about the high fuel consumption, difficult maintenance, and expensive parts, the French car manufacturer netted huge short-term profits at approximately $480 million by selling a large amount of CKD kits and parts. Among its numerous problems, the JV also reportedly repatriated most of its profits and made relatively few changes to its 1970s era products, whereas VW in Shanghai reinvested profits and refined Its production, introducing a new "Santana 2000" model in the mid-1990s. Around 1991, Guangzhou Peugeot ac- counted for nearly 16% share of China's passenger car market. But it began to go into the red in 1994 with its losses amounting to $349 million by 1997, forcing Peu- geot to retreat from China. It sold its interest in the JV to Honda in 1998 (see the following page). While the sour memories of the disappointing per- formance of its previous ) were still there, Peugeot (now part of PSA Peugeot Citroen) decided to return to the battlefield in 2003. This time, the Paris-based carmaker seemed loaded with ambitious expectations to grab a slice of the country's increasingly appealing auto market sparked by the post-WTO boom. One of its latest moves in China is an agreement in 2003 under which PSA Peugeot Citroen would further its partnership with Hubei-based Dongfeng Motor, one of China's top three automakers which originally signed up as a JV partner with Citroen, to produce Peugeot vehicles in China. According to the new deal, a Peugeot production platform will be installed at the Wuhan plant of the ), Dongfeng Citroen. Starting from 2004, the new facility has turned out car models tailored for domestic consumers, including the Peugeot 307, one of the most popular models in Europe since 2003. Honda Peugeot's 1998 pullout created a vacuum for foreign manufactwers that missed the first wave of FDI into this industry. These late entrants included Daimler- Benz, GM, Opel (a German subsidiary of GM), and Hyundai. Against these rivals, Honda won the fierce bidding war for the takeover of an existing auto plant in Guangzhou of the now defunct Guangzhou Peugeot JV. The partner selection process had followed a famil- iar pattern: Beijing was pitting several bidders against each other to extract a maximum of capital, technology, and manufacturing capabilities, as well as the motor vehicle types deemed appropriate for China. Honda pledged to invest $887 million and committed the American version of the Honda Accord, whose pro- duction started in 1999, Two years later, Guangzhou Honda added the popular Odyssey minivan to its product mix, In less than two years, Honda had turned around the loss-making Peugeot facility into one of China's most profitable passenger car JVs. It is important to note that well before its JV with the Guangzhou Auto Group, Honda had captured a significant market share with exports of the popular Honda Accord and a most effective network of dealer ships and service and repair facilities all over China. These measures helped Honda not only to attain an excellent reputation and brand recognition, but also strengthened Honda's bargaining power with the Chinese negotiators. Emerging Domestic Players The original thinking behind the Open Door policy in China's auto market by forming IVs with multination- als was to access capital and technology and to develop Chinese domestic partners into self-sustaining inde pendent players. However, this market-for-technology strategy failed to achieve its original goal. Coopera- tion with foreign car companies did bring in capital and technology, but also led to over-dependence on foreign technology and inadequate capacity (or even incentive) for independent innovations. By forming JVs with all the major domestic manufacturers and controlling brands, designs, and key technologies, mul- tinationals effectively eliminated the domestic compe- tition for the most part of the last two decades. Only in the last few years did Chinese manufacturers start to design, produce, and market independent brands. In 2006, domestic companies controlled some 27% of the domestic market (mostly in entry- to mid-level Segments). They have become masters at controlling costs and holding prices down, with a typical Chinese auto worker earning $1.95 an hour against a German counterpart making $49.50 an hour. Ironically, the breakthrough came from newly established manufacturers without foreign partners. Government-owned Chery (Qirul) Automobile, which started with $25 million using second-hand Ford production equipment, produced only 2,000 vehicles six years ago. In 2006, it sold 305,236 cars, a surge of 118% over 2005, with plans to double that again by 2008. Privately owned Geely Group obtained its license only six year ago and began with crudely built copycat hatchbacks powered by Toyota-designed engines. With an initial output of 5,000 cars in 2001, Geely today produces 180,000 a year, with various models of sedans and sports cars, including those equipped with self-engineered six-cylinder engines. Beyond the domestic market, Chery now exports cars to 29 countries. In 2006, the company produced 305,000 cars and exported 50,000. Chery cars are expected to hit Europe soon. Geely Group plans to buy a stake in the UK taxi maker Manganese Bronze Holdings and start producing London's black taxis in Shanghai. It also aims to sell its affordable small vehicles in the US within several years. In an effort to get closer to overseas markets, the Chinese players are starting to open overseas factories too. Chery has assembly operations in Egypt, Indone sia, Iran, and Russia. The company now is planning to extend its reach in South America by opening an assembly plant to produce its Tigo-brand sport-utility vehicle in Uruguay. Brilliance produces vehicles in three overseas factories in North Korea, Egypt, and Vietnam, and Geely has a factory in Russia. One notable trend is the use of acquisition as a key mode for Chinese players to gain ownership of tech nologies, brands, and access to markets in developed countries with the profit from the domestic market: As the domestic competition and the pressure to con- solidate from the central government intensifies, firmus have participated in many high-profile bidding wars to acquire international brands/firms, such as BAIC's bid for Opel and Saab, Geely's bid for Volvo, and the acquisition of Huummer from GM by Tengzhong Heavy Industrial Corporation in 2009, Another significant development is the effort on "green vehicles." At present, energy conservation and environmental protection have represented a new wave of innovations. The development of new energy call BE technologies becomes an opportunity for China's auto industry to shorten the gap and enhance its interna- tional competitiveness, Total investment into this area in China has exceeded $850 million for the last decade and automakers have made certain noticeable achieve- ments. Of all the Chinese automakers that pursue new energy cars, perhaps the most significant is BYD, which has a promising breakthrough electric vehicle technology through its self-developed ferrous batter- ies. BYD Auto is a subsidiary of BYD Group, the lead- ing provider of lithium-ion cell phone batteries (with a 30% global market share). BYD has only been an automaker since 2003, when it acquired a small car company called Qinchuan Motor. The company's core business is producing bat: teries for mobile phones made by the likes of Nokia and Motorola. Since then BYD has developed its auto business, selling more than 100,000 cars in China in 2007. BYD sees major synergy between its batteries and its cars. At the moment, there is a worldwide race in pro- ducing the first conunercially viable "plug-in hybrid" car: Among about a dozen competitors, GM is plan ning to offer Chevy Volt and Toyota is working on a plug-in model of Prius-both have a target launching time of 2010. The key to the race is the battery technol- ogy, which BYD claims to have mastered through its own R&D efforts. The lithium-ion phosphate batteries are much safer than the common lithium-ion batteries seen in early development efforts. Chinese automakers, especially the independent brand holders, have made significant progress toward producing competitive vehicles for domestic market as well as external markets through licensing, self- development, outsourcing, and acquisition of tech nologies. However, the real breakthrough may not come from the traditional vehicles powered by inter- nal combustion engines where Chinese firms are per ceived to be still 10-20 years behind multinationals. With a coordinated effort from government, research centers, universities, as well as R&D centers estab- lished by auto firms, China is not far behind in the area of new energy vehicle technologies. Some firms such as BYD may even be among the leaders in of- fering a commercially viable "plug-in hybrid" and a pure electric car in the near future. Such kind of new technology-based vehicles will overcome many entry barriers to the mature markets like the United States. The Road Ahead China's automobile industry, which has almost exclu- sively focused on the domestic market, still has much room for future development and may maintain an annual growth rate of 10%-15% for the next few years. In the long run, as domestic growth inevitably slows down, there will be fiercer market competition and industry consolidation. The entry barriers will be high- er and resource development will be more crucial to the sustainability of the competitive advantage. In order to survive and maintain healthy and stable growth, China's JVs and indigenous automobile com- panies, having established a solid presence domesti- cally, must be able to offer their own products that are competitive in the global market. No doubt, the road to success in China's automo- bile industry is fraught with plenty of potholes. As latecomers, Hyundai, Toyota, Honda, and Nissan had fewer options in the hunt for appropriate JV partners and market positioning than did the first mover VW during the 1980s. All the way through the early 1990s, foreign auto companies were solicited to enter China and encountered very little domestic competition or challenge. This situation has changed significantly Today the industry is crowded with the world's top players vying for a share of this dynamic market. Suc- cess in China may also significantly help contribute to the corporate bottom line for multinationals that often struggle elsewhere. For example, China, having sur- passed the United States, is now Volkswagen's largest market outside of Germany. There are two competing scenarios confronting ex- ecutives contemplating a move into China or expand in China: (1) At the current rate of rapid foreign and domestic investment, the Chinese industry will rapid ly develop overcapacity. Given the inevitable cooling down of the overall growth of the economy, a blood- bath propelled by self-inflicted wounds such as mas- sive incentives looms on the horizon (2) Given the low penetration of cars among the vast Chinese population whose income is steadily on the rise, such a rising tide will be able to list all boats-or wheels--for a long while at least

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts