Question: Critically evaluate and recommend a term project for implementation ( Family home-based bakery, expanding to a franchise or official Location for a bakery ). Place

- Critically evaluate and recommend a term project for implementation (Family home-based bakery, expanding to a franchise or official Location for a bakery). Place yourself in an organizational (bakery business) context. Understand the environment in which this organization (bakery) functions.

- Describe the real or fictitious strategic context for your project topic (MENTIONED ABOVE). You may:

- Explain the industry, the organization, and other environmental factors. For example, IBM is a corporation that develops hardware, software, and provides information technology services.

- Write about its history, the way the company has changed, the evolution of the industry, current industry trends, etc.

- Present a SWOT analysis of the selected industry/organization (MADE UP FAMILY OWNED-BAKERY).

- Choose a business area for your project topic. Focus on, and explain a specific area within the organization such as marketing, information technology, finance, etc.

- Analyze your options and recommend your project topic. This will be a project in the chosen business area.

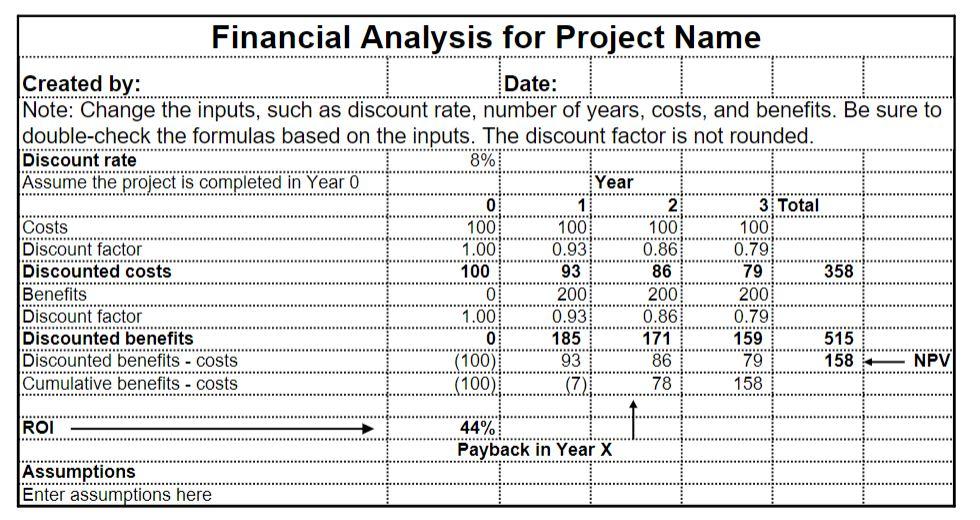

- Calculate and share the ROI and payback period for the recommended project, shown below:

- Describe the real or fictitious strategic context for your project topic (MENTIONED ABOVE). You may:

Finally, describe the most interesting and challenging parts of preparing the project proposal, as well as any recommendations to others if they were to also prepare for this same proposal.

So, my project is going to be to franchise/expand a Mexican bread bakery from a personal home into a factory in order to increase sales by increasing orders, thus needing to buy more ingredients in bulk with a higher discount rather than a smaller amount of the same ingredients, thus leaving out a discount from the supplier.

Financial Analysis for Project Name *** *************** *********************** SER 2. Created by: Date: Note: Change the inputs, such as discount rate, number of years, costs, and benefits. Be sure to double-check the formulas based on the inputs. The discount factor is not rounded. Discount rate 8% Assume the project is completed in Year 0 Year 0 3 Total Costs 100 100 100 100 Discount factor 1.00 0.93 0.86 0.79 Discounted costs 100 93 86 79 358 Benefits 200 200 200 Discount factor 1.00 0.93 0.86 0.79 Discounted benefits 0 171 159 515 Discounted benefits - costs (100) 93 86 79 158 NPV Cumulative benefits - costs (100) (7) 78 158 *************** ****************** *** 0 *........... ........ ..... ***** RE 185 ************************** ***************************** ....! EEEEEEEEEEEEEEEEEEEE....R ROI 44% Payback in Year X SERIES ......................... Assumptions ................................ Enter assumptions here Financial Analysis for Project Name *** *************** *********************** SER 2. Created by: Date: Note: Change the inputs, such as discount rate, number of years, costs, and benefits. Be sure to double-check the formulas based on the inputs. The discount factor is not rounded. Discount rate 8% Assume the project is completed in Year 0 Year 0 3 Total Costs 100 100 100 100 Discount factor 1.00 0.93 0.86 0.79 Discounted costs 100 93 86 79 358 Benefits 200 200 200 Discount factor 1.00 0.93 0.86 0.79 Discounted benefits 0 171 159 515 Discounted benefits - costs (100) 93 86 79 158 NPV Cumulative benefits - costs (100) (7) 78 158 *************** ****************** *** 0 *........... ........ ..... ***** RE 185 ************************** ***************************** ....! EEEEEEEEEEEEEEEEEEEE....R ROI 44% Payback in Year X SERIES ......................... Assumptions ................................ Enter assumptions hereStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts