Question: Critically evaluate the assumptions on which your forecasts are based and perform a sensitivity analysis on the fiscal year-end cash balance when sales forecasts vary

-

Critically evaluate the assumptions on which your forecasts are based and perform a sensitivity analysis on the fiscal year-end cash balance when sales forecasts vary from expectations.

-

Should the bank extend the maturity of the current loan and approve the additional loan? What terms and conditions should the bank impose to reduce the risks of the loan to the bank?

-

Why did the company repurchase a substantial fraction of its outstanding common stocks? Whats the impact of the repurchase on Jacksons financial condition?

-

Critically assess the companys proposed dividend payout in September 2013. Should the bank agree with the payout? What seems to be an appropriate amount

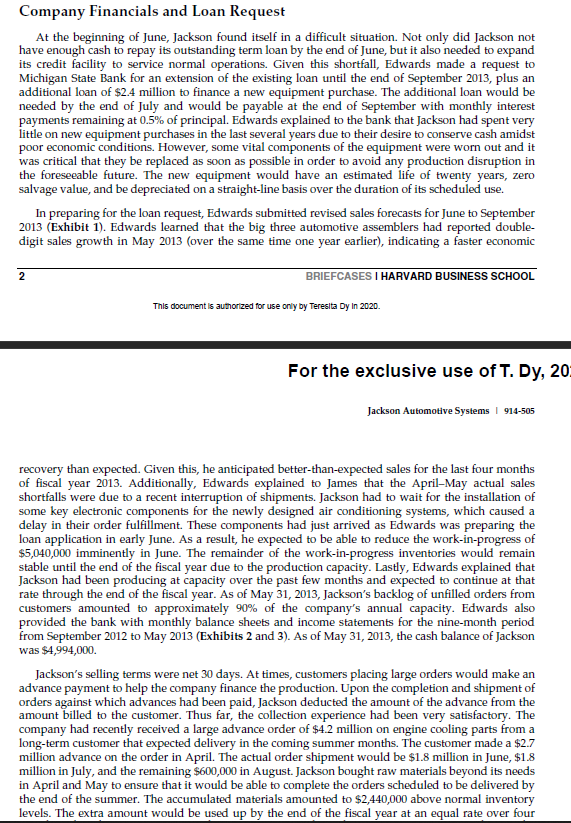

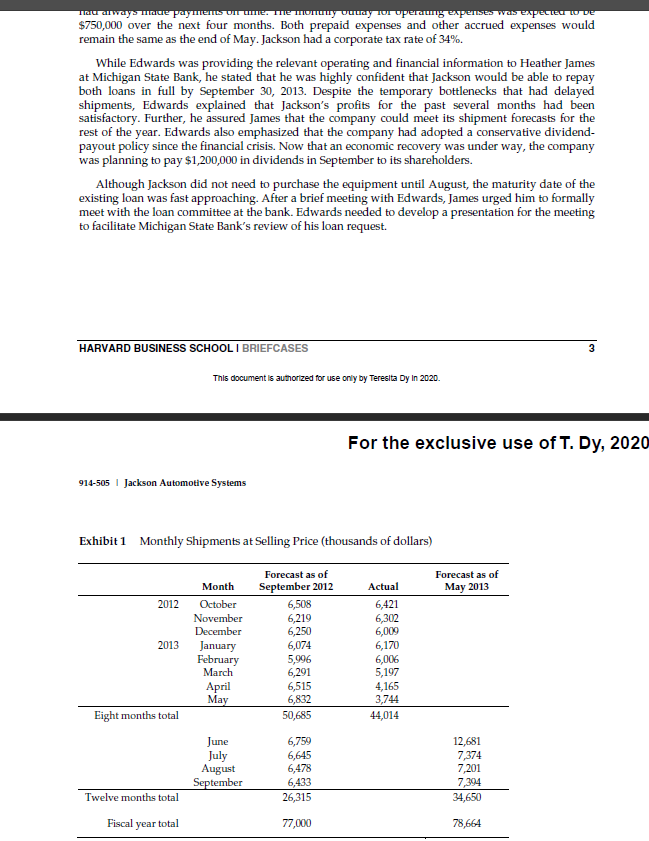

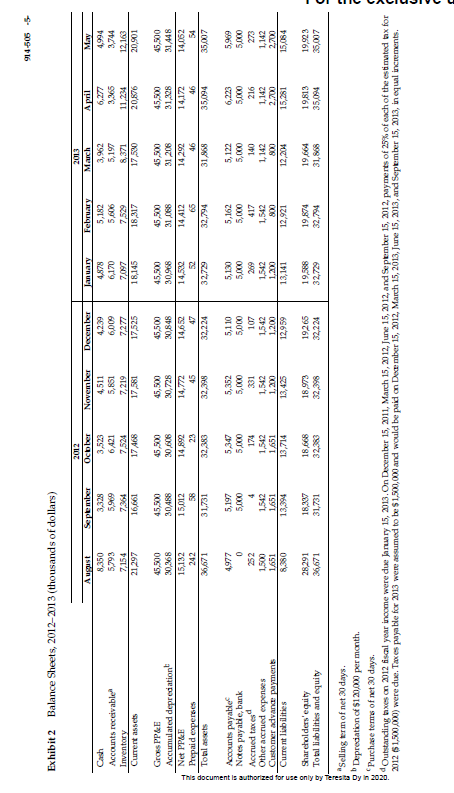

WILLIAM E. FRUHAN WEI WANG Jackson Automotive Systems It was early June 2013. Heather James, vice president at the Michigan State Bank, was considering a loan request from a longtime client, Jackson Automotive Systems. Jackson had requested the renewal of an existing term loan with the bank in the amount of $5 million that was originally scheduled to be repaid at the end of the month. Jackson was also seeking to borrow an additional $2.4 million to fund the acquisition of a long-needed piece of equipment, which it planned to purchase in late July. Both loans, which totaled $7.4 million, would be repayable on September 30, 2013. Jackson Automotive Systems, an Original Equipment Manufacturer (OEM) located in Jackson, Michigan, carried product lines in advanced heating and air conditioning systems, engine cooling systems and parts, and fuel injection and transfer systems, as well as various other engine parts. Production of these lines required sophisticated and expensive precision equipment. The company's customers were reliable and reputable automotive assemblers located nearby in the Michigan area. Industry Background At the time of the loan in 2013, there were over 5,000 automotive parts suppliers located in the U.S. Less than 200 companies had annual sales of more than $100 million, while the remaining companies were small producers, representing a highly fragmented market. Small private companies, such as Jackson Automotive Systems, had specialized production lines and relied on sales to local customers. Given the location of the "big three" U.S. automotive companies, the state of Michigan hosted the largest presence of OEMs in comparison to the rest of the country. The U.S. OEMs experienced a severe slump in production after the 2008 financial crisis, with sales dropping more than 30%. Many suppliers managed to survive the economic downturn by rationing capacity and production. The industry was running at about 55% capacity during the financial crisis. Traditional products that required low-skill labor had already had their production shifted to Asia. Overseas producers from countries such as China and India were increasingly competing for U.S. market share, with any gains coming at the expenses of U.S. manufacturing participants. This fierce competition, coupled with higher cost structures, forced a number of U.S. OEMs into bankruptcy. Fortunately, the industry had rebounded since 2010 and had since returned to profitability in 2011. However, given the slow economic recovery and the high prices of raw materials, competition was still fierce. Company Background Jackson Automotive Systems was founded in 1961 by the father of Larry Edwards. Larry Edwards, the president of Jackson in 2013, took over the business from his father in the mid-1990s. Edwards was well respected in the local business community and was regarded as an energetic and successful entrepreneur. Under the leadership of Edwards, Jackson experienced fast growth and record production in the mid-2000s. Edwards had paid close attention to innovation, especially in the design of energy efficient auto systems, which had attracted new customers for their cutting-edge products. Further, he successfully led the company through the 20082009 global recession when many manufacturers in the industry were taken over or, worse, went out of business entirely. Since 2010, Jackson had seen a steady rebuilding of sales, including the substantial backlog of orders at the time of the loan request. In 2013, Jackson was on pace for its first year of capacity sales since 2007. In September 2012, Edwards decided to repurchase stock from a group of dissident shareholders. He approached Heather James at the Michigan State Bank, where Jackson kept its cash balance, for a $5 million short-term loan to facilitate the stock repurchase. James knew Edwards (and Jackson) reasonably well through their informal business interactions. Edwards planned to use the $5 million in excess cash on its balance sheet and the new short-term loan of $5 million to purchase one million shares of Jackson's $1 par value stock from the shareholders. This buyback would result in a 40% reduction to the number of common shares outstanding after the repurchase was complete. As support for his loan request, Edwards submitted a forecast of monthly shipments for the fiscal year of 2013 (Exhibit 1), a balance sheet as of August 2012 (first column of Exhibit 2), and documentation of the backlog of sales orders. Jackson had traditionally maintained a strong working capital position and a conservative financial policy. It had carried no debt on its balance sheet since 2004. James was confident that Jackson would have no problem servicing its debt and favorably approved the loan request. Jackson took the loan at the end of September 2012 to use it immediately for the stock repurchase. Conditions of the loan were such that Jackson was obligated to make monthly interest payments at an annual interest rate of 6% (0.5% per month) on the principal, and to pay off the balance of the loan (i.e., the principal) at the end of June 2013. After the loan initiation, Edwards regularly sent the bank income statements and balance sheets documenting Jackson's financial conditions. Company Financials and Loan Request At the beginning of June, Jackson found itself in a difficult situation. Not only did Jackson not have enough cash to repay its outstanding term loan by the end of June, but it also needed to expand its credit facility to service normal operations. Given this shortfall, Edwards made a request to Michigan State Bank for an extension of the existing loan until the end of September 2013, plus an additional loan of $2.4 million to finance a new equipment purchase. The additional loan would be needed by the end of July and would be payable at the end of September with monthly interest payments remaining at 0.5% of principal. Edwards explained to the bank that Jackson had spent very little on new equipment purchases in the last several years due to their desire to conserve cash amidst poor economic conditions. However, some vital components of the equipment were worn out and it was critical that they be replaced as soon as possible in order to avoid any production disruption in the foreseeable future. The new equipment would have an estimated life of twenty years, zero salvage value, and be depreciated on a straight-line basis over the duration of its scheduled use. In preparing for the loan request, Edwards submitted revised sales forecasts for June to September 2013 (Exhibit 1). Edwards learned that the big three automotive assemblers had reported double- digit sales growth in May 2013 (over the same time one year earlier), indicating a faster economic 2 BRIEFCASES I HARVARD BUSINESS SCHOOL This document is authorized for use only by Teresita Dy In 2020. For the exclusive use of T. Dy, 20 Jackson Automotive Systems 914-505 recovery than expected. Given this, he anticipated better-than-expected sales for the last four months of fiscal year 2013. Additionally, Edwards explained to James that the April-May actual sales shortfalls were due to a recent interruption of shipments. Jackson had to wait for the installation of some key electronic components for the newly designed air conditioning systems, which caused a delay in their order fulfillment. These components had just arrived as Edwards was preparing the loan application in early June. As a result, he expected to be able to reduce the work-in-progress of $5,040,000 imminently in June. The remainder of the work-in-progress inventories would remain stable until the end of the fiscal year due to the production capacity. Lastly, Edwards explained that Jackson had been producing at capacity over the past few months and expected to continue at that rate through the end of the fiscal year. As of May 31, 2013, Jackson's backlog of unfilled orders from customers amounted to approximately 90% of the company's annual capacity. Edwards also provided the bank with monthly balance sheets and income statements for the nine-month period from September 2012 to May 2013 (Exhibits 2 and 3). As of May 31, 2013, the cash balance of Jackson was $4,994,000 Jackson's selling terms were net 30 days. At times, customers placing large orders would make an advance payment to help the company finance the production. Upon the completion and shipment of orders against which advances had been paid, Jackson deducted the amount of the advance from the amount billed to the customer. Thus far, the collection experience had been very satisfactory. The company had recently received a large advance order of $4.2 million on engine cooling parts from a long-term customer that expected delivery in the coming summer months. The customer made a $2.7 million advance on the order in April. The actual order shipment would be $1.8 million in June, $1.8 million in July, and the remaining $600,000 in August. Jackson bought raw materials beyond its needs in April and May to ensure that it would be able to complete the orders scheduled to be delivered by the end of the summer. The accumulated materials amounted to $2,440,000 above normal inventory levels. The extra amount would be used up by the end of the fiscal year at an equal rate over four TIL Way The payments. The money try to percung expenses was expected DE $750,000 over the next four months. Both prepaid expenses and other accrued expenses would remain the same as the end of May. Jackson had a corporate tax rate of 34%. While Edwards was providing the relevant operating and financial information to Heather James at Michigan State Bank, he stated that he was highly confident that Jackson would be able to repay both loans in full by September 30, 2013. Despite the temporary bottlenecks that had delayed shipments, Edwards explained that Jackson's profits for the past several months had been satisfactory. Further, he assured James that the company could meet its shipment forecasts for the rest of the year. Edwards also emphasized that the company had adopted a conservative dividend- payout policy since the financial crisis. Now that an economic recovery was under way, the company was planning to pay $1,200,000 in dividends in September to its shareholders. Although Jackson did not need to purchase the equipment until August, the maturity date of the existing loan was fast approaching. After a brief meeting with Edwards, James urged him to formally meet with the loan committee at the bank. Edwards needed to develop a presentation for the meeting to facilitate Michigan State Bank's review of his loan request. HARVARD BUSINESS SCHOOL I BRIEFCASES 3 This document is authorized for use only by Teresita Dy in 2020. For the exclusive use of T. Dy, 2020 914-505 Jackson Automotive Systems Exhibit 1 Monthly Shipments at Selling Price (thousands of dollars) Forecast as of May 2013 2012 2013 Month October November December January February March April May Forecast as of September 2012 6,508 6,219 6,250 6,074 5,996 6,291 6,515 6,832 50,685 Actual 6,421 6,302 6,009 6,170 6,006 5,197 4,165 3,744 44,014 Eight months total June July August September 6,759 6,645 6,478 6,433 26,315 12,681 7,374 7,201 7,394 34,650 Twelve months total Fiscal year total 77,000 78,664 914-505 -5 Exhibit 2 Balance Sheets, 2012-2013 (thousands of dollars) 2013 March April September 3,328 5,969 May 4,994 August 8,350 5,793 7,154 21 297 Cash Accounts receivable Inventory Current assets 2012 October 3,523 6421 7524 17 468 November 4,511 5,851 7219 17,581 December 4,239 6,009 7,277 17,525 January 4878 6,170 7,097 18,145 February 5,182 5,606 7,529 18,317 3,744 5,197 8,371 17.530 3,365 11,234 20,876 16,661 12,163 20,901 Gross PP&E Accumulated depreciation Net PP&E Prepaid experees Toulasses 45,500 30,368 15,132 45,500 30,488 15,012 45,500 30,606 14,892 23 32,383 45,500 30,728 14,772 45 32,398 45,500 30,848 14,652 47 32,224 45,500 30,968 14,532 45,500 31068 14 412 65 32,794 45,500 31 206 14,292 46 45,500 31,328 14,172 46 35,094 45,500 31448 14,052 242 36,671 31,731 32,729 31.865 35,007 4977 0 252 5,197 5.000 5,130 5.000 5.000 Accounts payable Notes payable, bank Accrued taxes Other accrued expenses Customer advance payments Current liabilities 5,347 5.000 174 1,542 1651 13,714 This document is authorized for use only by Teresita Dyin 2020. 5,352 5,000 331 1,542 1,200 13,425 5.110 5,000 107 1,542 1,200 12,959 5,162 5,000 417 1,542 5,122 5,000 140 1,142 1,542 1651 13,394 1651 8.380 5,000 216 1,142 2.700 15,281 1,542 1.200 13,141 1,142 2,700 15,084 12,921 12,204 28291 36,671 18,337 31,731 18.668 Shareholders'equity Total liabilities and equity 18,973 19265 19,568 32,729 19,874 19,664 31,868 19.813 35,094 19,923 35,007 "Selling term of net 30 days. b Depreciation of $120,000 per month. Purchase terms of net 30 days. d Outstanding taxes on 2012 fiscal year income were due January 15, 2013.On December 15, 2011, March 15, 2012, June 15, 2012, and September 15, 2012, payments of 25% of each of the estimated tax for 2012 $1,500,000) were due. Taxes payable for 2013 were assumed to be $1,500,000 and would be paid on December 15, 2012, March 15, 2013, June 15, 2013, and September 15, 2013, in equal increments. WILLIAM E. FRUHAN WEI WANG Jackson Automotive Systems It was early June 2013. Heather James, vice president at the Michigan State Bank, was considering a loan request from a longtime client, Jackson Automotive Systems. Jackson had requested the renewal of an existing term loan with the bank in the amount of $5 million that was originally scheduled to be repaid at the end of the month. Jackson was also seeking to borrow an additional $2.4 million to fund the acquisition of a long-needed piece of equipment, which it planned to purchase in late July. Both loans, which totaled $7.4 million, would be repayable on September 30, 2013. Jackson Automotive Systems, an Original Equipment Manufacturer (OEM) located in Jackson, Michigan, carried product lines in advanced heating and air conditioning systems, engine cooling systems and parts, and fuel injection and transfer systems, as well as various other engine parts. Production of these lines required sophisticated and expensive precision equipment. The company's customers were reliable and reputable automotive assemblers located nearby in the Michigan area. Industry Background At the time of the loan in 2013, there were over 5,000 automotive parts suppliers located in the U.S. Less than 200 companies had annual sales of more than $100 million, while the remaining companies were small producers, representing a highly fragmented market. Small private companies, such as Jackson Automotive Systems, had specialized production lines and relied on sales to local customers. Given the location of the "big three" U.S. automotive companies, the state of Michigan hosted the largest presence of OEMs in comparison to the rest of the country. The U.S. OEMs experienced a severe slump in production after the 2008 financial crisis, with sales dropping more than 30%. Many suppliers managed to survive the economic downturn by rationing capacity and production. The industry was running at about 55% capacity during the financial crisis. Traditional products that required low-skill labor had already had their production shifted to Asia. Overseas producers from countries such as China and India were increasingly competing for U.S. market share, with any gains coming at the expenses of U.S. manufacturing participants. This fierce competition, coupled with higher cost structures, forced a number of U.S. OEMs into bankruptcy. Fortunately, the industry had rebounded since 2010 and had since returned to profitability in 2011. However, given the slow economic recovery and the high prices of raw materials, competition was still fierce. Company Background Jackson Automotive Systems was founded in 1961 by the father of Larry Edwards. Larry Edwards, the president of Jackson in 2013, took over the business from his father in the mid-1990s. Edwards was well respected in the local business community and was regarded as an energetic and successful entrepreneur. Under the leadership of Edwards, Jackson experienced fast growth and record production in the mid-2000s. Edwards had paid close attention to innovation, especially in the design of energy efficient auto systems, which had attracted new customers for their cutting-edge products. Further, he successfully led the company through the 20082009 global recession when many manufacturers in the industry were taken over or, worse, went out of business entirely. Since 2010, Jackson had seen a steady rebuilding of sales, including the substantial backlog of orders at the time of the loan request. In 2013, Jackson was on pace for its first year of capacity sales since 2007. In September 2012, Edwards decided to repurchase stock from a group of dissident shareholders. He approached Heather James at the Michigan State Bank, where Jackson kept its cash balance, for a $5 million short-term loan to facilitate the stock repurchase. James knew Edwards (and Jackson) reasonably well through their informal business interactions. Edwards planned to use the $5 million in excess cash on its balance sheet and the new short-term loan of $5 million to purchase one million shares of Jackson's $1 par value stock from the shareholders. This buyback would result in a 40% reduction to the number of common shares outstanding after the repurchase was complete. As support for his loan request, Edwards submitted a forecast of monthly shipments for the fiscal year of 2013 (Exhibit 1), a balance sheet as of August 2012 (first column of Exhibit 2), and documentation of the backlog of sales orders. Jackson had traditionally maintained a strong working capital position and a conservative financial policy. It had carried no debt on its balance sheet since 2004. James was confident that Jackson would have no problem servicing its debt and favorably approved the loan request. Jackson took the loan at the end of September 2012 to use it immediately for the stock repurchase. Conditions of the loan were such that Jackson was obligated to make monthly interest payments at an annual interest rate of 6% (0.5% per month) on the principal, and to pay off the balance of the loan (i.e., the principal) at the end of June 2013. After the loan initiation, Edwards regularly sent the bank income statements and balance sheets documenting Jackson's financial conditions. Company Financials and Loan Request At the beginning of June, Jackson found itself in a difficult situation. Not only did Jackson not have enough cash to repay its outstanding term loan by the end of June, but it also needed to expand its credit facility to service normal operations. Given this shortfall, Edwards made a request to Michigan State Bank for an extension of the existing loan until the end of September 2013, plus an additional loan of $2.4 million to finance a new equipment purchase. The additional loan would be needed by the end of July and would be payable at the end of September with monthly interest payments remaining at 0.5% of principal. Edwards explained to the bank that Jackson had spent very little on new equipment purchases in the last several years due to their desire to conserve cash amidst poor economic conditions. However, some vital components of the equipment were worn out and it was critical that they be replaced as soon as possible in order to avoid any production disruption in the foreseeable future. The new equipment would have an estimated life of twenty years, zero salvage value, and be depreciated on a straight-line basis over the duration of its scheduled use. In preparing for the loan request, Edwards submitted revised sales forecasts for June to September 2013 (Exhibit 1). Edwards learned that the big three automotive assemblers had reported double- digit sales growth in May 2013 (over the same time one year earlier), indicating a faster economic 2 BRIEFCASES I HARVARD BUSINESS SCHOOL This document is authorized for use only by Teresita Dy In 2020. For the exclusive use of T. Dy, 20 Jackson Automotive Systems 914-505 recovery than expected. Given this, he anticipated better-than-expected sales for the last four months of fiscal year 2013. Additionally, Edwards explained to James that the April-May actual sales shortfalls were due to a recent interruption of shipments. Jackson had to wait for the installation of some key electronic components for the newly designed air conditioning systems, which caused a delay in their order fulfillment. These components had just arrived as Edwards was preparing the loan application in early June. As a result, he expected to be able to reduce the work-in-progress of $5,040,000 imminently in June. The remainder of the work-in-progress inventories would remain stable until the end of the fiscal year due to the production capacity. Lastly, Edwards explained that Jackson had been producing at capacity over the past few months and expected to continue at that rate through the end of the fiscal year. As of May 31, 2013, Jackson's backlog of unfilled orders from customers amounted to approximately 90% of the company's annual capacity. Edwards also provided the bank with monthly balance sheets and income statements for the nine-month period from September 2012 to May 2013 (Exhibits 2 and 3). As of May 31, 2013, the cash balance of Jackson was $4,994,000 Jackson's selling terms were net 30 days. At times, customers placing large orders would make an advance payment to help the company finance the production. Upon the completion and shipment of orders against which advances had been paid, Jackson deducted the amount of the advance from the amount billed to the customer. Thus far, the collection experience had been very satisfactory. The company had recently received a large advance order of $4.2 million on engine cooling parts from a long-term customer that expected delivery in the coming summer months. The customer made a $2.7 million advance on the order in April. The actual order shipment would be $1.8 million in June, $1.8 million in July, and the remaining $600,000 in August. Jackson bought raw materials beyond its needs in April and May to ensure that it would be able to complete the orders scheduled to be delivered by the end of the summer. The accumulated materials amounted to $2,440,000 above normal inventory levels. The extra amount would be used up by the end of the fiscal year at an equal rate over four TIL Way The payments. The money try to percung expenses was expected DE $750,000 over the next four months. Both prepaid expenses and other accrued expenses would remain the same as the end of May. Jackson had a corporate tax rate of 34%. While Edwards was providing the relevant operating and financial information to Heather James at Michigan State Bank, he stated that he was highly confident that Jackson would be able to repay both loans in full by September 30, 2013. Despite the temporary bottlenecks that had delayed shipments, Edwards explained that Jackson's profits for the past several months had been satisfactory. Further, he assured James that the company could meet its shipment forecasts for the rest of the year. Edwards also emphasized that the company had adopted a conservative dividend- payout policy since the financial crisis. Now that an economic recovery was under way, the company was planning to pay $1,200,000 in dividends in September to its shareholders. Although Jackson did not need to purchase the equipment until August, the maturity date of the existing loan was fast approaching. After a brief meeting with Edwards, James urged him to formally meet with the loan committee at the bank. Edwards needed to develop a presentation for the meeting to facilitate Michigan State Bank's review of his loan request. HARVARD BUSINESS SCHOOL I BRIEFCASES 3 This document is authorized for use only by Teresita Dy in 2020. For the exclusive use of T. Dy, 2020 914-505 Jackson Automotive Systems Exhibit 1 Monthly Shipments at Selling Price (thousands of dollars) Forecast as of May 2013 2012 2013 Month October November December January February March April May Forecast as of September 2012 6,508 6,219 6,250 6,074 5,996 6,291 6,515 6,832 50,685 Actual 6,421 6,302 6,009 6,170 6,006 5,197 4,165 3,744 44,014 Eight months total June July August September 6,759 6,645 6,478 6,433 26,315 12,681 7,374 7,201 7,394 34,650 Twelve months total Fiscal year total 77,000 78,664 914-505 -5 Exhibit 2 Balance Sheets, 2012-2013 (thousands of dollars) 2013 March April September 3,328 5,969 May 4,994 August 8,350 5,793 7,154 21 297 Cash Accounts receivable Inventory Current assets 2012 October 3,523 6421 7524 17 468 November 4,511 5,851 7219 17,581 December 4,239 6,009 7,277 17,525 January 4878 6,170 7,097 18,145 February 5,182 5,606 7,529 18,317 3,744 5,197 8,371 17.530 3,365 11,234 20,876 16,661 12,163 20,901 Gross PP&E Accumulated depreciation Net PP&E Prepaid experees Toulasses 45,500 30,368 15,132 45,500 30,488 15,012 45,500 30,606 14,892 23 32,383 45,500 30,728 14,772 45 32,398 45,500 30,848 14,652 47 32,224 45,500 30,968 14,532 45,500 31068 14 412 65 32,794 45,500 31 206 14,292 46 45,500 31,328 14,172 46 35,094 45,500 31448 14,052 242 36,671 31,731 32,729 31.865 35,007 4977 0 252 5,197 5.000 5,130 5.000 5.000 Accounts payable Notes payable, bank Accrued taxes Other accrued expenses Customer advance payments Current liabilities 5,347 5.000 174 1,542 1651 13,714 This document is authorized for use only by Teresita Dyin 2020. 5,352 5,000 331 1,542 1,200 13,425 5.110 5,000 107 1,542 1,200 12,959 5,162 5,000 417 1,542 5,122 5,000 140 1,142 1,542 1651 13,394 1651 8.380 5,000 216 1,142 2.700 15,281 1,542 1.200 13,141 1,142 2,700 15,084 12,921 12,204 28291 36,671 18,337 31,731 18.668 Shareholders'equity Total liabilities and equity 18,973 19265 19,568 32,729 19,874 19,664 31,868 19.813 35,094 19,923 35,007 "Selling term of net 30 days. b Depreciation of $120,000 per month. Purchase terms of net 30 days. d Outstanding taxes on 2012 fiscal year income were due January 15, 2013.On December 15, 2011, March 15, 2012, June 15, 2012, and September 15, 2012, payments of 25% of each of the estimated tax for 2012 $1,500,000) were due. Taxes payable for 2013 were assumed to be $1,500,000 and would be paid on December 15, 2012, March 15, 2013, June 15, 2013, and September 15, 2013, in equal increments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts